Solana (SOL) has been on a tear recently, with the price surging to over $54 for the first time since May 2022. According to on-chain analytics provider Santiment, this decisive breakout signals Solana is decoupling from other crypto assets as momentum builds. But can the rally be sustained and reach as high as $61 soon?

What you'll learn 👉

Mainstream Attention Returning

Source: Santiment – Start using it today

Santiment points out that discussion rates about Solana have spiked across social media and mainstream finance channels. This suggests regular investors are taking notice of Solana’s strengthening price performance compared to competitors. As more retail and institutional interest returns to Solana, this creates a feedback loop potentially helping drive the price higher.

Funding Rates Elevated But Not Yet Worrisome

At the same time, Santiment notes funding rates on Solana futures contracts are getting high but not yet in truly worrisome territory. This indicates trader enthusiasm and bullish speculation are picking up, but not at mania levels that would precede a blow-off top. There is still room for further momentum if funding rates remain reasonable.

Technical Resistance Ahead

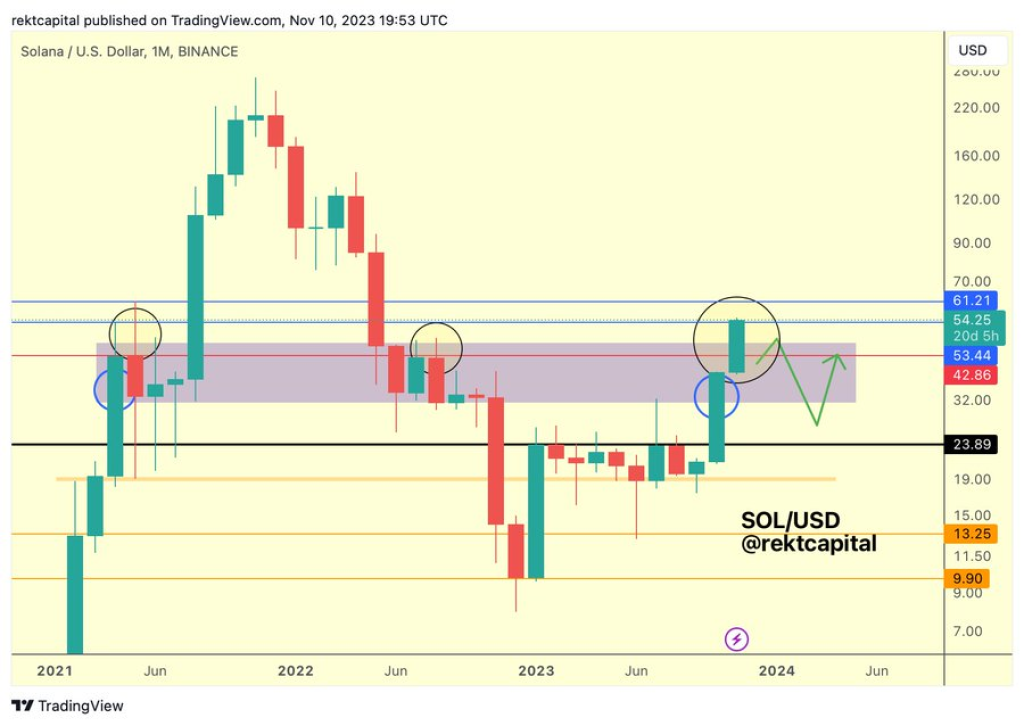

According to crypto analyst Rekt Capital, Solana still faces overhead resistance around the $61 that formed in 2021. While the price has already broken strongly above the 2021 resistance line around $53, it remains to be seen whether $61 will also be overcome convincingly. If Solana can replicate this feat, it signals a new bullish phase ahead.

Read also:

- Are Meme Coin Kings Dogecoin (DOGE) and Shiba Inu (SHIB) ‘Late for the Party’?

- Why Solana (SOL) Will Continue to be One of the Biggest Movers During This Bull Market

- Here are Two Tokens Set To Skyrocket in Price In The Upcoming Months

Major Technical Breakout Underway

In summary, Solana’s surge above its prior 18-month resistance is a very bullish technical sign of growing strength. With on-chain data also reflecting building momentum, Solana looks poised to keep rallying higher. The key test will be successfully conquering the $61 barrier and sustaining the breakout. But overall, Solana seems to be in the early stages of a renewed bull market.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.