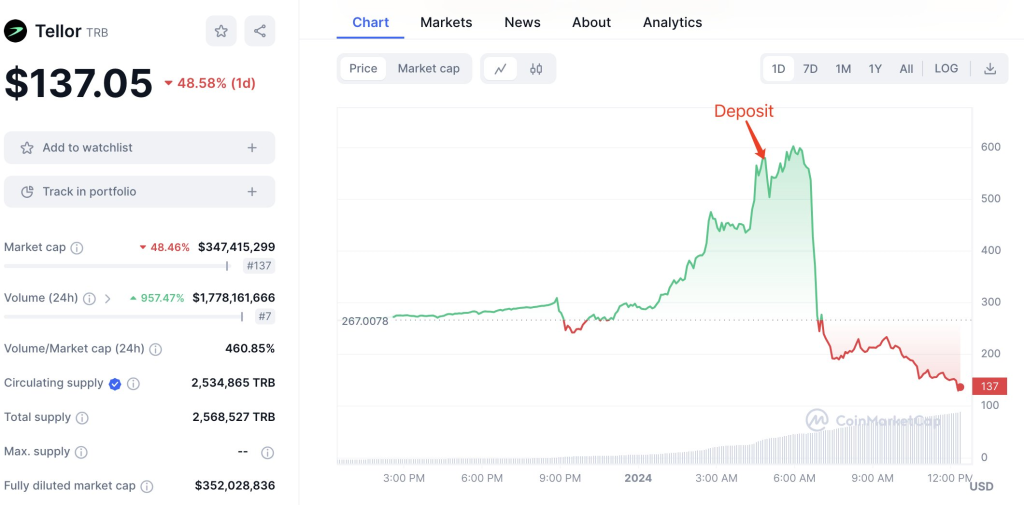

A massive price spike and subsequent crash in the Tellor (TRB) token have drawn scrutiny from analysts and traders alike this past week.

On December 31st, the TRB coin surged nearly 150% to hit an all-time high of $602 before plunging back down to $1396 within 13 hours. This represented a 78% retracement, prompting accusations of potential manipulation.

Adding to the uncertainties, Lookonchain revealed that the Tellor team executed a transfer of 4,211 TRB, valued at approximately $2.4 million, to Coinbase just as prices reached their peak. The synchronization of on-chain activity with price fluctuations prompts inquiries into the matter.

As TRB crashed from its highs, over $68 million worth of futures positions were liquidated, according to CoinGlass. Analytics provider Lookonchain cited this figure in calling attention to the incident on January 1st.

Blockchain analytics firm Spot On Chain provided an alternative perspective, noting that 95% of the total supply sits in just 20 “whale” wallets. This extreme concentration means little actual volume could trigger exaggerated price action.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Per Spot on Chain, these major holders began accumulating at ~$15 per TRB. They are now seemingly coordinating deposits with exchanges to sell into artificial rallies and realize profits.

To provide context, Tellor functions as a decentralized oracle network, akin to Chainlink, facilitating the provision of external data to various DeFi platforms. The native TRB token within the Tellor ecosystem serves dual roles as a governance tool and a unit for transaction fees.

The sequence of events, analytics, and market composition analysis paints a picture of potential manipulation and coordinated whale behavior around TRB’s price spikes. Most signs point to inorganic trading activity as the catalyst behind its wild volatility profile.

You may also be interested in:

- Ethereum Price Has “Clear Path Ahead” as ETH Eyes $2,700 According to Crypto Analyst – Here’s His Outlook

- Here’s the Recap of 2023 in the Crypto and Bitcoin Industry

- Ripple (XRP) vs. Cardano (ADA): The Battle for $1, How Meme Moguls (MGLS) is Revolutionizing Meme Coins

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.