This Friday could mark a pivotal moment for the cryptocurrency market. According to a recent post by crypto analyst Crypto Rover, there’s a high likelihood that all Bitcoin Spot ETFs might receive the Securities and Exchange Commission’s (SEC) nod by the end of this week. The reason? The SEC is approaching a deadline.

Crypto Rover [@rovercrc] detailed on his social media platform: “This Friday marks the deadline for the SEC to appeal the Grayscale Bitcoin Spot ETF decision. If they don’t appeal the court’s decision, they will have no further options to decline any other Spot Bitcoin ETFs, and thus, they will be forced to approve them all.”

What It Means for the Future of Bitcoin

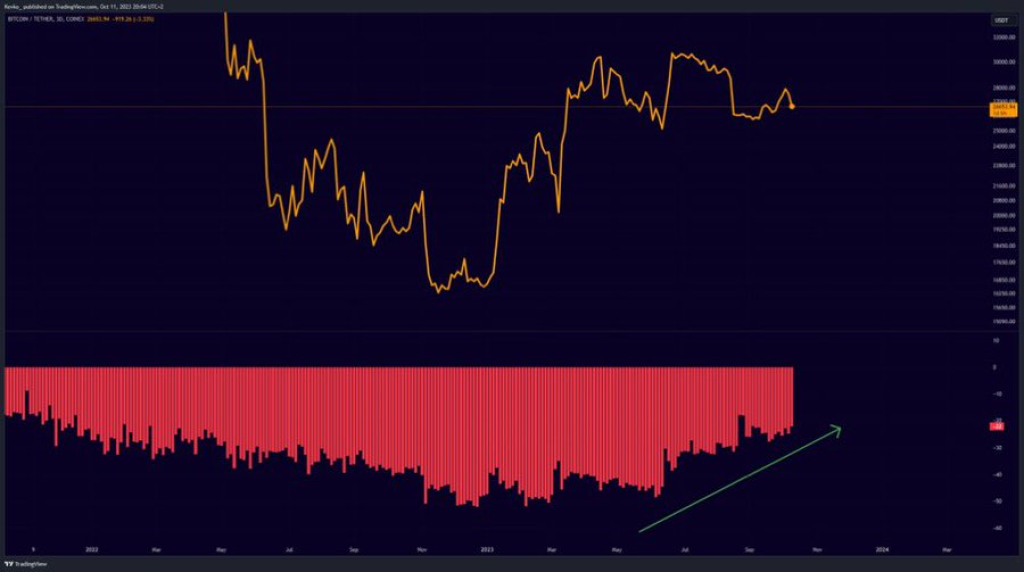

If the SEC refrains from filing an appeal against the recent court decision that favored Grayscale’s Bitcoin Spot ETF, it implies that the regulatory body has run out of moves to prevent the approval of spot Bitcoin ETFs. This potentially game-changing event for the crypto world comes at a time when many suggest we are at the tail end of a crypto bear market. With the potential for the first Bitcoin spot ETF to debut in a couple of months, the analyst opines that brighter days for Bitcoin are on the horizon.

The implications of such an outcome are wide-reaching. The gates could be swung open for a series of Bitcoin spot ETF applications from significant players in the market, such as BlackRock, Fidelity, Bitwise, Ark Invest, and Invesco.

For a long time, the SEC has been on the fence, rejecting spot Bitcoin ETF proposals. However, this week’s potential non-appeal would signal a dramatic shift in the cryptocurrency regulatory landscape. If this goes forward, mainstream investors might soon have a more extensive array of options to include Bitcoin in their portfolios.

Analysts from across the sector believe that such a move could catalyze a surge in Bitcoin prices, perhaps signaling the termination of the ongoing crypto bear phase. As the crucial Friday deadline looms, all eyes within the crypto sphere are keenly fixed on the SEC’s next steps. Will they appeal, or will Bitcoin Spot ETFs finally see the light of day? Only time will tell.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.