The cryptocurrencies Raydium (RAY) and Jupiter (JUP) have recently experienced substantial price surges, attracting attention from investors and analysts alike. Let’s delve into the potential reasons behind these rallies.

Raydium (RAY) Breaks Resistance, Targets $3.84

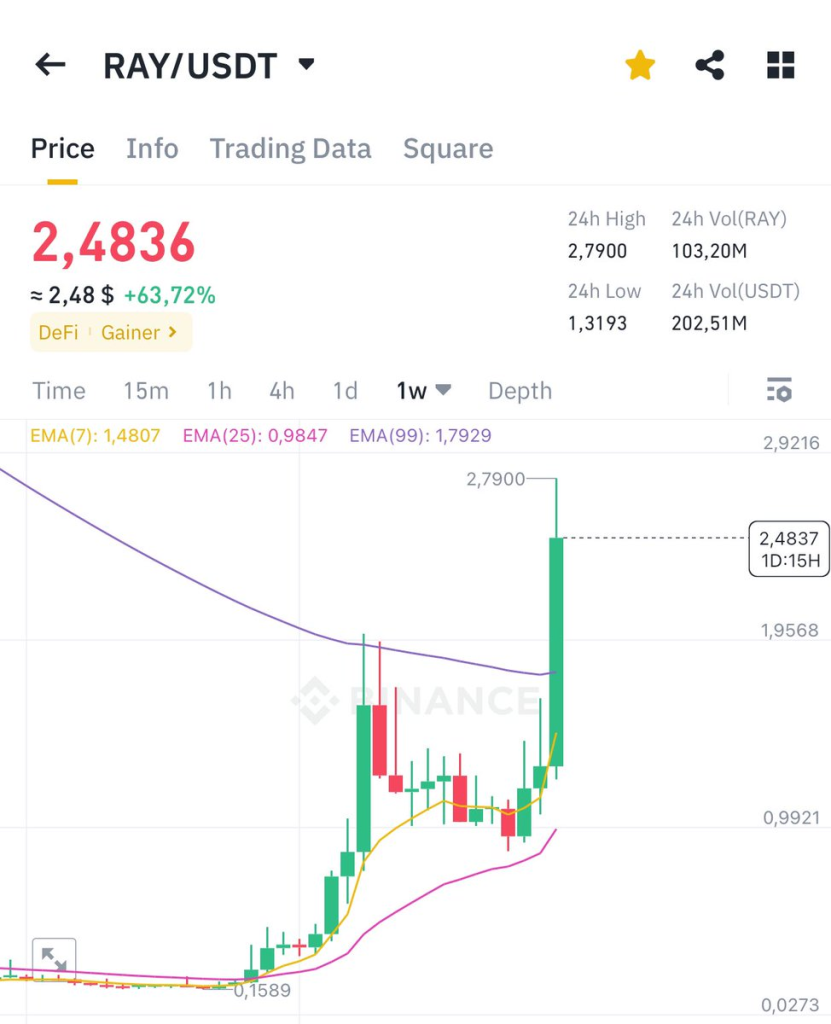

According to X user @CryptoCodreanu, Raydium (RAY) has successfully broken through two significant resistance levels and is currently “grinding to $3.” The analyst states that if RAY manages to surpass the $3 mark, the next target could be $3.84.

The Raydium token has indeed witnessed a remarkable price surge, opening at $1.7 and spiking to $2.7 on the day, representing a 58% increase. Over the past 24 hours, RAY has surged by an impressive 75%, accompanied by a more than 300% increase in trading volume.

The price breakout for RAY comes after the token had been facing resistance since the end of December. The rally could be attributed to a recent announcement by Rebase (@REBASEgg), which chose Raydium as the primary liquidity destination for its $IRL token on the Solana blockchain. This collaboration allows the Solana community to govern Rebase’s ecosystem through $IRL.

Raydium is an automated market maker (AMM) and liquidity provider built on the Solana blockchain, designed to facilitate trading on the Serum decentralized exchange (DEX).

Jupiter (JUP) Surpasses Polygon (MATIC) in 24-Hour Trading Volume

Meanwhile, Jupiter (JUP), a decentralized exchange built on the Solana blockchain, has also witnessed a remarkable price surge. According to @SolanaFloor, JUP has surpassed Polygon (MATIC) in terms of 24-hour trading volume.

The JUP token spiked by 55% in the past 24 hours, accompanied by a trading volume increase of more than 100% in the last 24 hours.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Twitter user @dewuntime praised Jupiter Exchange, stating that the team consists of “real software pros in web 3” who prioritize user experience and consistently collect feedback. The user expressed confidence in Jupiter, advising against “fading” (selling or shorting) the project, likening it to the early days of Binance.

The rallies witnessed by Raydium and Jupiter could be attributed to a combination of factors, including new partnerships, increased trading activity, and positive sentiment surrounding the Solana ecosystem. However, it’s essential to exercise caution and conduct thorough research before making any investment decisions in the highly volatile cryptocurrency market.

You may also be interested in:

- Why Kaspa (KAS) Bullish Run Isn’t Over Despite Ongoing Price Collapse

- Elite Analyst Explains The Graph (GRT) and Hedera (HBAR) Price Movements – Here’s His Outlook

- Remarkable & Limited Supply: Why Pushd (PUSHD) Sets to 50X Ethereum (ETH) & USD Coin (USDC) Holders Investment – Presale Still Available

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.