A new discussion around lending on the XRP Ledger is gaining attention after analyst VET shared a diagram outlining how a potential XRPL-based lending protocol could work. The concept is not entirely new in crypto, but applying it directly to XRP and XRPL-native assets like RLUSD brings a different set of implications, especially around risk, incentives, and taxes.

At a high level, the model focuses on using XRP or XRPL-issued assets as deposits, while intermediaries manage lending activity and absorb part of the risk.

How the Proposed XRPL Lending Structure Works

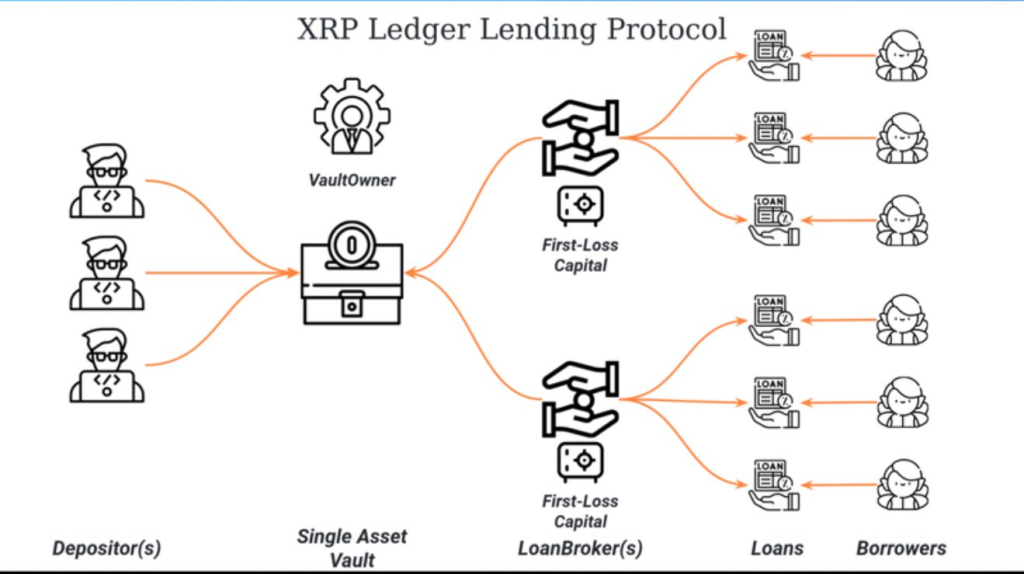

The image shared by VET lays out this structure in a relatively simple way.

Depositors would place XRP or IOUs such as RLUSD into a single-asset vault. That vault does not lend directly to borrowers. Instead, loan brokers sit between depositors and borrowers. These brokers issue one or multiple loans from the pooled assets and collect interest payments from borrowers over time. The interest flows back into the vault, increasing its value and creating yield for depositors.

The key mechanism is the buffer. Loan brokers are required to post first-loss capital. If borrowers repay their loans as expected, the system runs normally and depositors earn yield from the interest collected. If borrowers default, the loss is first absorbed by the broker’s buffer before it impacts depositors.

This “skin in the game” aspect is central to the design. Rather than pushing all default risk onto depositors, brokers are incentivized to manage risk carefully, since reckless lending directly hits their own capital.

Borrowing Against XRP and the Tax Question

While the structure itself is relatively straightforward, the implications for XRP holders become more complex when different collateral and borrowing configurations are considered.

That is where Vincent Van Code, a software engineer and well-known XRP supporter, added a different perspective. Instead of depositing XRP and lending it out directly, he suggested that a more appealing setup could involve locking XRP as collateral and borrowing RLUSD against it.

In his scenario, an XRP holder locks a large XRP position into the system. Based on a loan-to-value ratio, the protocol lends out a percentage of that value in RLUSD. For example, someone holding 100,000 XRP could borrow roughly $100,000 worth of RLUSD at a fixed interest rate, such as 4%.

The appeal of this approach is not yield, but liquidity. The holder does not sell XRP. Instead, they access spending power through RLUSD, which can be used for purchases, credit card payments, or other expenses. Interest can be paid either by selling small amounts of XRP or by deploying the borrowed RLUSD into other strategies.

This structure raises an obvious and sensitive question: taxation.

I would think the opposite is more appealing.

— Vincent Van Code (@vincent_vancode) December 23, 2025

That is, locking in, and loaning XRP as collateral, then loaning out RLUSD, which can then be used either for purchases, pay credit card off, etc.

What would be interesting is how would tax be calculated? Will the XRP still be…

If XRP is locked as collateral and not sold, is it still considered “held” from a tax perspective? If so, capital gains tax may not be triggered when borrowing against it. Only the interest payments or any income generated using the borrowed RLUSD would be taxable. This is a familiar concept in traditional finance, where wealthy individuals often borrow against appreciating assets rather than selling them.

Vincent pointed out that this is where things become both appealing and complicated. The final treatment depends entirely on how tax authorities classify crypto-backed loans, stablecoin borrowing, and on-chain transparency. With KYC-enabled systems and full ledger visibility, tax agencies could theoretically gain more insight than ever before.

There are also practical risks that should not be ignored. XRP price volatility matters. A big drop could trigger liquidations or force borrowers to add collateral. The stability and acceptance of RLUSD is another factor, as is the reliability of loan brokers and the enforcement of first-loss buffers.

At this stage, the XRPL lending model is more a framework than a finished product. It shows how XRP could be used in more capital-efficient ways without relying on external chains or wrapped assets. At the same time, it highlights how quickly questions around risk management, incentives, and taxation emerge once lending enters the picture.

For XRP holders, the discussion is less about short-term yield and more about optionality. Lending and collateralization open new paths, but they also demand clearer rules and stronger infrastructure. Whether this becomes a meaningful use case on XRPL will depend on execution, regulation, and how comfortable users are with the trade-offs involved.

Read also: Why a $20 XRP Price Prediction in 2026 Could Suddenly Make Sense

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.