For years, Ripple has been under fire from XRP holders who believe the company has been dumping its tokens and keeping prices down.

But let’s take a closer look at Ripple moves and a viral X(Formerly Twitter) thread is flipping that narrative. What if Ripple wasn’t selling XRP just to make a profit, but using it to quietly build something much bigger behind the scenes?

What you'll learn 👉

A Web of Global Partnerships Most People Overlook

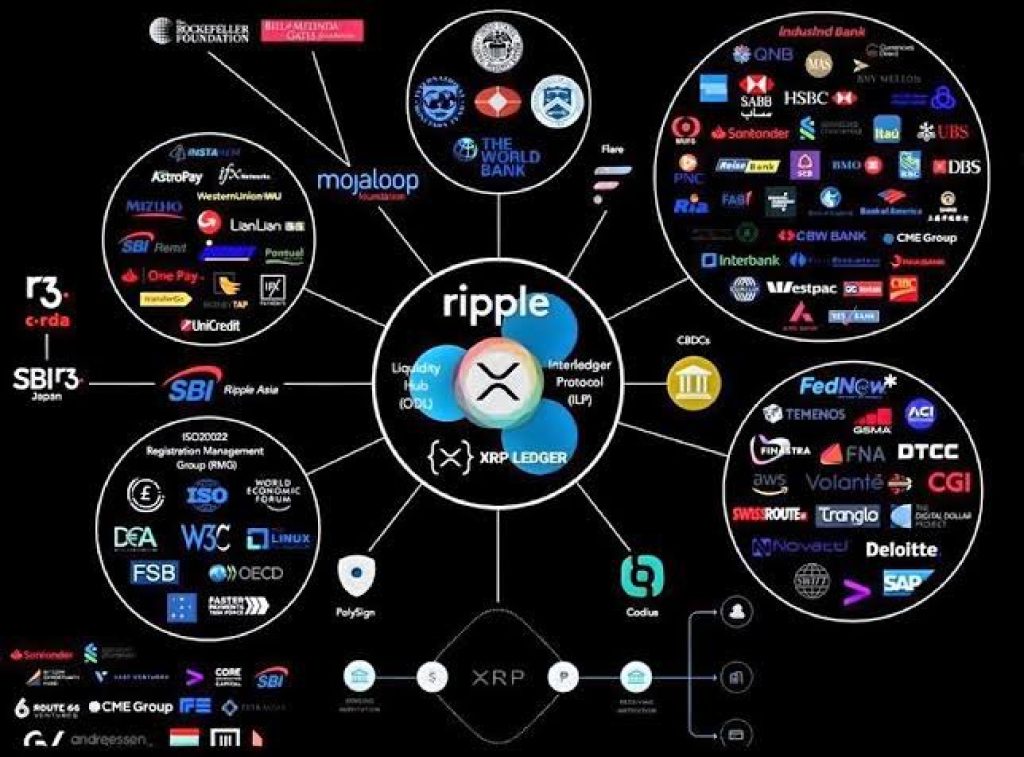

One infographic circulating online maps Ripple deep connections across global finance, and it’s hard to ignore. Ripple isn’t just working with a few banks, it’s tied into major players like HSBC, Bank of America, Santander, SBI, and DBS.

It also shows partnerships with organizations like the World Bank, IMF, ISO 20022, and even the Gates Foundation’s Mojaloop. This isn’t a typical crypto project.

Ripple is building tech that fits into traditional finance, not replacing it. It’s working with regulatory bodies, aligning with messaging and liquidity standards, and building the pipes that big institutions use every day.

Read Also: Ripple vs SEC Ends in Twist: This Deal Could Close the Case for Good!

And on the tech side? Ripple ecosystem includes infrastructure tools like PolySign, Metaco, and the Interledger Protocol, key building blocks for things like smart contracts, custody, and real-world asset transfers.

Retail Frustration Still Runs Deep

While Ripple’s strategy might look impressive to institutions, many retail investors feel burned. A Change.org petition titled “Stop Ripple Dumping” has over 2,300 signatures from XRP holders angry about what they see as constant sell pressure.

For them, it looks like Ripple is tanking the price by flooding the market. Ripple, on the other hand, claims these XRP sales are necessary to fund operations and grow the ecosystem. It’s a clash between short-term price pain and long-term development and not everyone is convinced.

The Thread On X That Changed the Conversation

That’s where the thread on X(Formerly Twitter) from Stellar Rippler comes in. According to them, Ripple wasn’t dumping XRP, it was using it as strategic capital to fund acquisitions and build out its ecosystem.

The thread lists some major moves: acquiring stakes in Bitstamp and MoneyGram, launching the RLUSD stablecoin, expanding Asian corridors with Tranglo, investing in tokenized treasuries via $ONDO, and more.

The thread argues that Ripple used the SEC lawsuit as cover. While the case kept prices frozen and media attention low, Ripple went to work, quietly onboarding institutions and building the foundation for what could become a much bigger system.

Ripple Bigger Play Might Be Just Getting Started

What Ripple is building looks a lot bigger than a remittance company. The thread compares it to BlackRock (for custody), SWIFT (for messaging), Visa (for payments), and even a future on-chain bank.

XRP, in this setup, isn’t just a token, it’s the fuel powering this entire financial engine. Whether you agree or not, one thing is clear: Ripple’s XRP sales may have looked like dumping on the surface.

But behind the scenes, they may have been buying something far more valuable, time, infrastructure, and influence. And now that the lawsuit fog is lifting, many are wondering just how far ahead Ripple already is.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.