According to analysts Rekt Capital and Jacob Canfield, Solana is displaying bullish technical and on-chain signals that could propel further upside for the $SOL token. Unlike previous cycles, Solana is consolidating differently after sharp gains, while increased network activity looks primed to drive new demand.

Breaking Old Consolidation Patterns

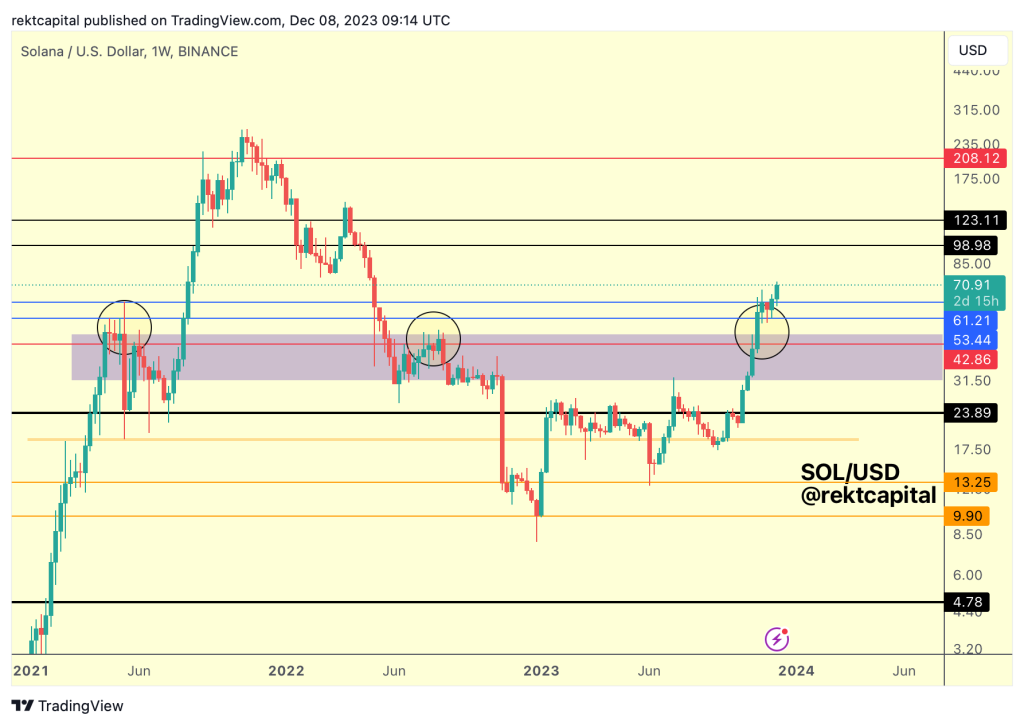

As Rekt Capital highlighted recently, “$SOL Solana is doing something completely different at these price levels compared to previous rejections in 2021 and 2022.” Based on the chart, Solana has spike up sharply in value recently before consolidating.

But unlike past market cycles, Solana is holding support above previous resistance levels and consolidation ranges. As the additional analysis added: “Solana is not consolidating below the Critical price levels in which it consolidated on 2021 and 2022.”

This unique price action for $SOL could signal bullish continuation ahead thanks to shifting market dynamics.

Demand Growing Across Solana Ecosystem

Jacob Canfield notes one factor driving renewed Solana adoption – increased incentives and airdrops rewarding participation:

“The thesis for $SOL continuing higher is very simple. The network effect of seeing all these people getting 5-6 figure air drops will result in a significant number of people buying $SOL and bringing assets over to farm the air drops.”

As more users interact with Solana dApps to capitalize on airdrops and DeFi opportunities, demand for the underlying $SOL token naturally increases. With fixed token supply, rising utility should translate to appreciating prices over the long-term.

Read also:

- Solana (SOL) Shows Signs of Strength, But Is a Pullback Due?

- Ethereum On-Chain Data Promising as ETH Reaches 18-Month Highs Amid Whales Accumulating Over $45 Million in 5 Days

- Chainlink (LINK) Surges 10%; Polkadot (DOT) and InQubeta (QUBE) Emerge as Top Purchased Token

So with Solana breaking out of previous consolidation ranges, alongside accelerating on-chain activity, analysts like Jacob Canfield and Rekt Capital argue the top blockchain has room to continue surging.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.