Staking has become a common method for blockchain users to support network functionality while earning returns on held assets.

Ethena (ENA), a token operating within the Ethena Finance ecosystem, offers a staking mechanism that allows users to earn yield passively. Built on Ethereum and featuring a synthetic stable asset (USDe), Ethena has seen growing interest, particularly among users in regions like the UAE.

This article presents a detailed, step-by-step guide to staking ENA tokens, outlines the process for using the platform’s UI, and includes a comparison of available staking platforms, based on updated details from Ethena Finance and verified third-party sources.

What you'll learn 👉

Setting Up for Ethena Staking

As an initial step for ENA token staking, the token has to be kept in a wallet that supports cryptocurrencies. The most widely used wallets are MetaMask or Trust Wallet as they support Ethereum-based tokens and decentralized applications. The user needs to download a wallet, configure it properly, and link it to the Ethereum Mainnet.

Secondly, users need to acquire ENA tokens. ENA is available on both centralized and decentralized exchanges. For those based in the UAE, they can utilize platforms like Gate.io or Uniswap for purchasing the token. After the tokens have been purchased, users need to transfer their tokens to the already existing wallet, making sure they double verify transaction details to make deposit smooth.

Connecting to Ethena’s Staking Interface

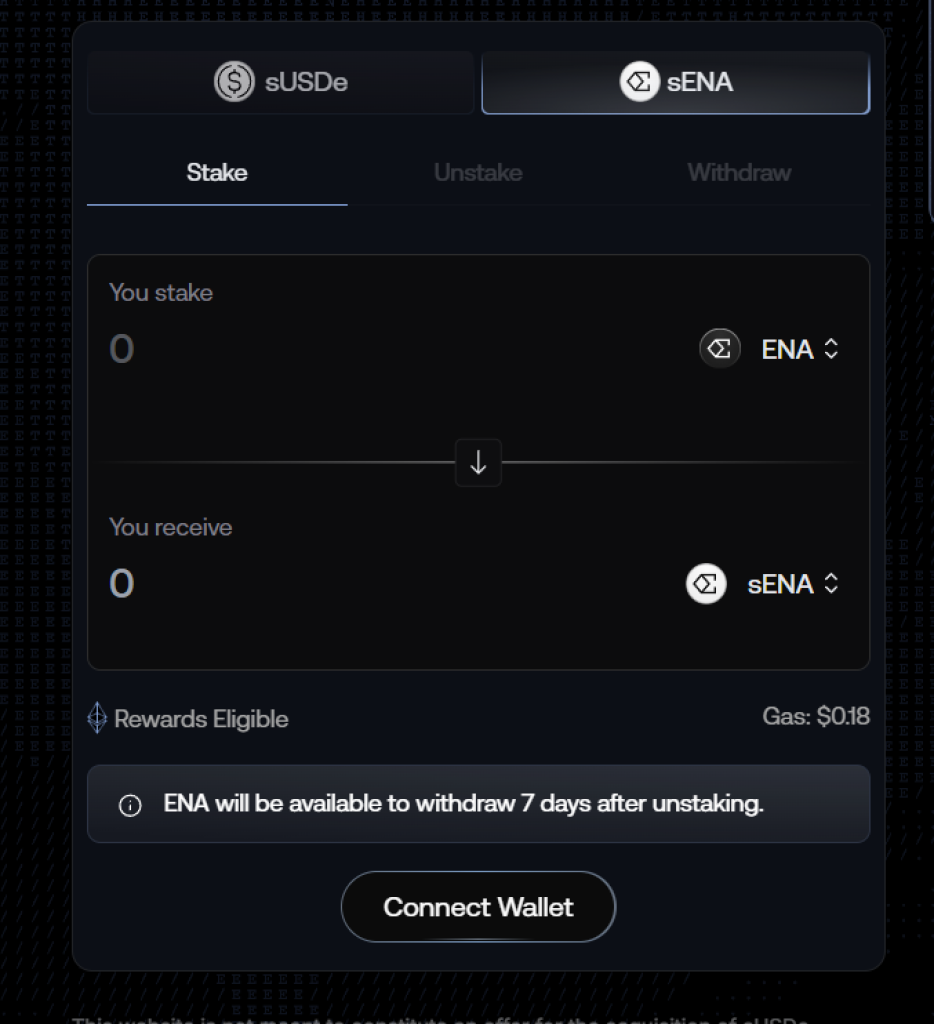

The official staking portal for ENA is located at ethena.fi. To proceed, users should navigate to the website and connect their wallet via the site’s dApp interface. This allows the platform to detect the ENA balance held in the user’s wallet.

