As we venture into 2024, the quest to identify the next cryptocurrency to explode is gaining unprecedented momentum. Investors are keenly analyzing the market, seeking out the crypto set to explode and deliver substantial returns. Amidst a plethora of options, pinpointing which crypto will explode requires a discerning eye for innovation, utility, and market readiness.

The next altcoin to explode could be just around the corner, with potential candidates already showing signs of significant traction. In this dynamic market, staying informed and ahead of trends is crucial for those looking to invest in the next cryptocurrency to explode in 2024 or the next coin to explode that could reshape the financial landscape.

With crypto remaining extremely volatile, it’s always risky predicting which digital assets will go parabolic next. But for investors willing to take a chance, the possibility of finding the next cryptocurrency to explode makes 2024 an exciting year. This article will analyze the top cryptocurrencies that could deliver massive returns on investment for next year based on their fundamentals, real-world traction, and growth potential.

| Crypto | Description |

|---|---|

| 🚀 Tectum | Tectum, crafted by CrispMind, is a Layer 2 blockchain platform that excels in processing 1.3 million transactions per second, offering the SoftNote feature for instant, free transactions, and a suite of tokens for diverse functionalities. |

| 🎰 Rollbit | Rollbit is a crypto gambling platform with its RLB token offering fee discounts and a buyback-and-burn mechanism, though its tokenomics lack full transparency. |

| 💡 Radiant Capital | Radiant Capital is a DeFi lending platform across blockchains, incentivizing liquidity provision with its RDNT token and focusing on long-term growth by extending token reward durations. |

| ⛓️ Chainge Finance | Chainge Finance provides DeFi services on the Fusion Protocol, rewarding users in its CHNG token for staking and liquidity provision across multiple blockchains. |

| 🚀 RocketX Exchange | RocketX Exchange aggregates liquidity from various exchanges for easy trading and cross-chain swaps, with its RVF token likely serving as a reward and governance mechanism, though details are not fully outlined. |

| 🌱 Dione | Dione Protocol offers a decentralized ecosystem powered by renewable energy, with the DIONE token facilitating governance and transactions in its marketplace for energy trades. |

| 🧠 Dynex | Dynex leverages AI and machine learning on a supercomputing blockchain, with its DNX token used for staking, rewards, and governance in an energy-efficient ecosystem. |

| 🔗 Radix | Radix is a DeFi protocol with its XRD token used for staking and securing the network, featuring a token burn mechanism and a developer-friendly engine for building DeFi and Web3 apps. |

What you'll learn 👉

Next Cryptocurrency to Explode in 2024

Tectum

Crafted by the cybersecurity experts at CrispMind, Tectum emerges as an innovative Layer 2 blockchain platform, adeptly navigating the complexities that networks such as the Lightning Network face. With its impressive capability to process 1.3 million transactions per second without the need for sharding, Tectum has earned the title of the fastest blockchain globally.

Tectum’s SoftNote feature revolutionizes the blockchain space by facilitating immediate, free, and trustless cryptocurrency transactions, thereby creating a new form of digital cash. This innovation scales effortlessly across various blockchains, embodying Tectum’s commitment to a decentralized and seamless monetary system accessible to all.

More than just a high-speed blockchain, Tectum has built a diverse and decentralized suite of products, all under the vigilant protection of CrispMind’s extensive eight-year experience in cybersecurity. The platform’s array of tokens, including the Tectum Emission Token (TET) along with its ERC-20 and BEP-20 variants, provide distinct benefits such as the creation of SoftNotes and reductions in merchant fees. These features are underpinned by transparent tokenomics and a variety of revenue streams, including fees from SoftNote creation and merchant services.

Looking to the future, Tectum’s roadmap is rich with potential, including the introduction of SoftNote and NFT marketplaces, as well as the promise of cross-chain functionality. Having already issued over 1.4 million SoftNotes and secured a user base of over 45,000 wallet holders, Tectum is strategically positioned for significant expansion within the blockchain sector. This potential is further amplified by the integration of the T12 protocol into the Metamask wallet, which will allow for the free transfer of major cryptocurrencies such as Bitcoin, Ethereum, and USDT.

For more information, check out their Pitch Deck, Website, Telegram, Twitter, Facebook, Tokenomics, and WhitePaper.

Rollbit

Rollbit is a cryptocurrency gambling platform with games like slots and live dealer games. It also has NFT gambling and high-risk trading.

Rollbit’s RLB token gives users discounts on fees for paying and staking RLB. Rollbit buys back and burns RLB tokens daily to reduce the supply and increase the price. But exactly how the tokenomics model works is still unclear.

Overall, Rollbit uses its RLB token to incentivize use of the gambling platform. It buys back and burns tokens to try to increase the token’s value. But the details of the tokenomics are not fully transparent.

