Raydium (RAY), the decentralized protocol built on the Solana blockchain, has been making significant strides in recent weeks, experiencing a surge of 400% in its token price. This impressive growth has caught the attention of crypto enthusiasts and investors, leading to speculation about what lies ahead for the Solana token. Let’s delve deeper into the factors that have contributed to Raydium’s success and explore technical analysis that suggests further potential upside.

The Surge in Raydium’s TVL and Price

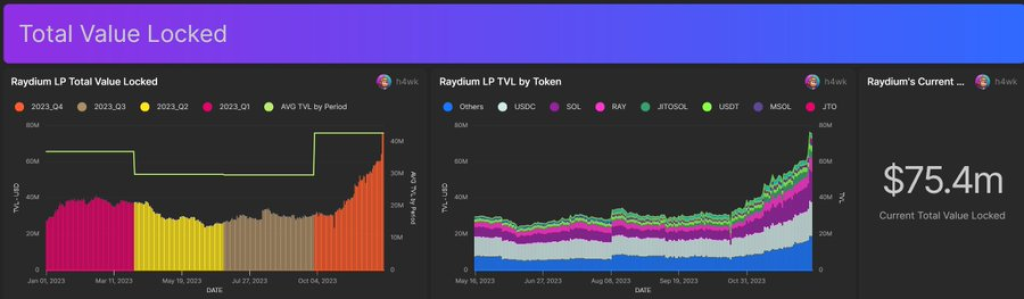

H4wk, a prominent figure in the cryptocurrency community, shared an analysis of the Raydium protocol, shedding light on its recent achievements. According to H4wk’s analysis, Raydium’s Total Value Locked (TVL) has skyrocketed from an average of $29.7 million in Q3 to an impressive $75 million at present, marking a substantial increase of 2.5 times. Alongside the TVL surge, the price of the RAY token has also seen a remarkable rise, increasing threefold from $0.25 to $0.75 in just two months. These developments indicate growing interest and adoption of Raydium’s offerings within the Solana ecosystem.

Growing Liquidity and User Engagement

One of the key factors contributing to Raydium’s success is the growing liquidity and user engagement on its platform. H4wk’s analysis reveals that there have been over 17,000 liquidity pools (LPs) created on Raydium in the last two years, with more than 8,000 LPs established in the past two months alone. The most popular LPs, based on transaction count, include RAY-SOL and RAY-USDC pairs. This surge in LP creation highlights the increasing participation of users in providing liquidity to the protocol.

Furthermore, Raydium has witnessed a significant volume of direct swaps, excluding AMM swaps, with an impressive $750 million in swap volume originating from the last two months. This surge in swap volume indicates the growing popularity of the Solana ecosystem as a whole, with Raydium being a prominent player in facilitating decentralized swaps.

Revenue Generation and RAY Token Utility

Raydium’s revenue generation model is another factor driving its growth. H4wk’s analysis reveals that every swap conducted on Raydium’s platform contributes to the buyback of RAY tokens. A portion of the trading volume (0.03%) from Automated Market Maker (AMM) swaps and 12% of the fees from the Concentrated Liquidity Market Maker (CLMM) are used to buy back RAY tokens. As a result, approximately 2.4 million RAY tokens, equivalent to $750,000, have been bought back since January 2023. This mechanism incentivizes token holders by creating demand for RAY and increasing its value.

Additionally, H4wk highlights that following an exploit in December 2022, fees were designated for RAY buybacks to restore target balances and compensate LPs affected by the exploit. The buyback treasury address currently holds assets worth over $10 million, consisting of RAY (71%), SOL (17%), and USDC (7.8%).

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Collaborations and Recent Updates

Raydium’s continuous collaborations and platform updates have further contributed to its recent surge. The protocol has welcomed several projects into the Solana ecosystem, expanding its offerings and attracting more users. Collaborations with projects like Token22, Ondo Finance, and Circle’s launch of EURC have brought new opportunities and increased utility to Raydium’s platform. These developments demonstrate the growing integration of Raydium within the Solana ecosystem and its commitment to providing diverse and valuable services.

Technical Analysis and Potential Upside

In addition to the fundamental factors driving Raydium’s growth, technical analysis by RoccobullboTTom, a renowned crypto analyst, suggests further potential upside for the RAY token. RoccobullboTTom’s analysis indicates that the RAY token has already broken out on the weekly chart, indicating a bullish trend. According to the analysis, the breakout occurred around $1.4 and RoccobullboTTom expects the price to rise as high as $4, which would represent close to another 300% increase.

Encouragement for Independent Research

While Raydium’s recent performance is impressive, it is important for investors and enthusiasts to exercise caution and conduct thorough research before making any investment decisions. Market conditions can be volatile, and individual projects may face unforeseen challenges. Therefore, it is essential to independently assess the potential risks and rewards associated with investing in Raydium or any other cryptocurrency.

You may also be interested in:

- Fusionist (ACE) Surges 30% as It Secures Binance Listing: Analysts Set Their Price Targets

- Veteran Crypto Analyst: Critical Ethereum Signal Points to “Brutal” Altcoin Run Ahead

- Diversifying Your Digital Portfolio: Top Altcoins Set to Explode in 2024 (BONK, FIL, NUGX)

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.