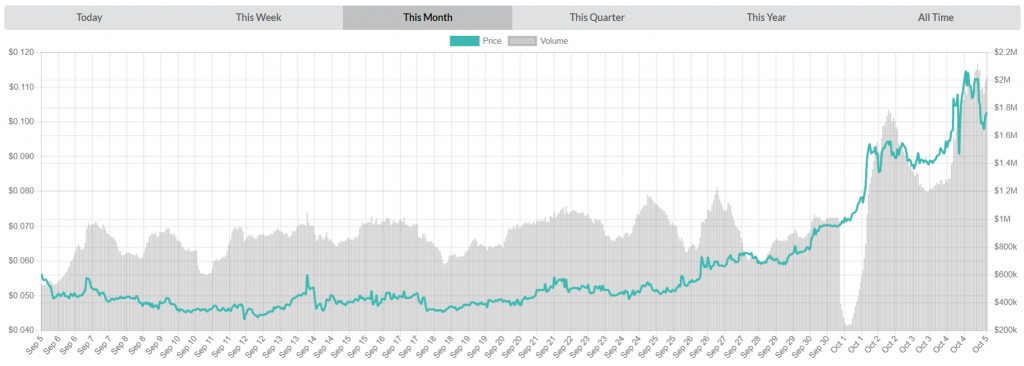

Nexo project has somewhat exploded as of late. After a prolonged period of sideways movement throughout the month of September, staying just below $0.050, the currency started growing around 21st. The slow rise lasted until 30th, when the daily trade volume sharply dropped off from $984,935 to $230,742. The same way it dropped, the volume soared back up on October 1st. NEXO price followed suit and grew to$0.0933 on a daily trade volume of $1,765,517. After a short correction of both parameters, the price and volume spiked up once again on the 5th, this time reaching $0.1143 and $1,936,530 respectively.

At the moment of writing, NEXO can be purchased for $0.101722 USD (-1.61% drop in the last 24 hours)/0.00001551 BTC (-1.47% drop in the last 24 hours). This value represents a 75.66% drop from this currency’s all time high of $0.4306. Daily trade volume is currently at $1,412,264, with most of it coming from Allbit (50%) and Hotbit (35%). With a market cap of $56,964,520, Nexo is currently the 102nd most valuable crypto project on the market.

Nexo project recently caught the eye of the crypto community. Developed by a bulgarian Fintech company Credissimo, Nexo wants to provide the service of crypto-backed lending to users all around the world. Users are able to retain ownership of their cryptocurrency while making their bags liquid in the short term thanks to the Nexo platform. Crypto is used as collateral on the platform for getting a fiat credit which can be sent to your bank account or to a credit card (a statement regarding the credit card release has recently been released by the team).

Nexo project has its own native token called NEXO. NEXO tokens are securities, as they promise to pay out dividends from company profits to the token holders. The company behind NEXO have been very clear about their token’s security status from the start and have made sure to remain compliant with the Securities and Exchange Commission Regulation D Rule 506(c).

?Read: Best Bitcoin Exchanges 2018

In accordance to their dividend policy, 30% of profits from Nexo loan transactions are deposited in the dividend pool and later distributed to NEXO owners. The dividend is currently paid out in ETH; the project just recently announced that they will be paying out their first ever dividend on December 15th.

As a profitable enterprise from the very beginning, Nexo is paying out the first ever Dividend on a token on December 15! In an industry first we will share 30% of current profits with the holders of our asset-backed NEXO token! Eligibility requirements: https://t.co/cxTPkM4Djl pic.twitter.com/KD4kPXseG7

— Nexo (@NexoFinance) October 5, 2018

As noted before, the funds for these dividends will be paid out from money earned through Nexo platform operations. Nexo themselves claim they’ve processed over 1 billion transactions to date. This move will give the project a lot of legitimacy and potentially make it an excellent target for passive investment.

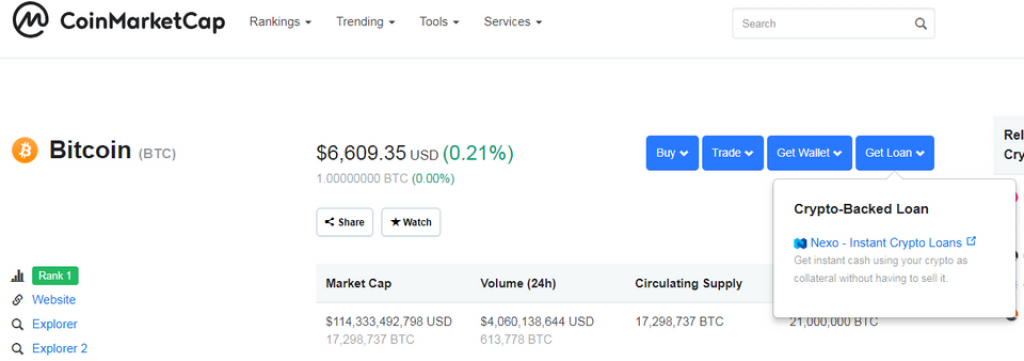

The previous announcement likely caused the described explosion in NEXO’s price which happened at the turn of the month. Another reason for the price hike could have been the fact that on October 1st, the project reported that well-known crypto portal CoinMarketCap decided to integrate a button into its interface that allows borrowing using Nexo currency.

Nexo is now the only crypto-backed loans provider with a “Get Loan” button on each page of the most visited website in blockchain, which gets around 100+ million views each month. This is definitely a good move for the platform as it should result in a gradual increase in its user base.

The price was likely affected by Binance releasing an article which promoted the use of NEXO token in conjunction with BNB, Binance’s native token. Other key factors we noticed included NEXO being recognized among top 10 most traded assets on the ERC-20 focused decentralized exchange Bancor.

$BNT, $ETH, $CEEK, $NEXO, $KIN, $DRGN, $XPAT, $BAX, $DAI and $BAT are currently the #Top10 tokens by volume on Bancor. Instantly #convert #tokens now: https://t.co/FhKhdPC7ak pic.twitter.com/tY7fDiTkg9

— Bancor (@Bancor) October 2, 2018

Finally, Nexo becoming the only company in the blockchain space to service 200+ jurisdictions in 40+ currencies probably helped boost its latest bull run.

With scams like Bitconnect and Davor being removed from the market, this left a room for legitimate projects to move in and revolutionize the crypto lending industry. This time the focus isn’t on achieving 40% monthly gains and getting paid in shitcoins but rather on making your crypto stash liquid by taking out reasonable fiat loans. The market for this is definitely out there, and Nexo is just one of several projects that will attempt to satisfy its needs. Will Nexo become the most successful lending platform in the crypto world? Only time will tell.

Hello, Credissimo is not a Swiss company, they started in Bulgaria. Nexo is incorporated in Switzerland.