Following Bitcoin ETF approvals earlier this month, BTC price plunged from $48k to around $40k. Price rebounded today after crashing below $39k in recent days amid a broader market decline. WhaleWire, one of the most popular crypto analysts on Twitter, drew attention to possible price manipulation in a recent tweet.

According to WhaleWire, “The Bitcoin cartel, working behind the curtains to rig the prices, is deeply concerned about the growing BTC ETF outflows. If this selling pressure continues, it will completely destabilize and melt the markets.”

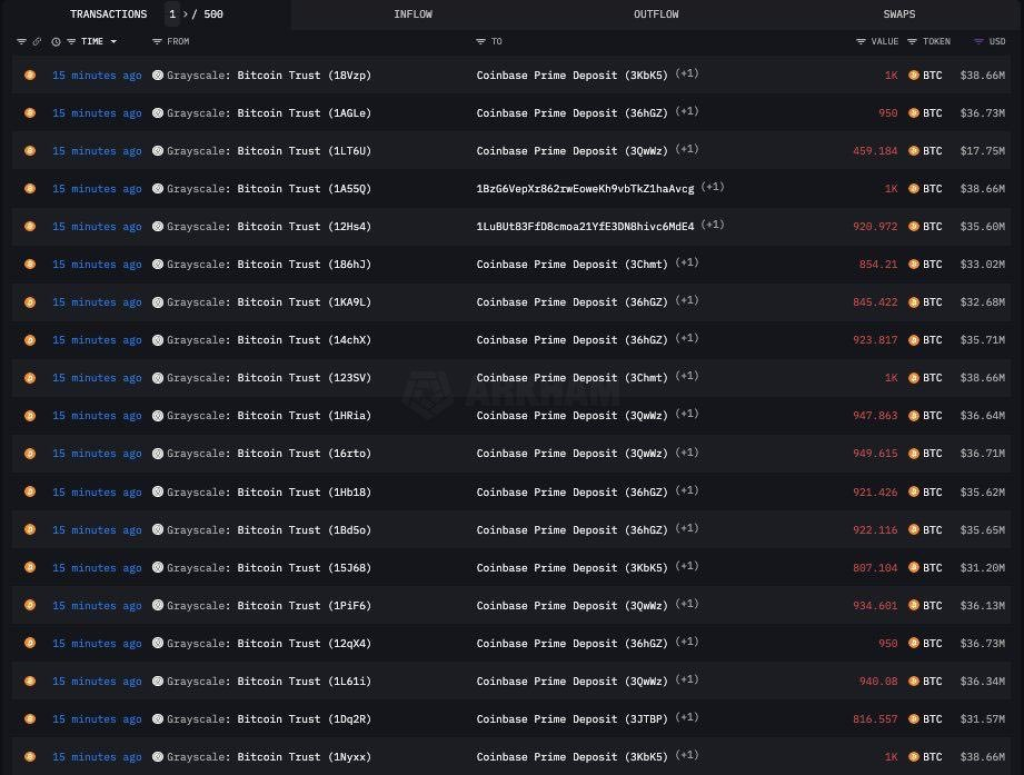

By “cartel,” WhaleWire appears to be referring to large Bitcoin holders and miners who may have an incentive to manipulate the price. The argument is that recent outflows from the Grayscale Bitcoin Trust (GBTC), one of the largest Bitcoin investment vehicles, are putting selling pressure on the market.

On the same day that GBTC saw withdrawals of $647.1 million, Tether printed exactly $647.1 million worth of new USDT tokens on the Tron network. WhaleWire notes this indicates the funds were then sent to Tron founder Justin Sun, who has previously been accused of fraud. The implication is that Tether and Sun may be working together to stabilize the Bitcoin price by pumping new USDT into the market.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The analyst takes this as a sign that market manipulation may be rampant, stating “The crypto markets are a heavily rigged casino. Those who fail to admit this reality will end up losing everything in the end.” Their overall theory is that a “Bitcoin cartel” works behind the scenes to control prices and support liquidity through the use of vehicles like Tether.

WhaleWire is raising the possibility that price manipulation may be occurring behind the scenes through the printing of USDT, in an effort to offset selling pressure from GBTC outflows and prevent further destabilization and decline in the Bitcoin price.

Of course, these are just allegations and theories from one analyst. But the opaque nature of major stablecoins like Tether and their role in crypto markets has led some to question whether active price manipulation takes place. As Bitcoin volatility continues, these claims of behind-the-scenes efforts to influence prices may gain more attention.

You may also be interested in:

- RAY Stays Strong Above $1, Analyst Says Raydium Is ‘Practically the Backbone of Solana Shitcoin Season’

- Bitcoin Crash Continues, But Experienced Crypto Trader Spots Buy Opportunities – Here His Outlook

- Which Crypto Coin Will Pump Next? 7 Trending Altcoins To Watch In 2024

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.