Ripple has finally released their standard quarterly crypto market report. This time it was for Q3 2024.

Ripple’s CEO Brad Brad Garlinghouse posted a viral X tweet last night explaining that the report is pretty clear and it shows how insitutional interest in XRP is growing with Bitwise, Canary Cpaital and most recently, 21Shares all filing for XRP ETFs.

What you'll learn 👉

Broader Crypto Market Context and ETF Developments

Q3 2024 brought big changes to the crypto landscape, including a 50-basis-point rate cut by the Federal Reserve that triggered positive movement across crypto markets. Bitcoin rose over 10%, with several altcoins gaining up to 50% following the announcement.

The ETH ETF market made its U.S. debut in July, with major players like BlackRock, Fidelity, and Grayscale entering the space. U.S. ETH ETFs have attracted $552.2 million, while Bitcoin ETFs continue their impressive run with $18.5 billion in year-to-date inflows. Notably, among the top 50 ETFs by assets under management, 15 are now focused on BTC or ETH.

XRP Market Performance and Trading Activity

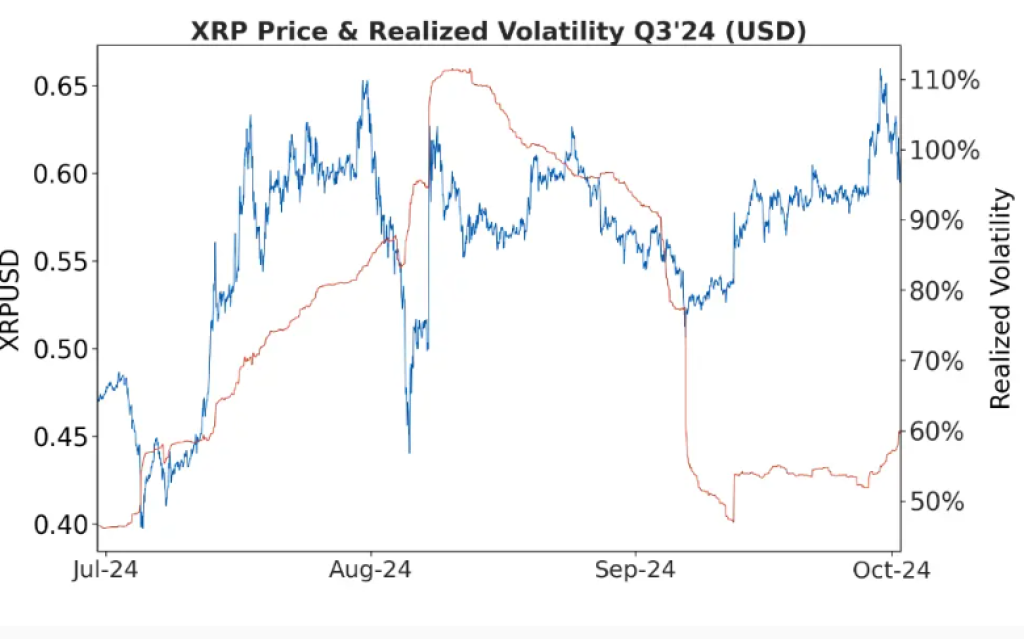

The quarter showed strong performance for XRP markets, with average daily volumes reaching $600-700 million on top-tier exchanges. XRP’s volatility peaked in mid-August at over 110%, driven by price movements between 40 and 65 cents, before settling to around 60% in the latter half of the quarter.

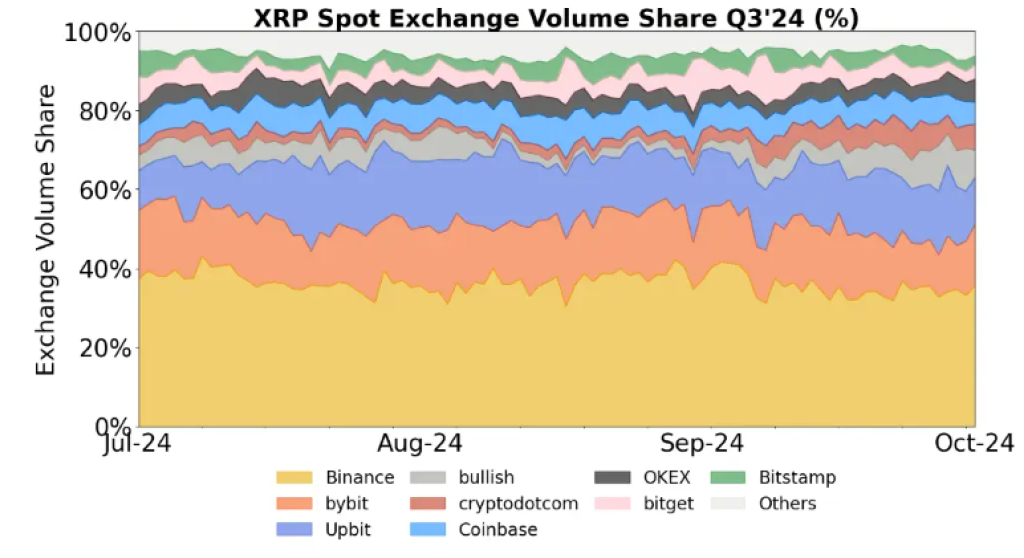

Trading volume distribution remained relatively stable, with Binance, Bybit, and Upbit accounting for over 65% of total traded volume. Binance saw a slight decline (-3 percentage points) while CryptoDotCom gained ground (+6 percentage points) compared to Q2. The proportion of fiat pair trading increased from 10% to 14%, though USDT pairs continue to dominate trading activity.

XRPL Developments and Ripple USD

The report highlighted huge developments for the XRP Ledger, including plans to introduce advanced programmability through two key initiatives: native smart contract capabilities on the XRPL Mainnet and the XRPL EVM Sidechain. The latter, developed in partnership with Peersyst, will use Axelar as a bridge to enable cross-chain transitions with over 55 blockchains.

Ripple also announced its stablecoin initiative, Ripple USD (RLUSD), securing partnerships with major exchanges including Uphold, Bitstamp, Bitso, MoonPay, and others. RLUSD will operate under a New York Trust Company Charter, with guidance from an advisory board including former FDIC Chair Sheila Bair and former CENTRE Consortium CEO David Puth.

Read also: Ripple Analyst Warns of Potential 80% Dip for XRP Price – Here’s Why

On-Chain Activity and Network Growth

The third quarter saw a significant uptick in on-chain activity, with successful transactions more than doubling compared to Q2. The Total Value Locked in Automated Market Makers doubled from $8.5 million to $16.2 million, with notable increases in CRYPTO/XRP and MAG/XRP pools.

Key metrics for Q3 included:

- 172.6 million transactions (99% increase from Q2)

- 598,477 XRP burned for transaction fees

- 111,967 new wallets created (11% increase)

- Average transaction cost decreased by 32%

Regulatory Landscape and Legal Updates

While the SEC’s appeal continues, the report emphasizes that XRP’s non-security status remains unchallenged. The current appeal focuses on certain historical distributions rather than XRP’s fundamental nature. The appeal process is expected to continue through early 2025, with final arguments anticipated in Fall 2025.

Globally, the regulatory landscape shows increasing crypto adoption, with Japan reviewing crypto regulations, South Korea reconsidering its spot crypto ETF ban, and the UAE positioning itself as a blockchain-friendly jurisdiction. Notably, Ripple received in-principle approval from the Dubai Financial Services Authority to expand its payment solutions.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.