Solana’s SOL token has rallied to a critical technical level that could determine its next major move.

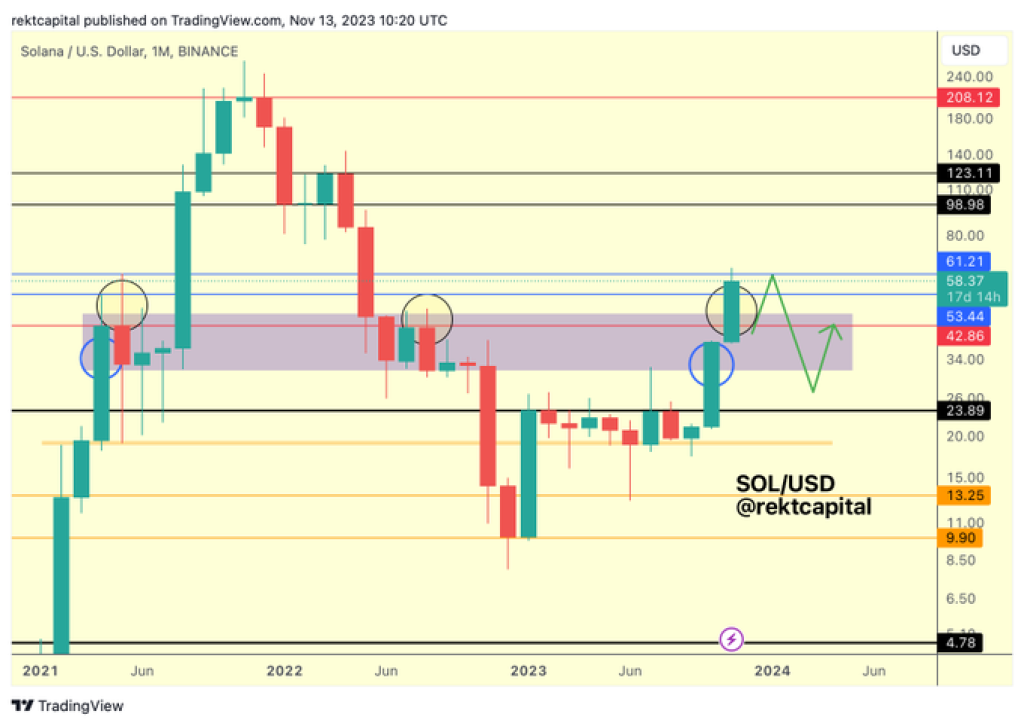

According to widely-followed analyst Rekt Capital, SOL is now testing the $61 resistance level that previously capped upside in 2021. This area lines up with the top of a key range defined by horizontal resistance and an ascending trendline.

Notably, SOL stalled out and retraced sharply the last two times it reached this zone over the past year. Rekt Capital suggests history could repeat itself once again.

On the way up, SOL also faced stiff resistance around $53, resulting in consolidation before eventually breaking out to the current $61 area. This underscores just how significant the $61 barrier is from a technical perspective.

A rejection here would open the door for a pullback toward the bottom of the range around $35, where SOL found support earlier this year.

However, a decisive daily close above $61 would be very bullish and suggest room to run toward horizontal resistance around $88. This would represent a new high for the cycle.

Read also:

- Bitcoin, MATIC and These Altcoins Are Top Cryptos to Watch This Week

- Dogecoin Devotees Pivot to This New Memecoin, Eyeing a Fresh Financial Frontier

- How Taraxa (TARA) Could Mirror Kaspa’s Parabolic Success

In summary, SOL is at a pivotal make-or-break level that has repeatedly stopped rallies over the past year. How it acts around $61 will offer meaningful clues about whether recent strength marks the early stages of a macro-uptrend or a short-term bounce within a broader downtrend.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.