Bitcoin is displaying unprecedented behavior that could redefine the next bull run, suggests a Twitter analyst Satoshi (@satoshimoneybtc). The crypto maven, known for his in-depth technical analysis and foresight, posted a thread highlighting three phenomena Bitcoin is exhibiting for the first time in its 14-year existence: record-breaking hash rates, a decline in supply availability, and an influx of institutional money, all taking place amid a prevailing bear market.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +

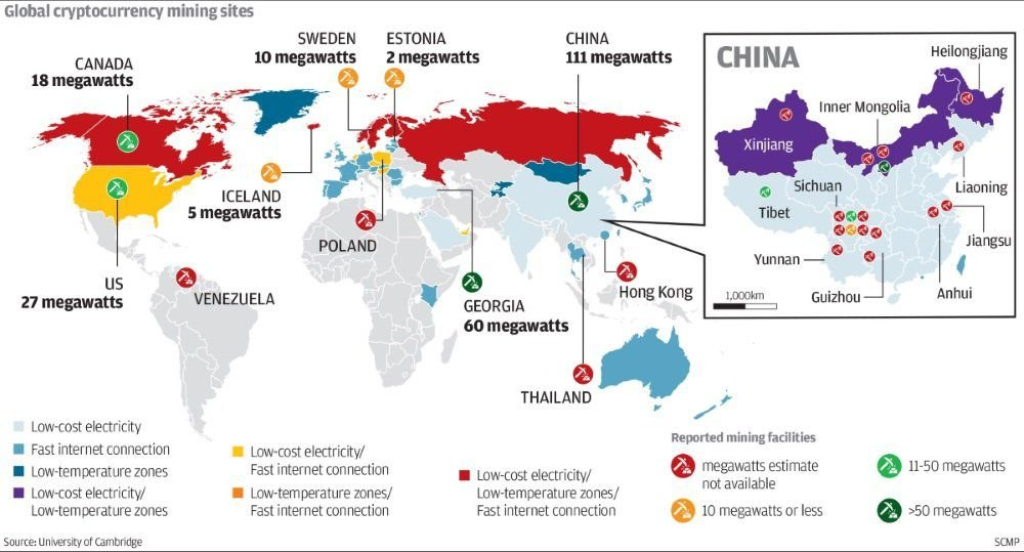

In his well-received thread, the crypto expert pointed to the robust growth in the Bitcoin hash rate, even during the current bear market. The hash rate is a measure of the processing power devoted to Bitcoin’s network. It’s a reliable indicator of the overall health and security of the Bitcoin network. The current all-time highs could be attributed to a diverse list of nations and companies, including government entities from Bhutan, Venezuela, Laos, and El Salvador, and energy giants such as Japan’s Tepco, Russia’s Gazprom, and US’ Exxon Mobile.

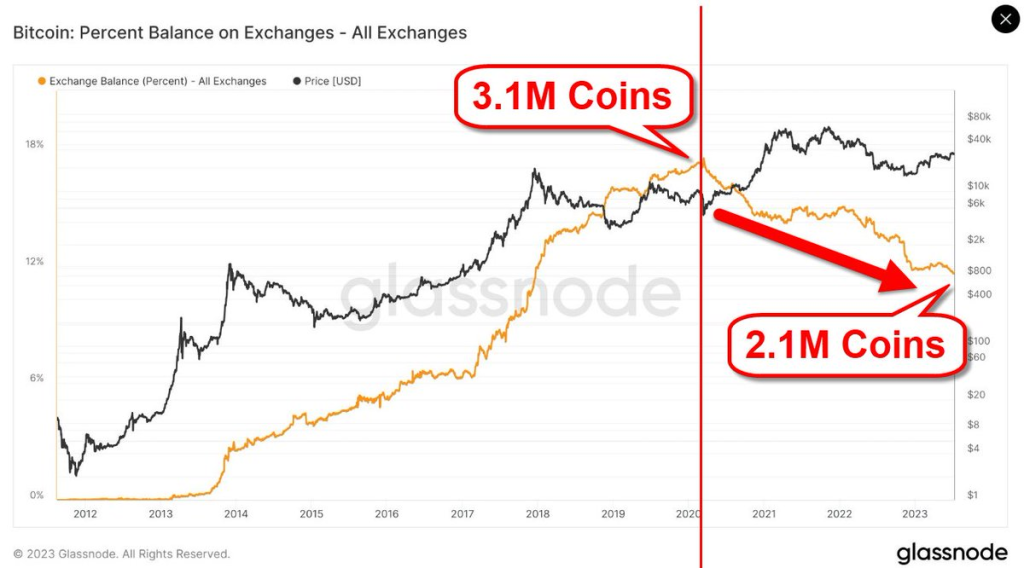

But this development isn’t the only one shaking up the Bitcoin universe. Satoshi, the well-respected technical analysis expert, identifies a trend of “supply suffocation.” The supply of Bitcoin on exchanges has reduced by over one-third, from 3.1 million in March 2020 to just 2.0 million in July 2023. This reduction is contrary to the historical pattern of coins being sent to exchanges and raises questions about who has been absorbing these Bitcoins.