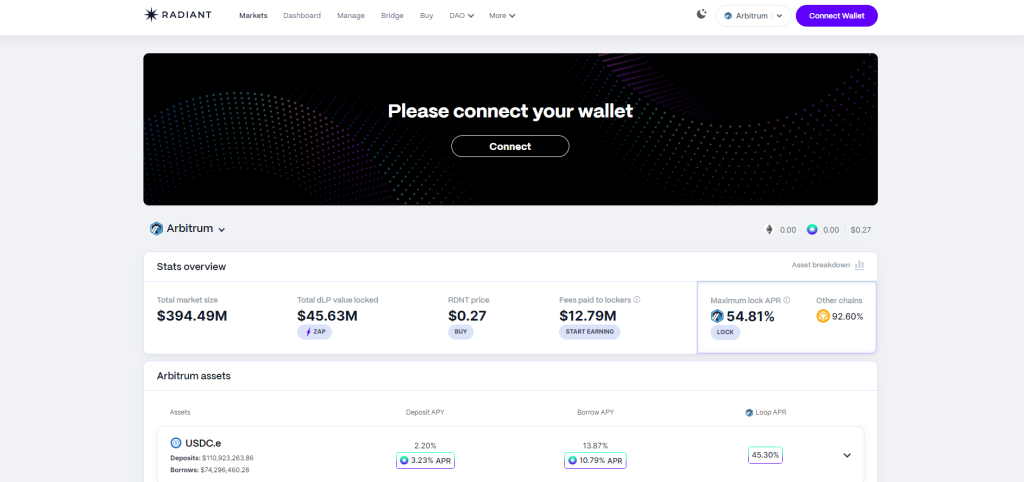

Radiant Capital

Radiant Capital is a decentralized finance (DeFi) platform that lets users lend and borrow cryptocurrencies across different blockchains. It aims to connect the fragmented DeFi lending markets.

Radiant’s RDNT token incentivizes users to provide funds for lending and borrowing. RDNT holders earn rewards when they deposit funds or take loans.

Radiant wants to encourage long-term use and discourage short-term speculation. It proposed spreading out token rewards over 5 years instead of 2 years. This gives the team more time to develop the platform.

In summary, Radiant Capital is a cross-blockchain DeFi lending platform. Its RDNT token rewards users for providing liquidity. Radiant aims for sustainable long-term growth by extending token rewards over a longer timeframe.

Chainge Finance

Chainge Finance is a decentralized finance (DeFi) platform built on the Fusion Protocol. It lets users manage assets and use financial tools without intermediaries.

Users can access services like a Web3 wallet, decentralized exchange (DEX), and escrow without middlemen. Chainge connects to 40+ blockchains and 1600+ assets using Fusion’s multi-chain architecture.

The CHNG token incentivizes participation in the Chainge ecosystem. CHNG is an ERC-20 token with a maximum supply of 10 billion. Users earn CHNG rewards for staking and providing liquidity.

In summary, Chainge Finance provides DeFi services on the multi-chain Fusion Protocol. Its CHNG token encourages use of the platform through staking and liquidity mining rewards.

RocketX Exchange

RocketX Exchange lets users easily access decentralized and centralized crypto exchanges through one platform.

It aggregates liquidity from 270+ exchanges so users can trade a wide range of token pairs. RocketX also enables swaps between different blockchains.

The platform has a simple interface for smooth trading. RVF is likely RocketX’s native token used for rewards and governance. But details of the tokenomics model are unclear.

In summary, RocketX aggregates liquidity across many exchanges for easy trading and cross-chain swaps. RVF seems to be its native token, but its tokenomics model is not fully documented.

Dione

Dione Protocol is a decentralized ecosystem running on renewable energy. It bridges real-world problems and DeFi solutions.

The Dione Wallet stores crypto assets and runs on renewable energy. The DIONE token is used for governance and utility within the ecosystem.

Dione has a marketplace where users trade power units based on their protocol roles. Trades occur on-chain for transparency.

DIONE can be staked for rewards and governance rights. Validators and developers earn DIONE for securing and building the network. The total token supply is unspecified.

Dynex

Dynex is a cryptocurrency built on a supercomputing blockchain using AI and machine learning.

It uses Proof of Useful Work – miners perform useful computations to validate transactions. This optimized blockchain processes data quickly.

The DynexSolve chip algorithm further improves efficiency and reduces energy costs. Dynex also enables easy cross-blockchain token swapping.

The DNX token can be staked for rewards and governance rights. DNX incentivizes validators, developers, and other participants. The total DNX supply is 110 million.

Radix

Radix is a decentralized finance protocol for dApps, decentralized exchanges, lending, stablecoins, and more.

