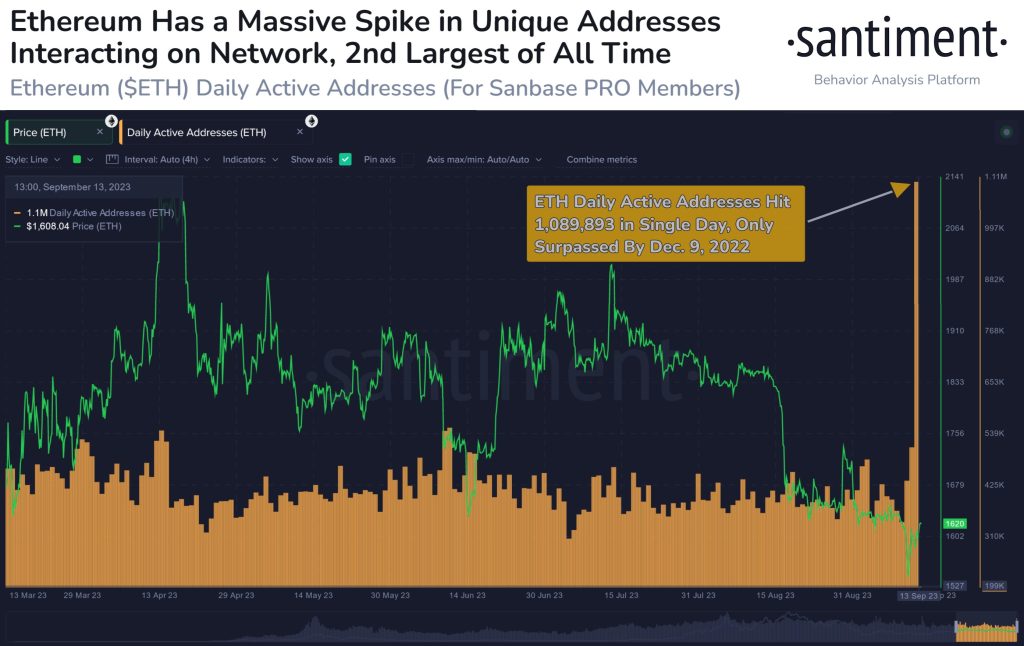

The Ethereum network experienced a significant surge in the number of unique wallets involved in transactions with Ether (ETH) on Wednesday. With a staggering count of 1,089,893 wallets acting as senders or receivers of ETH, this milestone stands as the second-highest recorded in the asset’s eight-plus year history. Experts speculate that this unusual spike in activity could signal a potential rebound in Ethereum’s price, serving as a crucial capitulation signal for investors.

Source: Santiment – Start using it today

The surge in unique wallet activity on the Ethereum network is a noteworthy anomaly, considering the historical significance of this digital asset. Ethereum, the second-largest cryptocurrency by market capitalization, has been facing a challenging period with a declining price trend. However, the sudden increase in the number of active wallets could indicate renewed interest and activity within the Ethereum ecosystem.

This surge in unique wallet activity has caught the attention of market observers, who believe it could be a pivotal moment for Ethereum’s price trajectory. Historically, such spikes in wallet activity have often preceded significant price recoveries in the cryptocurrency market. As investors and traders capitulate, the increased participation in Ethereum’s network suggests a possible bottoming out of prices and a subsequent resurgence.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +While it’s important to note that past performance is not indicative of future results, the surge in unique wallets on the Ethereum network presents an intriguing opportunity for market participants. As the cryptocurrency market continues to evolve and mature, it’s crucial to closely monitor these key signals that could potentially influence price movements.

As with any investment decision, it is essential for individuals to conduct thorough research, seek professional advice, and consider their own risk tolerance before making any financial commitments. The cryptocurrency market is known for its inherent volatility, and investments should be made with caution.

In conclusion, the recent surge in unique wallets participating in transactions on the Ethereum network could be a sign of a potential rebound in prices. While it remains to be seen how this anomaly will unfold, market participants and investors should closely monitor the Ethereum ecosystem for further developments and evaluate the impact on their investment strategies.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.