Rekt Capital posted an analysis of Solana and Injective price action in the latest edition of his newsletter. He discussed what to expect next from SOL and INJ prices based on recent price action.

The following paragraphs will reveal the main content of the newsletter.

What you'll learn 👉

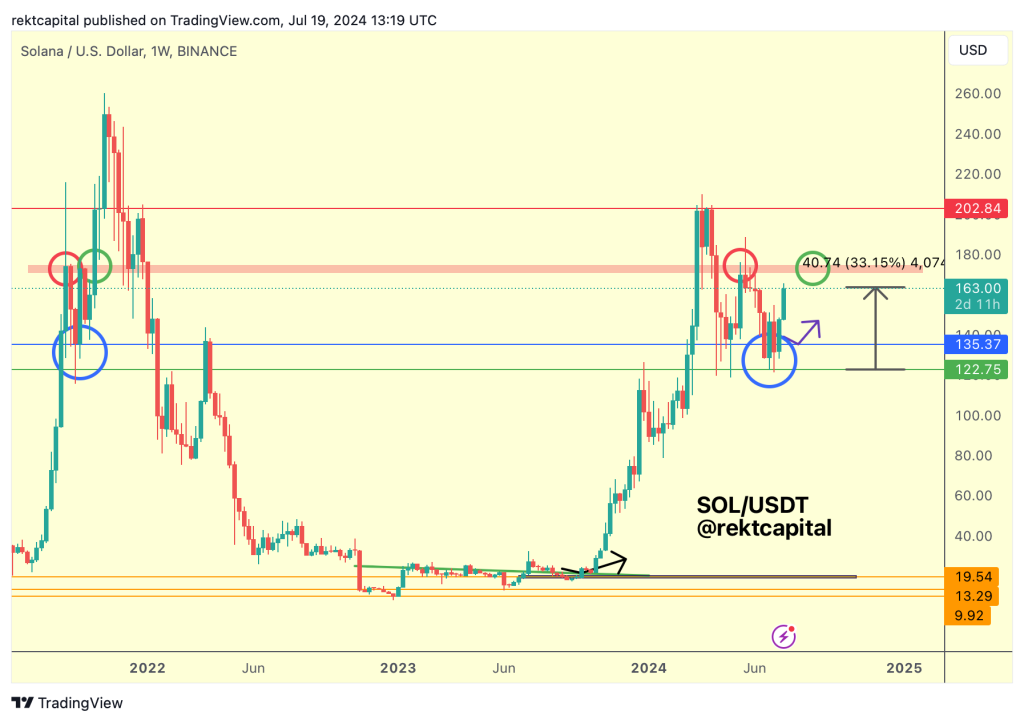

Solana Must Break Key Level for a Bullish Continuation

The analyst started by describing Solana’s price action last month when he discussed Solana’s crucial retest of the green level around $125, which has acted as a good source to buy Solana in the past. Solana was able to stabilize the price, and since then it has spiked by 33%.

Now the analyst is hoping that Solana closes above the red-boxed resistance at around $170 on the weekly chart. This will also enable trade in the green circle. If the price gets there and is rejected from there, it could set Solana up for another rejection.

SOL is range-bound between $122 (green) and $170 (red box), and once SOL is ready to break out of this range, this breakout will be confirmed via a weekly close above the red-boxed resistance.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Also Read: Analyst Warns Polygon (MATIC) Price is ‘Under Pressure’ – Here’s His Outlook

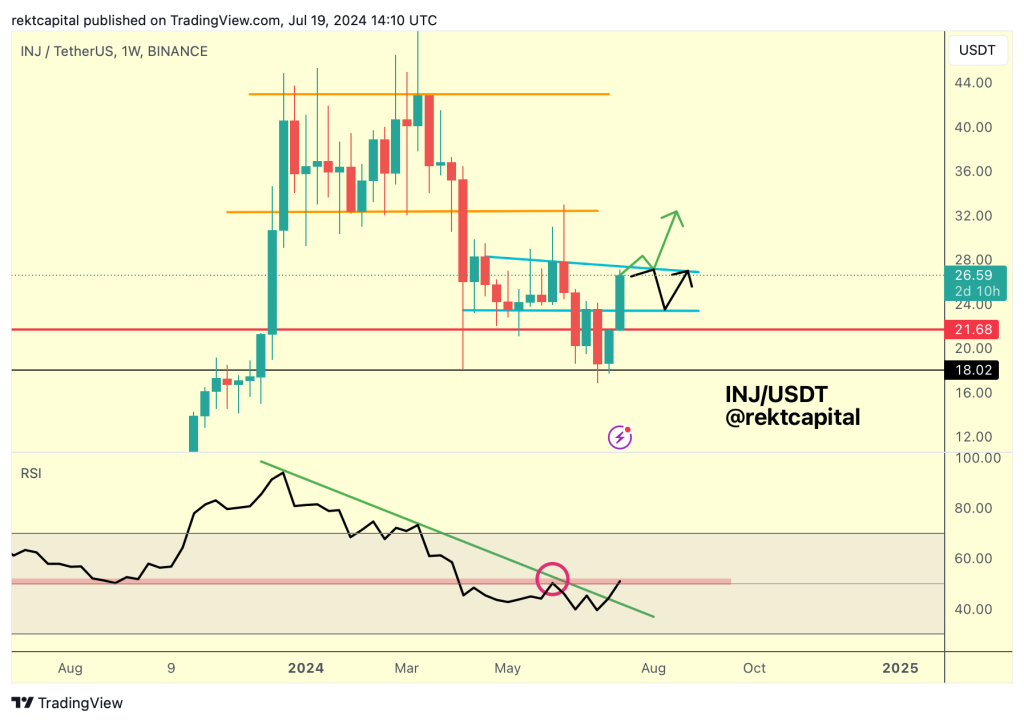

Injective Recovering Fine: Looks Poised for Uptrend

Based on the newsletter, INJ is enjoying a strong recovery after rebounding from the $18.00 (black) support. This has made its price even lower than the previous triangular structure (light blue).

Going forward, INJ has a few options: If INJ Weekly closes above the light blue diagonal, then a retest of it could be next to confirm the breakout to the orange $30+ resistance.

However, if INJ instead upside wicks beyond this diagonal resistance and fails to Weekly Close above it, it could reject back into the base of the triangular market structure, following the black path instead.

An important positive is that the RSI has broken its green downtrend dating to late 2023; this means that INJ is probably ready for a new uptrend, especially when the RSI breaks its red resistance box.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.