The easiest way to spot where real crypto activity is forming often appears long before price charts react. Decentralized exchange volume tends to reveal which networks users are actively choosing, not just discussing. That signal is flashing clearly again, and this time it places Sui far ahead of Cardano in a way that is becoming increasingly difficult to overlook.

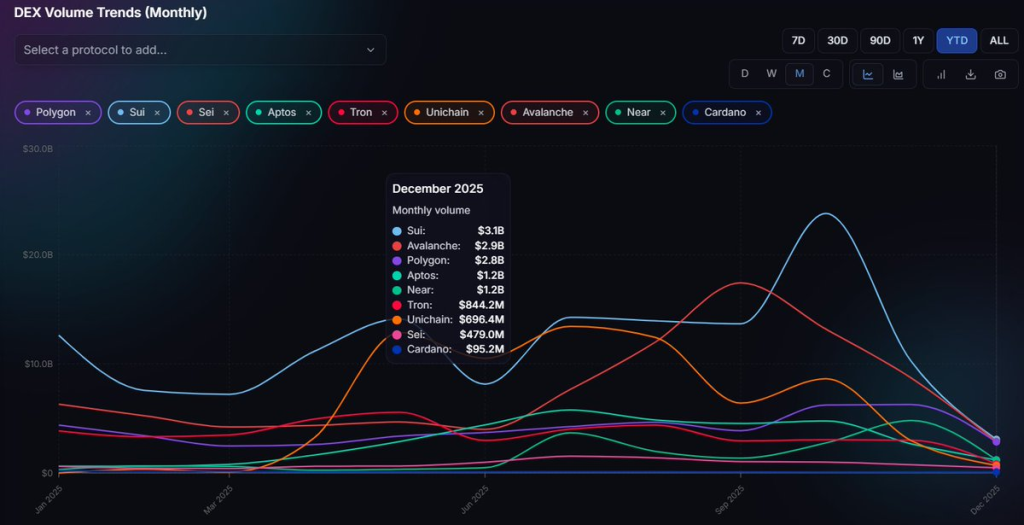

Data highlighted by analyst eye zen hour shows Sui closing December with DEX volume that dwarfs several established chains. The numbers are not subtle, and they suggest a shift in attention, liquidity, and usage that looks structural rather than temporary.

What you'll learn 👉

Sui DEX Volume Shows A Clear And Growing Lead Over Cardano

Sui finished December with roughly $3.1B in decentralized exchange volume. Cardano, by comparison, recorded about $95M during the same period. That difference is not marginal. Sui processed more than 30 times the onchain trading volume of Cardano across the month.

Eye zen hour pointed out why this gap matters during his breakdown. DEX volume reflects real behavior such as swaps, liquidity deployment, and protocol usage. Artificial incentives may create brief spikes, yet sustained volume at this scale usually points to genuine demand rather than short lived activity.

Context makes the contrast even sharper. Sui moved around 3 times more DEX volume than Tron and more than 30 times the volume seen on ADA. That kind of spread rarely happens by chance, especially in a market where capital is increasingly selective.

Decentralized Exchange Activity Signals Real Network Usage

Short-term price movements can be influenced by sentiment shifts, leverage, or broader market conditions. DEX activity tends to be slower to fake and harder to sustain without actual users. Every swap, liquidity addition, and protocol interaction represents capital choosing one ecosystem over another.

Eye zen hour stressed that DEX volume is often one of the earliest indicators of where builders and users are converging. Networks that quietly accumulate activity frequently see price narratives follow later, not the other way around.

Sui’s steady climb in monthly volume suggests its ecosystem is becoming a preferred venue for onchain trading. Cardano’s comparatively low figures highlight a disconnect between long term development goals and current user behavior.

The Volume Gap Suggests A Structural Shift Rather Than A Fluke

Monthly trends help separate noise from signal. A single spike can be dismissed. Sustained dominance across several months is harder to ignore. The chart shows Sui maintaining elevated activity while Cardano struggles to capture meaningful DEX flow.

That divergence hints at deeper dynamics. Liquidity tends to attract more liquidity. Developers often build where users already are. Once an ecosystem reaches a certain activity threshold, momentum can reinforce itself without needing constant external incentives.

Sui appears to be benefiting from that feedback loop. Cardano, despite its reputation for careful development, is not seeing comparable engagement on decentralized exchanges.

DEX volume does not predict price on a fixed timetable. It does, however, offer insight into where real usage is accumulating. Eye zen hour framed this metric as a way to observe capital movement before narratives catch up.

Sui’s dominance in this area does not guarantee immediate outcomes, yet it does highlight where users are choosing to transact today. Cardano’s lower numbers suggest it still faces challenges converting long term vision into everyday onchain activity.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.