The price of Polygon’s MATIC token has fallen around 15% this week, making it one of the poorest performers among major altcoins. MATIC is currently trading around $0.8, down from highs above $1 in late December. This steep decline seems to be driven in part by whales moving significant funds to centralized exchanges.

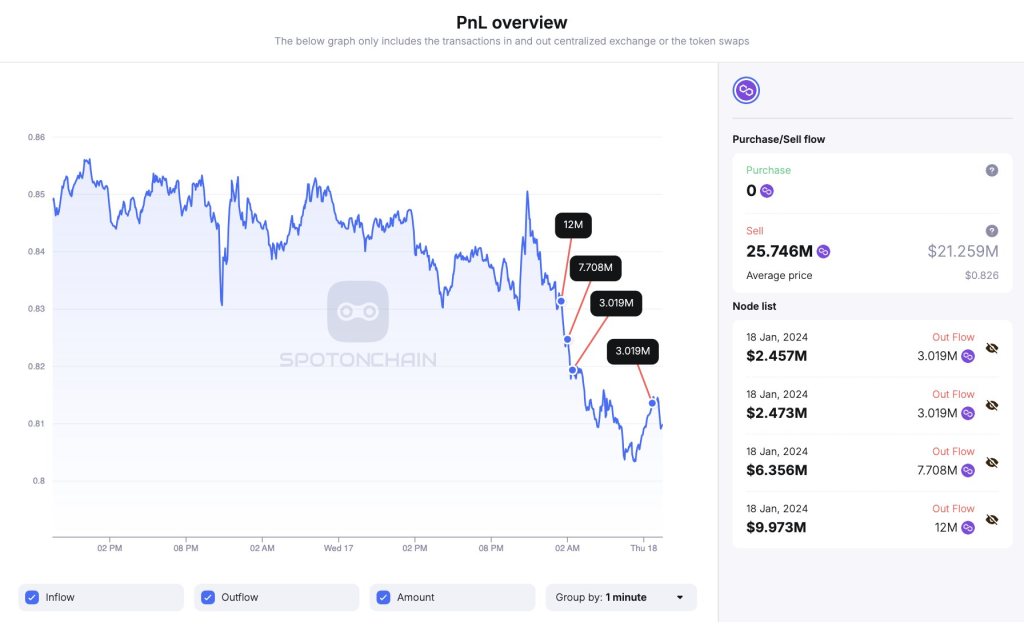

According to on-chain analytics provider Spot On Chain, Celsius Network recently deposited nearly 26 million MATIC tokens worth over $21 million to Binance and Crypto.com as the price dropped.

This movement of funds to exchanges is often viewed as a precursor to selling, as traders seek to liquidate holdings. When major holders sell large portions of their tokens, it can put significant downward pressure on the price.

Technically, MATIC looks vulnerable to further declines in the short term. Key support sits around $0.72, which aligns with the 4.236 Fibonacci retracement level from the November lows to December highs. There is also technical support around the crucial 200-day moving average near $0.69. If these levels fail to hold, MATIC could easily test the psychological $0.50 level.

The relative strength index (RSI), a key momentum indicator, shows MATIC as significantly oversold across all timeframes. RSI levels are ranging between 30-40 on the daily, weekly, and monthly charts. While oversold conditions can persist in bearish markets, MATIC looks poised for at least a minor relief rally once selling pressure subsides.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +So, the technical outlook and on-chain activity point to elevated risks for MATIC in the near term. Investors should keep a close eye on the $0.72 support zone and watch for signs of a trend reversal on the higher timeframes. If the whales stop depositing to exchanges, that could mark the end of the current capitulation.

You may also be interested in:

- Overnight Millionaires: How 4 Traders Cashed In Big On This Meme Coin

- Analyst Suggests Solana (SOL) Could Reach This Level Following Bull Flag Breakout

- Is Dogecoin ($DOGE) Preparing For An Epic Rebound After Holding 100-Day MA, Or Is This a Better Alternative? Here Are The Levels to Watch

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.