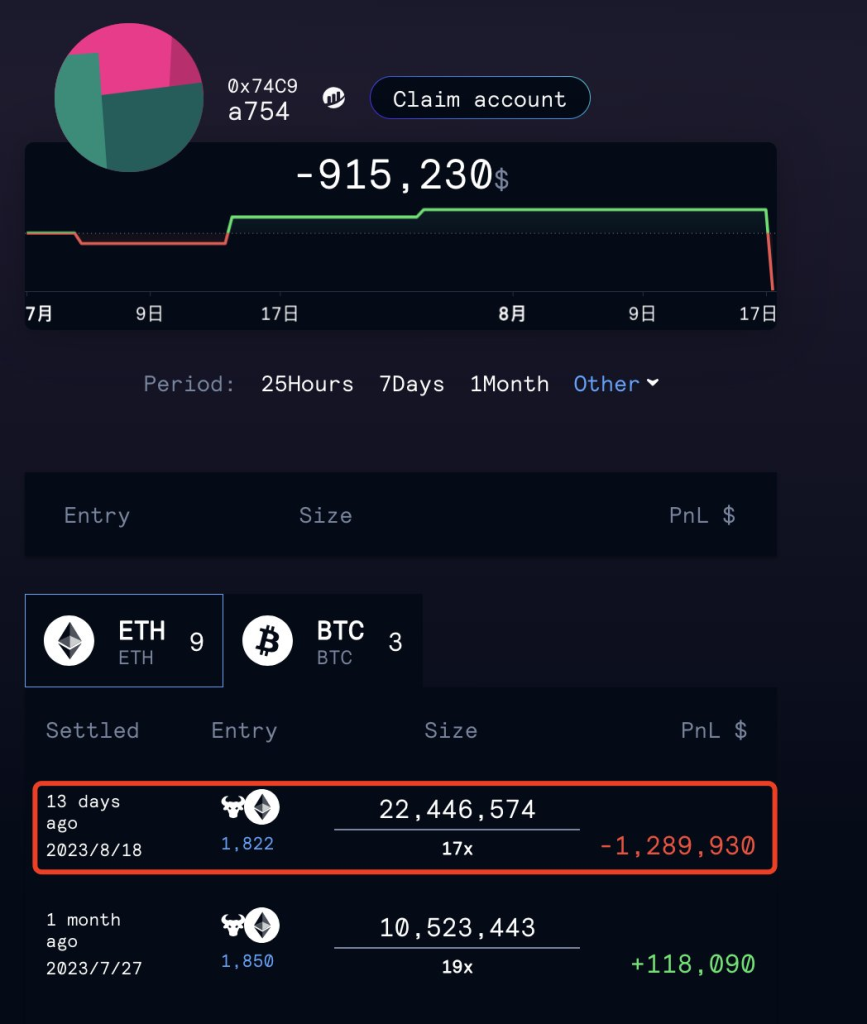

Crypto markets are known for their high volatility, offering significant opportunities for profit—but also substantial risks. One Ethereum (ETH) whale recently came under the spotlight for a series of trading mishaps that culminated in approximately $5.1 million in losses according to the data by on-chain analyst Lookonchain.

Failed Long Positions on ETH

It seems that this particular investor is struggling to master the art of perpetual contracts. In the last two major market downturns, the whale saw their long positions on Ethereum liquidated. For those less familiar with the term, a “long position” essentially means betting that the asset—in this case, Ethereum—will increase in value. When the market doesn’t follow this trajectory, liquidation can be an expensive reality.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Despite their prior misfortunes, the whale seems undeterred. As the market showed a bullish inclination, they took another long position on Ethereum at an entry price of $1,717. This decision showcases a hallmark of both crypto markets and human psychology: the inclination to “double down” when faced with prior losses.

Traders should take heed of such examples as cautionary tales. Cryptocurrency markets are complex ecosystems influenced by a myriad of factors. A single investor, even one with significant capital, cannot easily manipulate or predict market movements. It’s crucial to conduct thorough research, hedge risks, and, perhaps most importantly, know when to exit a position to minimize losses.

While many continue to be enticed by the lucrative possibilities that crypto trading presents, this tale serves as a timely reminder of the downside risks involved. For this whale, the lesson has been costly; whether they will adapt and recover remains to be seen.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.