The Radix network has its own native token, XRD. XRD secures the network via staking and earns rewards. Radix burns transaction fees, reducing supply.

The initial XRD supply was 12 billion. Currently 9.6 billion are circulating and 2.4 billion are locked. Radix generates 300 million new XRD yearly.

The Radix Engine provides developer tools and features to build DeFi and Web3 apps quickly. Radix aims to be a fast, secure alternative to Ethereum for DeFi.

Should You Invest In The Next Cryptocurrency To Explode?

Finding the next big cryptocurrency before it explodes in value is challenging. The crypto market contains many scams and low-quality projects, so extensive research is required to identify truly promising coins.

For quick high returns, small-cap cryptos with low market capitalizations may seem appealing. However, these come with substantial risks. Small cryptos can crash in value overnight or fail altogether. To lower risks, diversifying across large and small cryptocurrencies is better than investing in obscure assets.

Even established cryptos carry risks, though. In 2021, mainstream cryptocurrencies underperformed while meme coins with no fundamentals delivered returns of thousands of percent. Predicting breakouts is near impossible.

Like any market, crypto investing involves calculated risks. By investing in researched assets with high growth potential, you can maximize upside while minimizing downside risk. Never invest more than you can afford to lose, as crypto remains highly speculative.

Read also:

- Top 15 Cryptos With the Highest Potential: Comprehensive Analysis & Investment Guide

- Best Future Crypto Projects to Buy: Which Crypto Will Grow Fastest?

- Best Crypto to Buy Now on Reddit

Cryptocurrencies With Explosive Growth Potential

To identify cryptos with upside potential, start by analyzing market capitalization. Cryptocurrencies with smaller market caps have greater room for exponential growth compared to large-cap assets.

Expecting Bitcoin to deliver 1000x returns from its current price is unrealistic. That would require a multi-trillion dollar market cap exceeding the global economy. For maximum upside potential, smaller cryptocurrencies have a lower bar.

However, investing in micro-cap cryptos under $100k market cap carries many risks. Many are scams or jokes destined to crash. High volatility also enables pump and dump manipulation. Research diligently before investing in tiny market cap coins.

The sweet spot for explosive growth may be mid-cap cryptocurrencies with fundamentals suggesting real utility and value. As always, only invest money you can afford to lose in this highly speculative space.

Read our article about Best DeFi 2.0 Coins to Buy.

How To Find The Next Cryptocurrency To Explode

Finding the next big cryptocurrency before it explodes in value requires research into key factors:

- Resilience – Look for cryptos that rebound quickly after market crashes and downturns. This shows underlying stability and demand.

- Price action – Favor cryptocurrencies with an overall upward price trajectory over time. Steady growth suggests sustainability.

- Fundamentals – Cryptos need solid fundamentals like a capped token supply, clear use cases, advanced blockchain technology, and an active development team.

- Adoption – Opt for projects with real-world adoption and partnerships. This demonstrates real demand and utility for the cryptocurrency.

With thousands of cryptocurrencies in existence, doing in-depth research on each is extremely difficult. Analysts recommend focusing on these key metrics:

- Past price performance – Consistent gains over time predict future growth potential.

- Sustainability – Analyze whether growth has been stable or heavily pumped. Favor stability.

- Technology – The blockchain, consensus mechanism, and features should solve real problems.

- Community – An engaged community of users, developers, and partners supports longevity.

- Scalability – Look for projects scaled for massive adoption and ready for the future.

How To Buy The Next Big Cryptocurrency

Once you’ve identified a promising cryptocurrency, like Ethereum, that exhibits signs it could explode in value, follow these steps to invest:

- Sign up for an account on a reputable crypto exchange that lists the cryptocurrency. Provide personal details to verify your identity.

- Fund your exchange account by depositing fiat currency or sending existing crypto assets. Make sure you have funds available to trade.

- Search for the cryptocurrency trading pair you want to buy and enter the amount. For example, ETH/USD if buying Ethereum with dollars.

- Carefully review the order details like exchange rate, fees, and total cost. Submit the buy order when ready.

- Wait for the exchange to process and fulfill your buy order. The purchased cryptocurrency will appear in your exchange wallet.

Follow the exchange’s specific instructions for buying, selling, and trading cryptocurrencies. Do research to choose an exchange suitable for your region and needs.

Conclusion

Numerous factors like past performance, underlying technology, real-world usage, and growth prospects help identify emerging cryptocurrencies with explosive upside potential.

While investing in obscure cryptos is risky, the possibility of exponential returns exists. As the crypto market trends upward again, having a portfolio of thoroughly-researched tokens and coins could pay off hugely in 2023 and beyond.

Remember that cryptocurrencies are highly volatile assets. Only invest discretionary funds you can afford to lose.