Rocket Pool ($RPL) has been on a tumultuous journey, with many in the community finding it challenging to pinpoint its bottom. However, recent indicators suggest a potential shift in its trajectory.

Some analysts have observed strong bullish divergences in its daily performance, indicating that the asset might be oversold. This, combined with potential bullish pattern reversals, suggests that Rocket Pool might be gearing up for a significant move. Others have noted that the asset has the potential to surge by as much as 20% in a single day.

For those considering entering the Rocket Pool market, both spot and x3 leverage positions have been discussed, with the latter offering the possibility of significant gains. However, as always, potential investors are reminded that this is not financial advice and due diligence is essential.

In a recent analysis, it was highlighted that $RPL, after facing a challenging period for nearly three months, has touched its Fibonacci level and found support at $24. This is noteworthy, especially considering the asset had multiplied its value by five times at the beginning of 2023.

The Relative Strength Index (RSI) for Rocket Pool is currently on the shorter side. This has led some to believe that Dollar-Cost Averaging (DCA) should be approached with caution. However, there’s a growing sentiment among a part of the community that Rocket Pool could emerge as a significant performer in the near future.

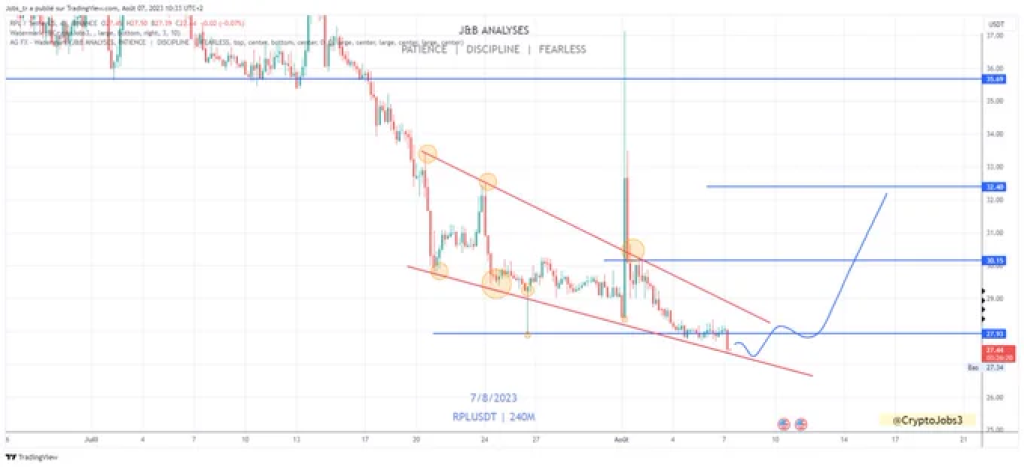

RPL token is currently exhibiting a neutral stance in its near-term outlook according to a technical analysis by altFINS. This sentiment is primarily influenced by the emergence of a Channel Down pattern, which has been a point of discussion among traders and analysts familiar with the token.

Channel Down Pattern: What Does It Indicate for RPL?

The Channel Down pattern is a technical chart pattern that signifies a potential downtrend. For the RPL token, the price experienced a bearish breakout from its previous Channel Up pattern. This shift became more pronounced when the RPL token’s price descended below its 200-day moving average, marked at $38. Such a move is typically interpreted as bearish, hinting at a possible reversal to a downtrend for the token.

At present, the RPL token’s price is navigating within the Channel Down pattern. For traders who believe that the token’s price will continue to remain within this channel, now might be a suitable time to initiate trades when the price undergoes fluctuations within its channel trendlines. However, for those awaiting a more definitive move, the strategy would be to observe a breakout. When the RPL token’s price breaks through the channel’s trendlines, either on the upper or lower side, it can lead to swift price movements in the breakout’s direction.

The prevailing trend for the RPL token indicates a downtrend across all time horizons, be it short, medium, or long-term. This observation is further supported by the fact that the liquid staking protocol associated with RPL was the centerpiece of a recent research report. Traders and investors are advised to set a price alert for the RPL token to stay abreast of developments.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The momentum for the RPL token presents a dichotomy. While the MACD Line is above the MACD Signal Line, suggesting bullish momentum, the RSI is less than 45, pointing towards a bearish undertone.

For those monitoring the RPL token’s support and resistance levels, the nearest Support Zone is identified at $25. Conversely, the Resistance Zones for the RPL token are set at $30 (previously a support level), followed by markers at $45 and $55.

Rocket Pool (RPL) has experienced notable price fluctuations recently. In the last 24 hours, the cryptocurrency has witnessed a 7.1% increase in its price, bringing its current value to $27.78. However, over the past week, RPL has seen a decline of 4.2%.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.