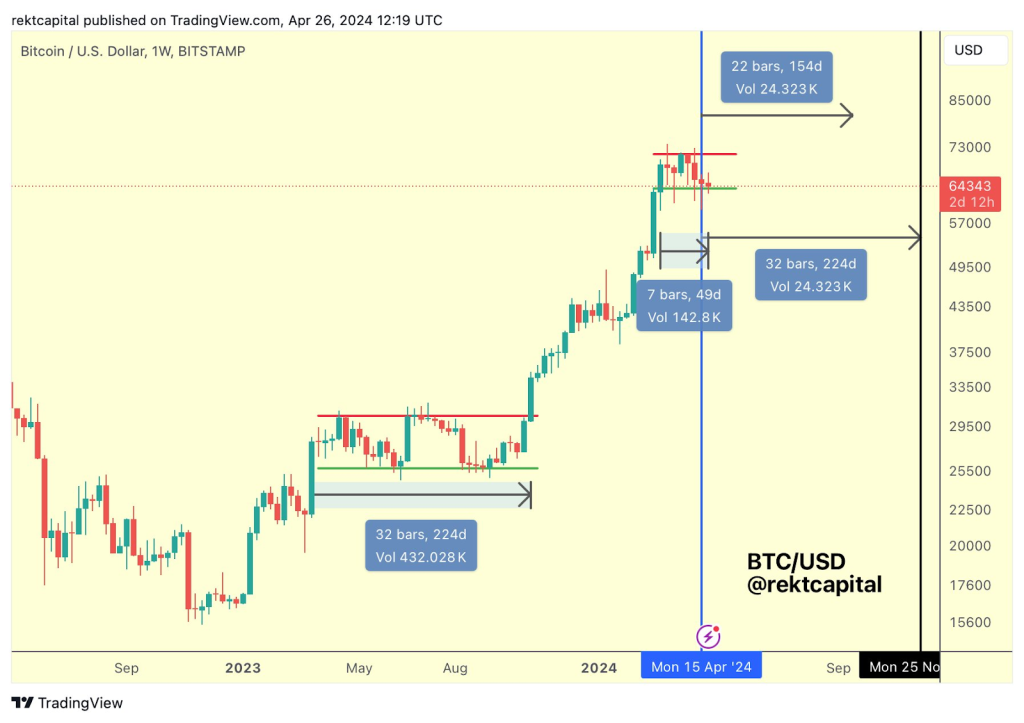

According to the top crypto analyst Rekt Capital (@rektcapital), Bitcoin (BTC) tends to develop a re-accumulation range around the time of its halving events. Historically, Bitcoin has consolidated within this range for up to 150 days after the halving before breaking out into a parabolic upside.

In the analyst’s words, “If Bitcoin were to consolidate for the next 150-days or so, then that would mean that Bitcoin would only breakout in September 2024.” However, Rekt Capital also notes that an ideal re-accumulation range could last longer than 150 days.

What you'll learn 👉

Analyzing Bitcoin’s Cycle Acceleration

When Bitcoin reached a new all-time high in mid-March, it signified an acceleration in its cycle by 260 days. Despite the subsequent 49-day consolidation, the acceleration has dropped to around 210 days. If Bitcoin were to repeat history and consolidate for a total of 150 days after the halving, it would still be accelerating in the current cycle, but to a lesser extent – by only 60 days.

For Bitcoin to fully resynchronize with historical halving cycles, however, it would need to consolidate for more than 150 days after the halving. Ideally, a consolidation of at least 210 days in the post-halving period would bring the rate of acceleration to zero. Consequently, an over 200-day post-halving consolidation could see Bitcoin break out sometime in November 2024.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Replicating the mid-2023 Range

In mid-2023, Bitcoin formed a re-accumulation range that lasted for 224 days before breaking out into a new uptrend. Rekt Capital suggests that for Bitcoin to fully resynchronize with its historical halving cycles and reset the current acceleration to zero, it would ideally need to replicate this 224-day range.

While Bitcoin has demonstrated the ability to produce such a range, it did so in the absence of fundamental catalysts like the anticipated Bitcoin exchange-traded fund (ETF) and the halving event itself.

Ultimately, the duration of the current re-accumulation range will dictate the remaining acceleration in this cycle and influence where Bitcoin will finally peak in its bull market.

According to CoinGecko, the price of Bitcoin (BTC) is currently $62,972.32, representing a 1.88% price decline in the last 24 hours and a 1.73% price decline in the past 7 days.

Hunting for a small cap coin that could explode 10x? We’ve unveiled a few last week alone.

Get all our future calls by joining our FREE Telegram community.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.