Decentralized blockchain projects ORDI and Aptos have abruptly rallied in the last 24 hours, outpacing broader market moves. The parallels between both emerging crypto upstarts: reliance on Bitcoin strength and their own individual fundamental improvements. We analyze the narratives around their breakouts.

What you'll learn 👉

ORDI Follows Bitcoin’s Lead Above $60K

ORDI, a protocol for timestamping data into Bitcoin’s blockchain via inscriptions written to satoshis, largely owes its double-digit intraday gains to Bitcoin reclaiming $60,000 – cracking levels that constrained BTC for over two years.

ORDI has seen a surge in its value, with a current price standing at $80.43, marking an 18.47% increase within a single day. The cryptocurrency fluctuated between a 24-hour low of $66.06 and a high of $82.71.

This volatility has contributed to a substantial 18.37% increase in its market capitalization, now valued at approximately $1.687 billion. Moreover, trading volume for ORDI has surged by 116.38%, reaching $637 million over the same period.

With ORDI closely correlated to Bitcoin as its base settlement network, sharp moves by the flagship crypto tend to precede demand spilling over into ancillary projects – especially given that ORDI facilitates BTC’s functionality.

However, as analyst Captain Faibik notes, beyond this macro tailwind, ORDI shows independent technical strength signaling upside conviction, with a series of bull flags and pennants igniting breakout moves. Targets reach up to 200% returns.

As ORDI stretches toward overbought daily RSI levels above 68, some cooling of its vertical trajectory in the near term provides probable dip-buying opportunities.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Aptos Expands Offerings Ahead of ETH Denver Conference

Aptos is a Layer 1 Proof-of-Stake blockchain, distinguished by its use of the Move programming language, initially developed by Meta’s Diem blockchain team. Aptos aims to drive mainstream adoption of web3 technologies by fostering a robust ecosystem of DApps designed to address real-world challenges.

Aptos (APT) has also witnessed a significant uptick in its price, now at $11.67, which represents a 17.00% increase in the last 24 hours. The token’s price ranged from $9.80 to $12.39 during this period. Aptos’s market capitalization has grown by 16.77%, reaching over $4.28 billion, with a remarkable 154.89% increase in trading volume, now at $609 million.

Catalysts for Aptos’s Price Increase

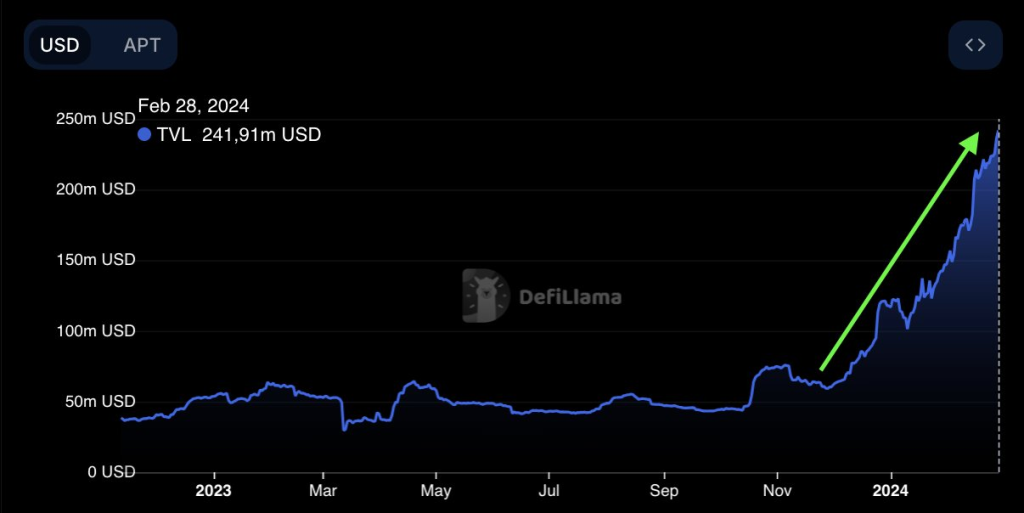

Aptos’s recent price surge is closely linked to its upcoming announcements at ETH Denver, scheduled for February 28 and 29. Additionally, the Total Value Locked (TVL) in Aptos has experienced a significant increase, jumping from $60 million to $240 million in just three months.

Market analysts, including traderfoxy, have pointed out the potential for further gains, with Aptos breaking key resistance levels and the RSI at 71.88, suggesting strong buying pressure while nearing overbought conditions.

Both ORDI and Aptos have demonstrated impressive growth, driven by innovative technologies and bullish market sentiments. As these platforms continue to evolve, they offer intriguing prospects for investors and users alike in the dynamic cryptocurrency landscape.

You may also be interested in:

- Expert Urges Caution on Long-Term Meme Coin Holdings; Dogecoin (DOGE), Shiba Inu (SHIB), and Others

- Stacks (STX) and Pyth Network (PYTH) Prices Pumping – Here’s Why

- SEC vs Ripple Lawsuit Prompts Investors to Turn Towards BlockDAG’s $2M Presale

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.