On login, the user is able to view the dashboard, on which one is displayed available balances, staking, and gas fees. The staking interface is designed to provide a precise understanding of the position of the user and to make it easier to manage running staking operations and monitor potential returns.

Executing the Staking Process

Once the user has selected the amount of ENA to stake, the next step is to authorize the transaction. This begins by clicking the “Stake” button, which prompts the wallet to sign the transaction.

After the user signs the transaction, it is submitted to the Ethereum blockchain. Upon confirmation, the ENA tokens are atomically swapped for sENA tokens.

sENA tokens represent staked ENA within the Ethena protocol. They accumulate rewards automatically through the token vault system built into the staking smart contract. This mechanism ensures that sENA owners accumulate more value with time based on the rewards deposited into the vault.

In addition, there is no need for users to manually redeem the rewards. Instead, the worth of sENA will appreciate over time as the staking contract distributes protocol-gained returns. 1 sENA is worth 1 ENA at launch, but the worth of sENA will most likely appreciate as rewards accumulate.

Withdrawing Staked Assets

Users who choose to not stake their tokens can do so at any time through the same dApp interface. Selecting the “Unstake” option will again prompt the wallet to sign and submit a transaction. Once confirmed, users receive ENA equivalent to their initial stake and any additional value gained during the staking period.

However, there is a mandatory seven-day cooldown period for the unstaked ENA to be withdrawn. The tokens are unavailable in the protocol during that time and cannot be accessed.

Considerations for Users in the UAE

Users participating from the UAE must account for certain platform-specific and regional considerations. Exchange and transaction fees can vary depending on the exchange used to acquire ENA. Staking pools and validators also charge service fees, and these can impact the net staking returns.

Verification times can also vary according to network activity. Once ENA is staked, users may experience delays before reward generation begins. This is typically tied to the block validation schedule of the staking pool selected.

Where to Stake ENA

Besides the native Ethena platform, ENA is supported on various staking-enabled platforms. These include CoinUnited, Gate.io, and Ethena Finance itself.

Ethena Finance provides an interface directly tied to its smart contract infrastructure. It integrates seamlessly with wallets and enables users to monitor sENA values in real time. The staking dashboard is user-friendly and suitable for managing staking without extensive experience.

CoinUnited offers support for over 100 cryptocurrencies, including ENA. It allows staking with no lock-up period, provides competitive yields, and incorporates enhanced security with insurance-backed digital assets. CoinUnited is frequently used by both retail and advanced traders due to its broad asset coverage.

Gate.io includes ENA in its HODL & Earn program. This platform allows users to select either locked or flexible staking, depending on risk tolerance and liquidity needs. Daily interest is offered for supported PoS assets, and users can stake directly via the mobile app or web interface.

Read also:

- How and Where to Stake Solana (Full Guide)

- Best Liquid Staking Platforms

- Best Place To Stake Stablecoins [USDC, USDT]

Technical Model Behind sENA

Ethena uses a token vault model similar to Rocketpool’s rETH. Rather than directly issuing yield as a separate token or balance increase, the value of sENA increases relative to ENA over time.

This reflects the underlying yield being accumulated in the staking contract. As a result, users may initially receive less sENA than the ENA staked, but the growing value of sENA compensates for that difference.

This approach reduces the need for reward claims and simplifies the reward tracking process. Since the yield is embedded in the rising value of sENA, users benefit from compounding effects without frequent transactions.

Conclusion

Ethena staking allows ENA holders to participate in network support while earning yield through a value-accruing token model. Users can begin staking by acquiring ENA, connecting to the Ethena interface, and confirming a staking transaction that converts ENA to sENA.

Rewards are accumulated automatically and reflected in the increasing value of sENA. Platforms like CoinUnited and Gate.io also support ENA staking, offering different structures such as flexible yields and insured assets.

There is a seven-day cooldown period upon unstaking. This kind of structure exists to ensure ease of use and network engagement for the jurisdictions that are supported, including the UAE.