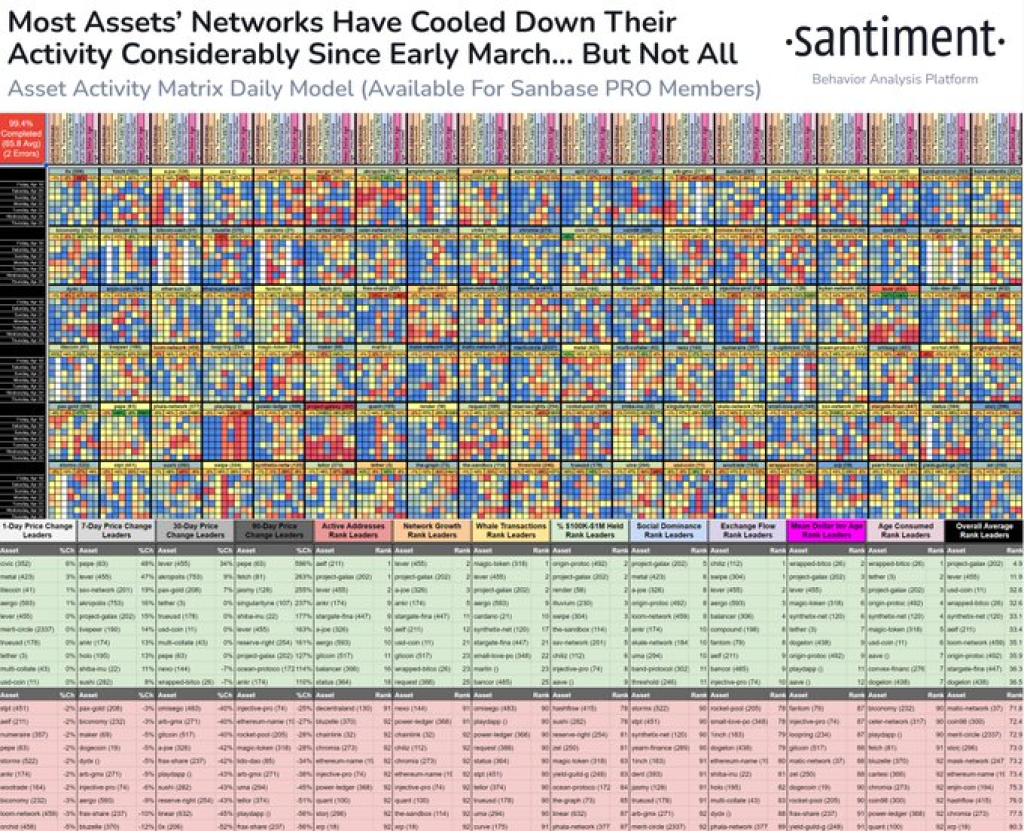

Santiment, a leading cryptocurrency analytics platform, has released its Activity Matrix, a tool that instantly identifies which digital assets are experiencing higher or lower on-chain and social activity than usual. The matrix provides valuable insights into the likelihood of price trend reversals or continuations for various altcoins.

Source: Santiment – Start using it today

What you'll learn 👉

Hot Networks: High Likelihood of Price Trend Reversal

According to the Activity Matrix, three altcoins are currently classified as “Hot Networks,” indicating a high likelihood of a price trend reversal:

- Galxe ($GAL) – Galxe, a decentralized credential data network, has seen a 15% price increase over the past 7 days. The increased on-chain and social activity suggest that the current uptrend may be due for a reversal.

- Lever Network ($LEVER) – Lever Network, a decentralized margin trading platform, has experienced a significant 44% price increase in the past week. However, the heightened network activity implies that the uptrend may be nearing its end.

- Wrapped Bitcoin ($WBTC) – Wrapped Bitcoin, an ERC-20 token backed 1:1 with Bitcoin, has remained stable over the past 7 days. The increased network activity suggests that a price trend change may be on the horizon.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Cold Networks: High Likelihood of Continued Price Trend

The Activity Matrix also identifies three altcoins as “Cold Networks,” indicating a high likelihood of a continued price trend:

- Ripple ($XRP) – Ripple, the digital payment protocol and currency exchange network, has seen a modest 3% price increase over the past week. The reduced network activity suggests that the current price trend may continue.

- Chromia ($CHR) – Chromia, a relational blockchain platform, has also experienced a 3% price increase in the past 7 days. The low network activity implies that the current trend may persist.

- Hashflow ($HFT) – Hashflow, a decentralized exchange for trading crypto assets, has seen a slight 2% price decrease over the past week. The reduced network activity indicates that the current downtrend may continue.

Interpreting the Activity Matrix Data

It is essential to note that an asset’s classification as “hot” or “cold” on the Activity Matrix is not necessarily related to its price performance. Instead, the matrix provides insights into the likelihood of a price trend reversal or continuation based on the asset’s network activity compared to its normal levels.

To accurately assess where the price of an asset will trend next, investors and traders should consider both the current price trend and the sudden changes in network activity. By combining these two factors, market participants can identify potential alpha opportunities and make more informed investment decisions.

However, in cases where an asset’s price trend has been flat, Santiment recommends taking a “wait and see” approach before overreacting to sudden changes in network activity. This cautious approach can help investors avoid making hasty decisions based on short-term fluctuations in on-chain and social activity.

Santiment’s Activity Matrix provides a valuable tool for crypto market participants to identify potential investment opportunities based on the on-chain and social activity of various altcoins. By monitoring the “Hot” and “Cold” networks identified by the matrix, investors can gain insights into the likelihood of price trend reversals or continuations.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.