A recent series of transactions by a particularly savvy investor, colloquially known as a ‘crypto whale’, has caught the attention of the market.

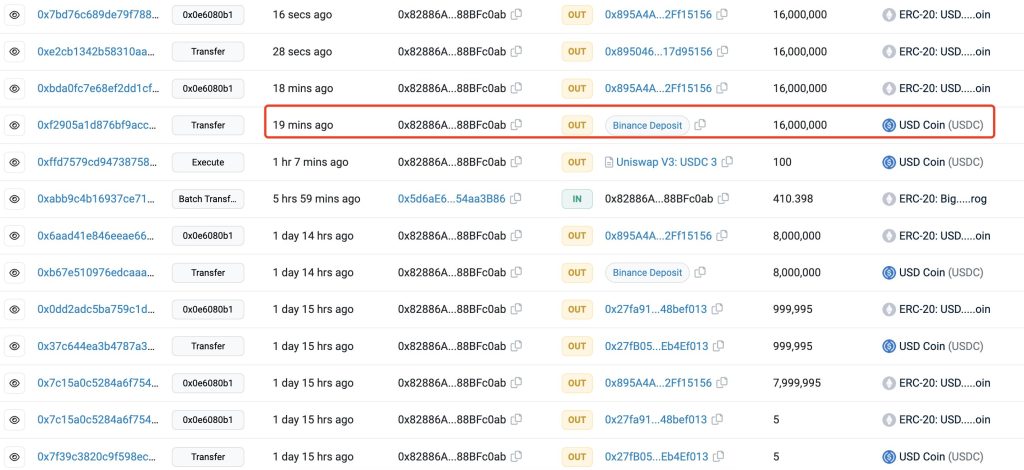

Just a few hours ago, this astute player made a substantial deposit of 16 million USDC (USD Coin) into Binance, one of the world’s leading cryptocurrency exchanges. This move is significant, as it indicates a potential shift in the whale’s investment strategy.

Previously, this whale had demonstrated a keen sense of timing and market dynamics. They had offloaded a hefty 34,000 ETH (Ethereum), equivalent to a staggering $65.4 million, when the price of Ethereum was hovering around $1,930. This move was a clear demonstration of the whale’s ability to capitalize on market trends and maximize returns.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In a further display of strategic acumen, the whale took advantage of the USDC de-pegging incident. During this period, they exchanged their USDC holdings for Ethereum, effectively leveraging the temporary instability for potential profit.

Perhaps most intriguingly, the whale managed to withdraw all their assets from FTX, another major cryptocurrency exchange, right before FTX suspended withdrawals. This move not only saved the whale from potential losses but also demonstrated their ability to anticipate and react to market events.

These actions by the ‘smart whale’ provide a fascinating glimpse into the strategies employed by major players in the cryptocurrency market. Their moves serve as a reminder of the dynamism and volatility inherent in this space, where timing, strategy, and a keen understanding of market trends can result in significant gains.