The global banking system has long favored institutions over individuals, offering depositors minimal interest while re-lending the same funds at much higher rates. For the unbanked, more than a billion people worldwide, access to credit remains difficult, burdened with paperwork, middlemen, and high costs.

However, the growth of decentralized finance (DeFi) projects is shifting the concept, with PayDax Protocol (PDP) becoming a familiar name. By combining crypto assets, tokenized RWAs, and decentralized insurance, PayDax is devising a lending model that could improve how money flows in the digital world.

What you'll learn 👉

How PayDax Protocol Breaks Investors Free from Traditional Banking

In traditional finance, borrowers face centralized gatekeepers who decide eligibility, terms, and fees. Depositors earn less than 1% while banks pocket the spread. PayDax disrupts this imbalance with a peer-to-peer system where users lend, borrow, and insure directly through smart contracts.

Borrowers can post cryptocurrencies like Ethereum or tokenized RWAs, such as gold, real estate, or luxury collectibles, as collateral. Instead of selling valuable holdings, they unlock stablecoin liquidity, keeping exposure to potential appreciation. Lenders step in to fund these loans, earning yields far higher than any bank offers.

Innovative Lending Through Decentralization

PayDax’s model focuses on overcollateralized loans that protect lenders while providing borrowers with instant liquidity. Loan-to-value (LTV) options range from a conservative 50% up to 97%, depending on user needs and risk tolerance.

For lenders, PayDax offers the chance for double-digit returns, with peer-to-peer loans reaching up to 15.2% APY. At the same time, borrowers benefit from fairer terms without the arbitrary decisions typical of banks.

This lending approach is strengthened by blockchain transparency: every transaction, repayment, and collateral lock is visible on-chain, ensuring the system is trustworthy and verifiable by all users.

Risk Management With the Redemption Pool

One of PayDax’s most compelling features is its Redemption Pool, which acts as decentralized insurance. If a borrower defaults and collateral fails to cover the debt entirely, the pool steps in to make lenders whole.

Stakers who contribute to the pool serve as insurers, earning premiums of up to 20% APY in exchange for taking on this role. When defaults are rare, stakers collect steady returns; when shortfalls occur, the system ensures lenders remain protected.

Beyond lending and insurance, PayDax offers leveraged yield farming, allowing users to borrow funds to farm liquidity pools and seek over 40% APY. Although riskier, strict collateral and automated liquidations ensure stability.

Industry Partners that Attract Institutional Support

PayDax’s credibility comes from its reliance on globally trusted partners. RWAs used as collateral are verified by Christie’s and Sotheby’s, two of the world’s most respected auction houses. Once confirmed, they are stored securely with Brinks, known for its high-security logistics and storage solutions.

Additionally, PayDax integrates Chainlink oracles for accurate real-time pricing and Jumio for KYC verification to ensure compliance and fraud prevention. MoonPay supports fiat on- and off-ramps, enabling seamless debit and credit card transactions, while Prosegur adds custodial robustness to Brinks’ role.

When it comes to security and community trust, PayDax Protocol is transparent with a fully doxxed team supported by dedicated developers and a CMO-led outreach strategy. With an audited contract by Assure DeFi and official registration, PayDax demonstrates its strong commitment to accountability and long-term reliability.

Why PayDax is The Number One Investor Choice

What sets PayDax apart is its utility-first token model. The PDP token powers borrowing, staking, governance, and solvency mechanisms across the platform. Unlike speculative tokens, its value is tied directly to network usage and adoption.

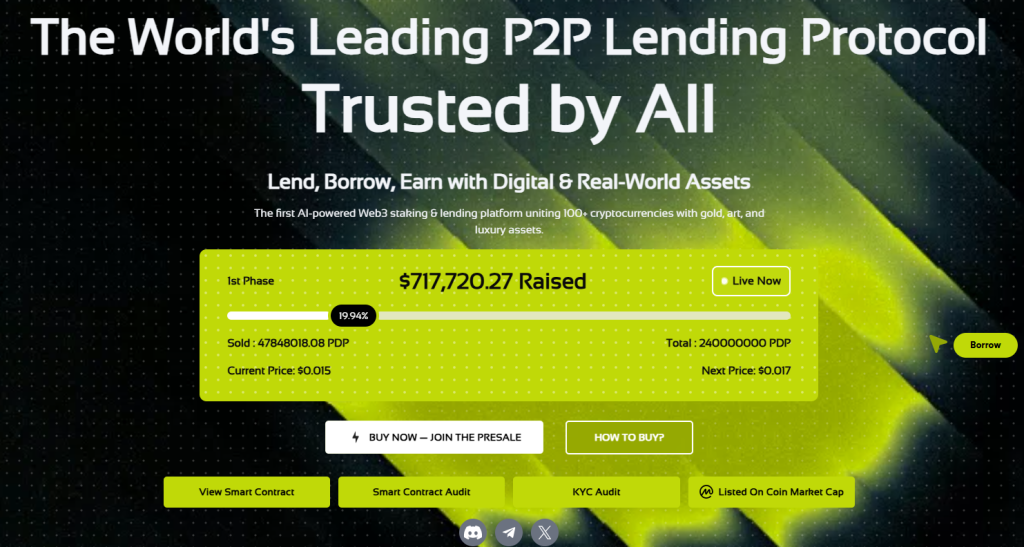

While other projects like XRP and Cardano are experiencing significant drops, the same cannot be said for PayDax Protocol, which is aiming for substantial gains from the current $0.015 price. Projections are bullish for this upcoming asset, with predictions of over 100x post-listing.

With compelling offerings like leader investor rewards and an 80% bonus for current investors, now is the perfect time to register for significant gains during the listing. For those seeking a project that combines real-world credibility with blockchain efficiency, PayDax marks the start of a People’s DeFi Bank.

Join the PayDax Protocol (PDP) presale Today.

Join PayDax Protocol (PDP) presale | Website | Whitepaper | X (Twitter)

DISCLAIMER: CAPTAINALTCOIN DOES NOT ENDORSE INVESTING IN ANY PROJECT MENTIONED IN SPONSORED ARTICLES. EXERCISE CAUTION AND DO THOROUGH RESEARCH BEFORE INVESTING YOUR MONEY. CaptainAltcoin takes no responsibility for its accuracy or quality. This content was not written by CaptainAltcoin’s team. We strongly advise readers to do their own thorough research before interacting with any featured companies. The information provided is not financial or legal advice. Neither CaptainAltcoin nor any third party recommends buying or selling any financial products. Investing in crypto assets is high-risk; consider the potential for loss. Any investment decisions made based on this content are at the sole risk of the readCaptainAltcoin is not liable for any damages or losses from using or relying on this content.