In a recent analysis conducted by Miles Deutscher, an industry analyst, it has been revealed that the Securities and Exchange Commission (SEC) has classified 19 tokens as securities within the legal frameworks outlined in the filings against Coinbase and Binance. This development holds significant implications not only for these tokens but also for the wider cryptocurrency industry. Let us examine the details discovered through Miles Deutscher’s insightful analysis.

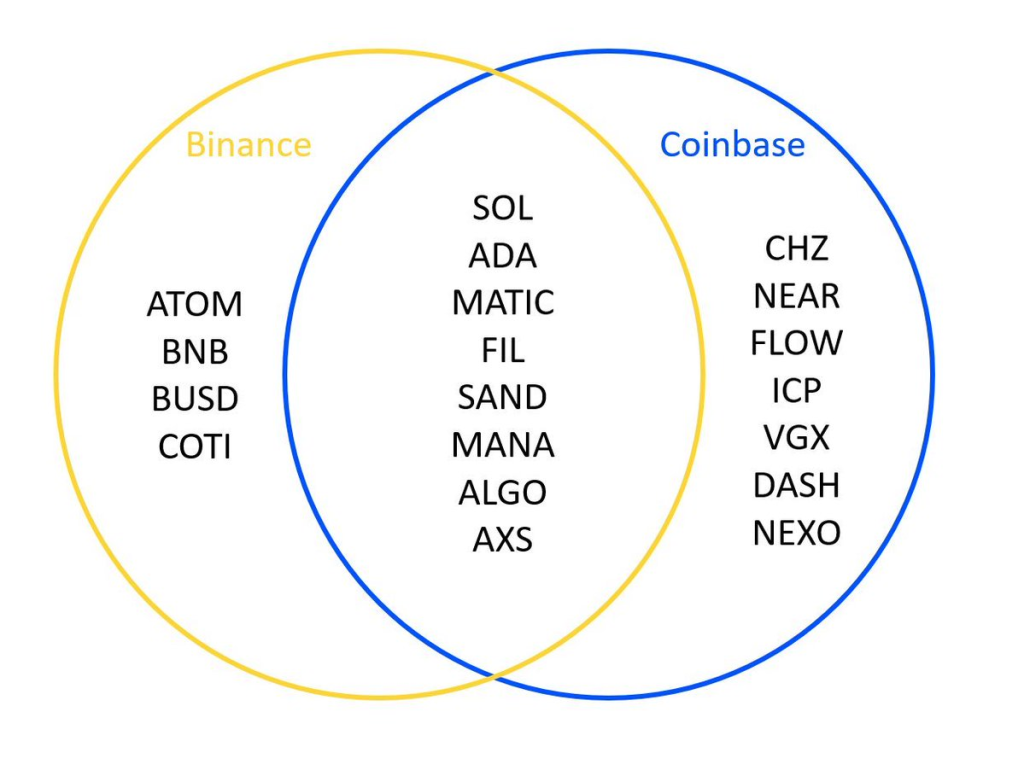

The identified tokens that the SEC considers as securities are associated with both Binance and Coinbase. Binance’s list includes $ATOM, $BNB, $BUSD, and $COTI, while Coinbase’s list comprises $CHZ, $NEAR, $FLOW, $ICP, $VGX, $DASH, and $NEXO. Interestingly, Ethereum’s $ETH has been excluded from this list, indicating a distinctive categorization for this particular cryptocurrency.

Upon closer examination, common characteristics can be observed among these identified tokens. Miles Deutscher highlights three significant aspects shared by these tokens. Firstly, each of these tokens underwent an initial sale or fundraising event, marking their introduction to the market. Secondly, the projects behind these tokens made commitments to ongoing protocol development, including allocating resources towards business development and marketing efforts. Lastly, social media platforms played a crucial role in promoting and emphasizing the unique features and advantages of these protocols.

Uncover the latest jaw-dropping trends in the crypto market that are turning everyday investors into millionaires! From explosive Asian meme tokens to a Wall Street Memes token on the verge of hitting a mind-blowing $5 million, the crypto world is ablaze with profit potential. Witness China’s surprising shift in crypto policy and dive into the viral sensation of Wall Street Memes, backed by global fame and Elon Musk’s attention. Plus, get an exclusive sneak peek at AiDoge, the AI-powered meme coin that’s set to revolutionize the industry. Don’t miss out on this once-in-a-lifetime opportunity to ride the wave of crypto success!

Show more +The classification of these tokens as securities is based on the application of the Howey Test, a framework used to determine whether something qualifies as an “investment contract” or security. The test comprises four criteria: an investment of money, participation in a common enterprise, an expectation of profit, and the profit being derived from the efforts of others. According to Miles Deutscher’s analysis, the SEC argues that these 19 tokens meet these criteria, leading to their classification as securities due to the presence of an “expectation of profit.”

The implications of this classification are significant and wide-ranging. Firstly, these tokens would become ineligible for trading on US exchanges, impacting their liquidity and accessibility. Moreover, there is a possibility that these tokens might be delisted from prominent US exchanges like Coinbase and Robinhood in the interim. This regulatory development poses challenges and establishes a precedent that raises concerns within the industry.

It is important to acknowledge that the Howey Test, which serves as the foundation for these determinations, was established in 1946 and may not fully address the complexities of the evolving digital asset landscape. Miles Deutscher’s analysis highlights the limitations of applying a precedent established over seven decades ago to this new and innovative asset class. The approach taken by the United States in this matter may require further examination to ensure a nuanced and forward-looking regulatory environment.

Looking beyond the United States, Miles Deutscher suggests that other nations adopt a progressive approach to cryptocurrency regulation. Notably, countries such as the United Arab Emirates, the United Kingdom, and Australia have shown positive and thoughtful developments in this regard.

Amidst this evolving landscape, regulatory clarity becomes crucial. The current development and future growth of the industry rely on clear guidelines that effectively integrate cryptocurrencies into the financial system. While formulating these guidelines may take time, it is essential for stakeholders to stay informed and prepared for the path ahead, as highlighted by Miles Deutscher’s comprehensive analysis.