Ahead of the imminent launch of the Spot Ethereum ETFs, fund issuers have begun to show their cards as they look to outbid the other Spot Ethereum ETF issuers. One way they plan to do this is through their management fees for their respective funds. Amid the fee wars, the ETFSwap (ETFS) ecosystem is buzzing ahead of the launch of these Spot Ethereum ETFs, given how it is set to benefit from these funds.

What you'll learn 👉

Spot Ethereum ETFs Begin ETF War With Management Fees

The Spot Ethereum ETF war has begun with fund issuers revealing their management fees in their final S-1 filings. These fees are meant to attract more clients to respective funds, with investors likely to consider the fees attached to each fund when looking for which Spot ETH ETF to invest in.

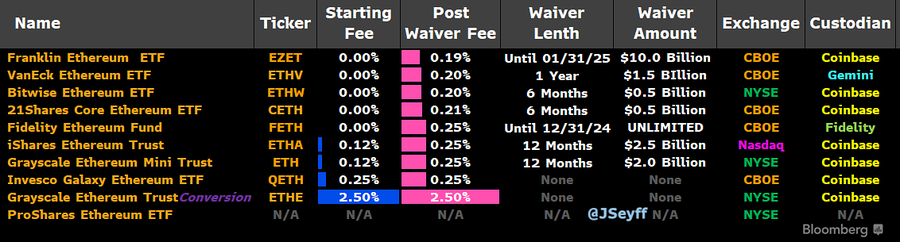

Bloomberg analyst James Seyffart highlighted the fees of the Spot Ethereum ETFs in an X (formerly Twitter) post. Franklin Templeton, VanEck, Bitwise, 21Shares, and Fidelity have all implemented fee waivers to launch their respective Spot Ethereum ETFs. These Fee waivers are meant to last a certain period, with Franklin Templeton’s, for instance, lasting until January 31 next year.

Franklin Templeton also has the cheapest post-waiver fee among these Spot ETH ETF issuers, with a management fee of 0.19%. VanEck and Bitwise both have a post-waiver fee of 0.20%. 21Shares stands alone with a management fee of 0.21%. Fidelity, BlackRock, Grayscale (Mini Trust), and Invesco have post-waiver fees of 0.25% for their respective Spot Ethereum ETFs. Meanwhile, Grayscale (Ethereum Trust) has the highest fees, with a management fee of 2.50%.

ETFSwap (ETFS) Is The Biggest Winner

ETFSwap (ETFS) is undoubtedly the biggest winner, while the Spot ETH ETF issuers fight to attract inflows to their respective funds. The trading platform will tokenize and bring these Spot Ethereum ETFs on-chain, meaning that most inflows into these funds could flow through the decentralized finance (DeFi) platform.

ETFSwap (ETFS) is well placed to witness most of these inflows, considering how easier it is to invest on the platform than in centralized trading platforms. ETFSwap’s decentralized nature means that investors can access the platform without authorization. The investment process is also much more straightforward since the DeFi platform has made its Know-Your-Customer (KYC) requirements non-mandatory.

The DeFi platform has also introduced features which investors won’t find anywhere else. For instance, those looking to invest in the tokenized Spot Ethereum ETFs on ETFSwap can also stake their ETH tokens to enjoy the impressive yields with which ETH validators are rewarded.

This staking feature will be very handy for Spot Ethereum ETF investors, considering these Ethereum ETFs do not have staking plans. Users can also stake their ETFSwap (ETFS) tokens and enjoy more mouth-watering gains, with the trading platform offering up to 80% annual percentage yield (APY) on their native token.

The ETFSwap (ETFS) token also provides access to various crypto assets and commodities on the trading platform. Users can swap the platform’s native token for other tokens or their preferred commodity. Thanks to ETFSwap, portfolio diversification is much easier, as users can convert their traditional assets to crypto assets and vice versa.

The DeFi platform has also introduced leverage trading for ETFs, allowing users to use up to 50x leverage on each ETF trade. Investors will also have artificial intelligence (AI) powered trading tools to work with to execute more successful trades and enjoy greater returns on their investments.

Ahead of the Spot Ethereum ETFs launch, the ETFSwap (ETFS) team has also boosted investors’ confidence in the trading platform. They were recently verified and certified by Solidproof.

Conclusion

The ETFSwap (ETFS) token’s price will skyrocket once these Spot Ethereum ETFs launch, given the increased demand it is set to enjoy from those looking to invest in these tokenized funds on the DeFi platform. Therefore, now is the best time to buy the token while it is still selling at a discounted price of $0.0183.

For more information about the ETFS Crypto Presale:

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.