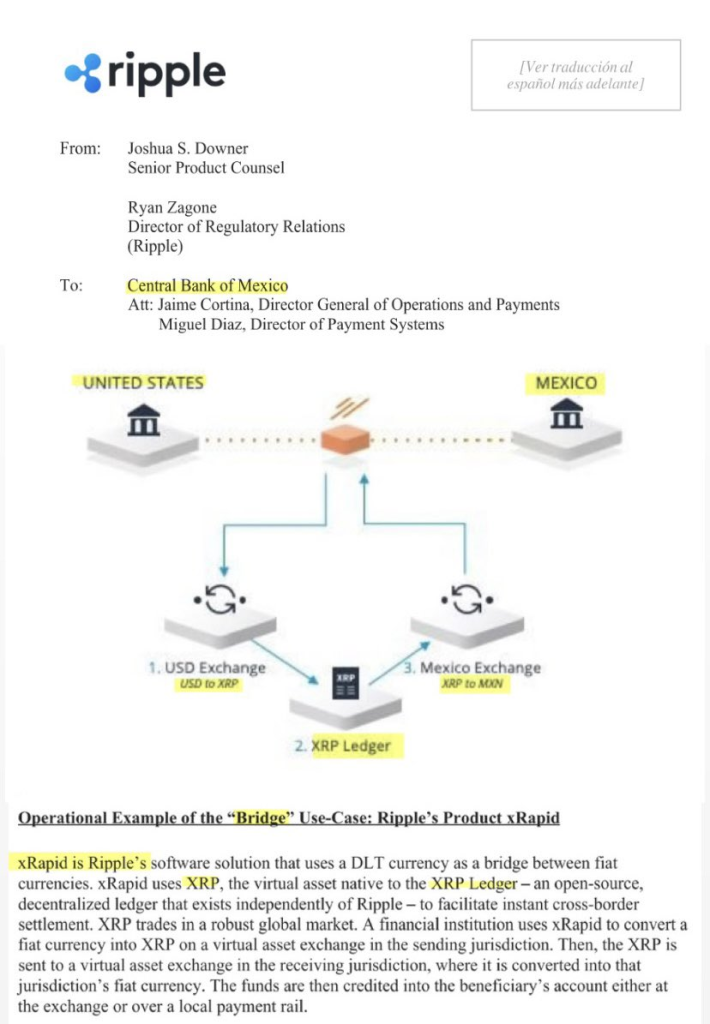

Popular XRP analyst Edo Farina tweeted that Ripple has been in discussions with the Central Bank of Mexico about using XRP as a “bridge asset solution” between the US dollar and Mexican peso.

According to Farina, Ripple presented information showing how its XRapid software and XRP cryptocurrency could facilitate faster and cheaper cross-border payments between the two countries.

“The official letter forwarded by Ripple also mentions XRapid, a software that utilizes DLT and $XRP,” said Farina on Twitter.

This potential real-world usage case for XRP could boost adoption and demand for the cryptocurrency. However, XRP’s price has stagnated in recent weeks despite altcoins like Avalanche and Solana seeing triple-digit gains.

In the last 30 days, XRP is up just 3% compared to 116% gains for AVAX, 65% for SOL, and even 22% gains for DOGE. This lack of upward price action is testing the patience of XRP investors.

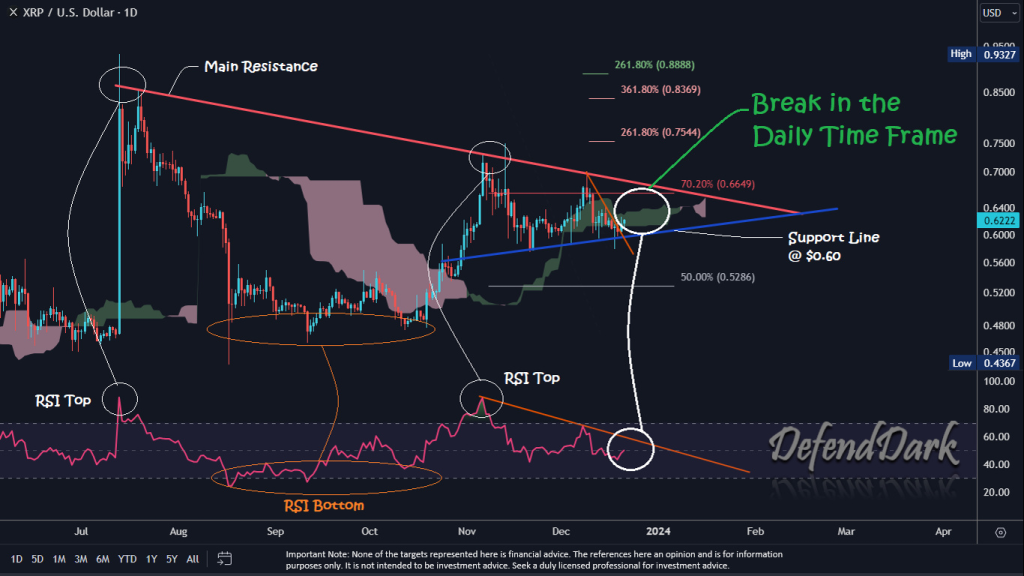

Popular analyst Dark Defender tweeted that XRP finally broke out above a key resistance level on the daily time frame after multiple failed breakout attempts. With the RSI momentum indicator moving back above 50, this could indicate the start of a new uptrend.

The breakout, when combined with the strengthening RSI, signals that XRP is likely heading back towards the $0.66 level. “It would be nice to have a Christmas and New Year gift of XRP touching the $1.05 level.” explained Dark Defender.

So while Ripple continues making progress on real-world adoption, XRP holders will be hoping the technical breakout translates to the cryptocurrency playing catch-up to broader market gains.

You may also be interested in:

- Why Has Centrifuge’s CFG Been Pumping in the Last Two Days? This Strategic Partnership Plays a Big Role

- Onomy Protocol (NOM) Surges Over 30% as Community Anticipates Third Airdrop: Here’s What to Know About the Upcoming Launch

- Retail Investors Break Into the Booming Online Gambling Industry with SCORP – $100,000 Paid Out Already

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.