Polkadot’s native token DOT saw massive growth and popularity during the 2021 bull market, but has since seen a dramatic price decline of over 90% from its peak. According to crypto analyst hitesh.eth, this boom and bust cycle is largely due to overhype and overvaluation of the project in its early stages.

In the lead up to Polkadot’s first parachain auction in 2021, there was huge excitement about the potential supply shock if a significant portion of the total DOT supply was bonded to secure parachain slots. The winning bid by Moonbeam bonded 3% of the total DOT supply. This led many to believe subsequent auctions would follow suit.

“Would I be surprised if $DOT drops to $1.5 from here? I wouldn’t, as I mentioned that $DOT was heavily overvalued from the start.” says hitesh.eth

However, as we entered the bear market, interest and bidding declined rapidly. Recent auctions have had winning bids as low as 75K DOT, a 99.79% decrease from the first auction. This demonstrated the overvaluation of DOT during the hype phase.

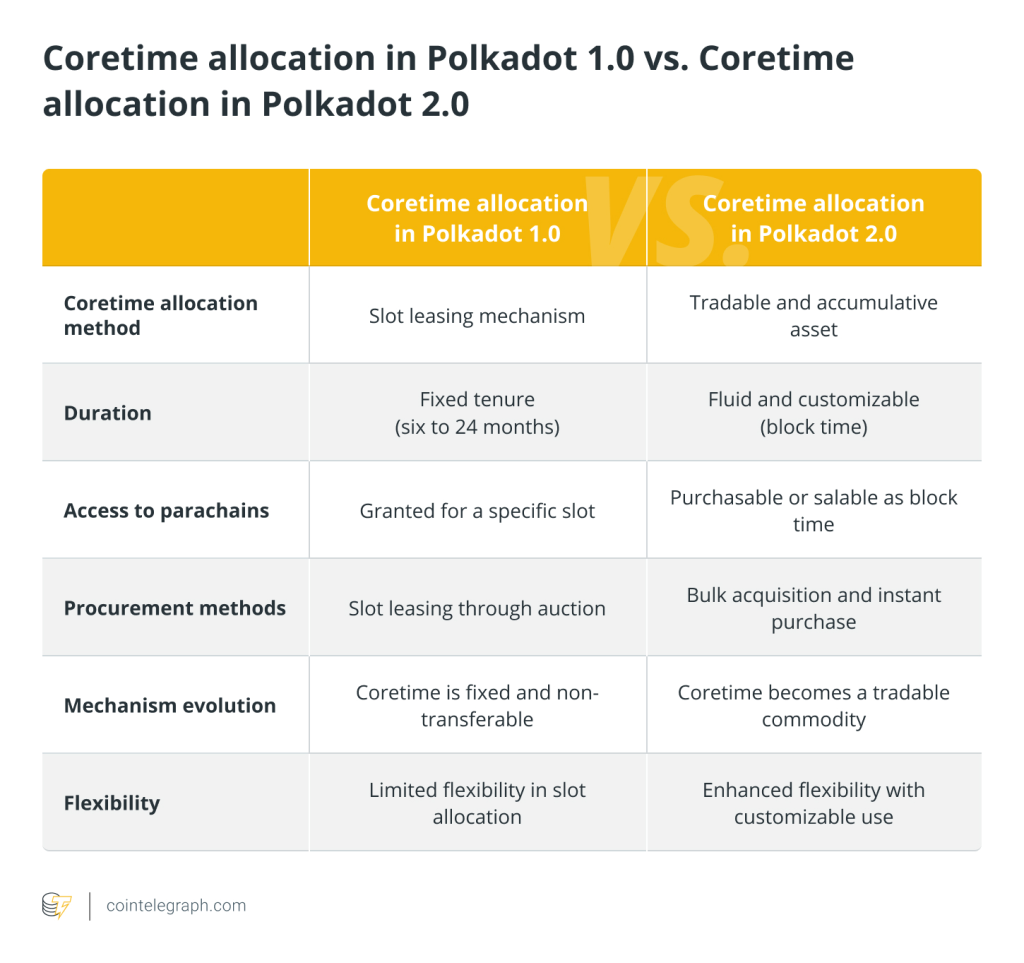

Nonetheless, Polkadot developers have been actively building. Polkadot 2.0 promises major improvements to scalability and flexibility. Key changes include:

- Support for up to 1 million TPS for parachains through asynchronous backing

- Phasing out the auction model for parachain slots

- Introducing Polkadot Core Time model where projects can lease blockspace and run smart contracts

- Allowing flexible leasing periods and sharing of blockspace

The goal is to build a massive blockspace that projects can use to build sovereign chains. Leasing this core blockspace requires payment in DOT, which can provide new supply shocks depending on governance decisions on treasury funds.

This has renewed some excitement for Polkadot’s potential, with ambitions to host 1000+ parachains leading to fresh predictions of supply squeezes. Polkadot’s advanced development framework, shared security, and liquidity model could attract projects.

However, Polkadot now faces greater competition from other chains like Cosmos, Polygon, and more. Its adoption will depend on whether its technology and solutions prove superior.

While Polkadot 2.0 provides a positive catalyst, DOT remains speculative. The overhype and comedown in price leaves doubts about returning to its all time high, but there is potential for good returns from its low point if adoption grows. Hitesh.eth personally remains skeptical and would avoid investing for now.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.