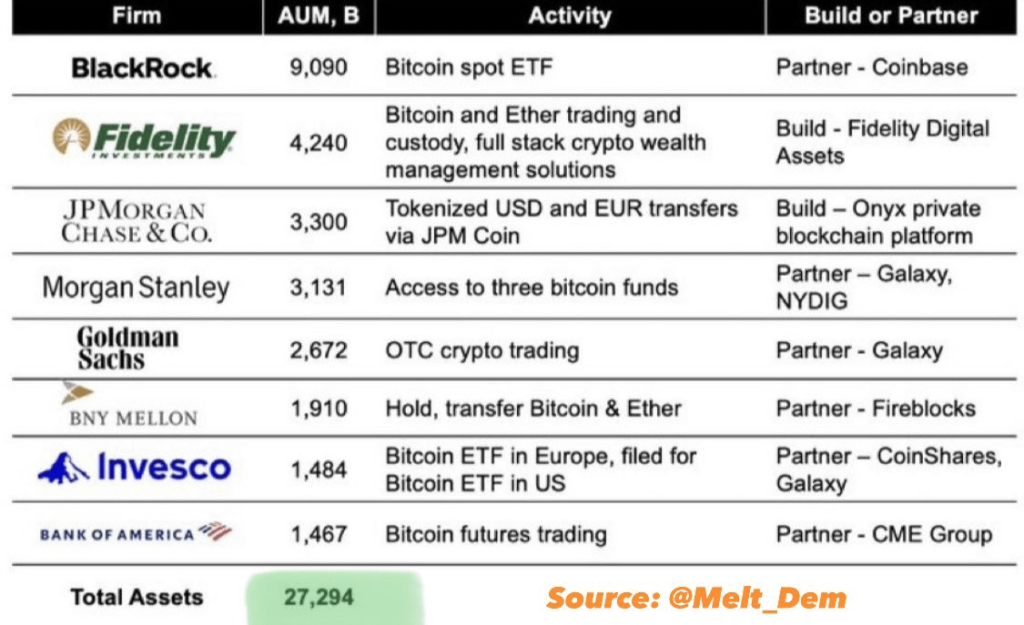

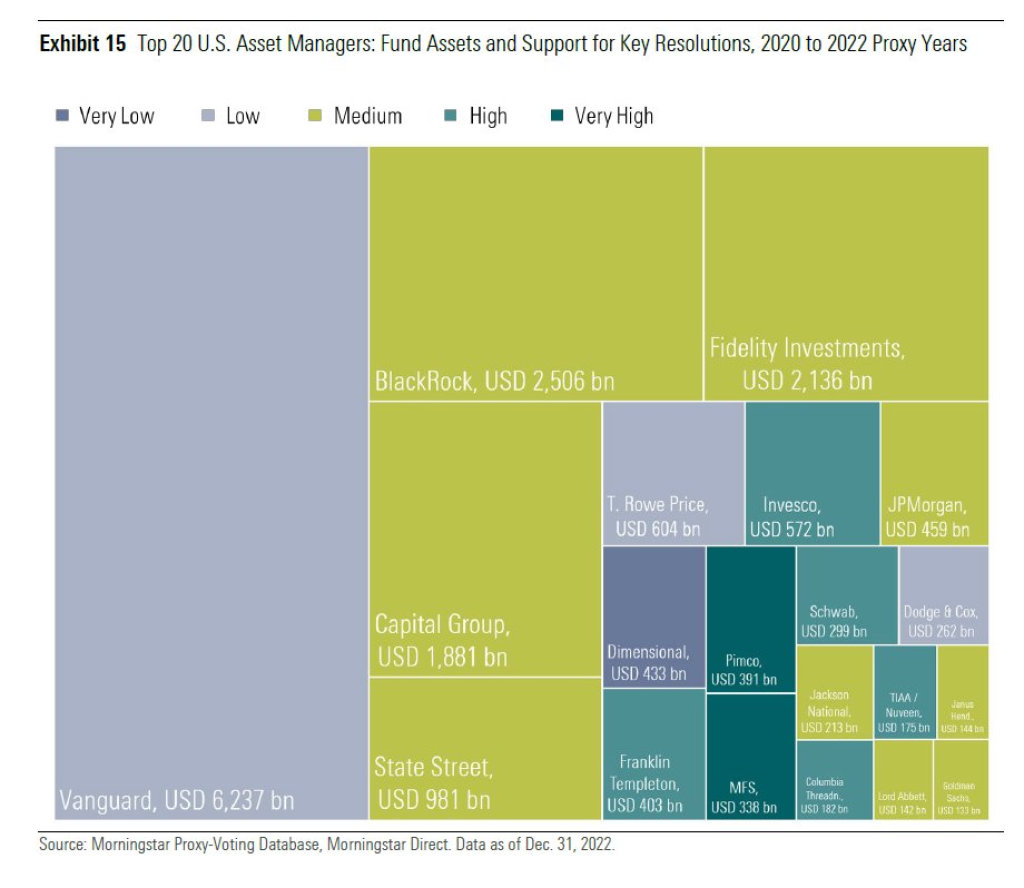

Satoshi hypothesizes that large financial entities may have played a part in this supply squeeze. He posits that asset managers and banks controlling a staggering $57 trillion might have been quietly accumulating Bitcoin since 2020 before announcing their exchange-traded funds (ETFs) publicly. This potential accumulation, coupled with the impending Bitcoin halving event due in 323 days, when new Bitcoin supplies will be cut in half, could be brewing a perfect storm for the next bull run.

Interestingly, this activity continues unabated during the current bear market, prompting Satoshi to question if we are witnessing the start of a global “hash war” or even something bigger.

“Isn’t it strange that all of this data is doing something we’ve never seen before, in the middle of a bear market?” Satoshi posits in his enlightening thread.

Satoshi concludes with a hint towards the possible role of nation-states in Bitcoin accumulation. He suggests that while El Salvador has proudly broadcast its Bitcoin adoption, other countries might not be as transparent, adding another layer of intrigue and excitement to the future of Bitcoin.

This analysis by the famed Twitter trader highlights the dynamic shifts happening within the Bitcoin ecosystem. It provides food for thought for all Bitcoin enthusiasts, from the casual observer to the most ardent believer.