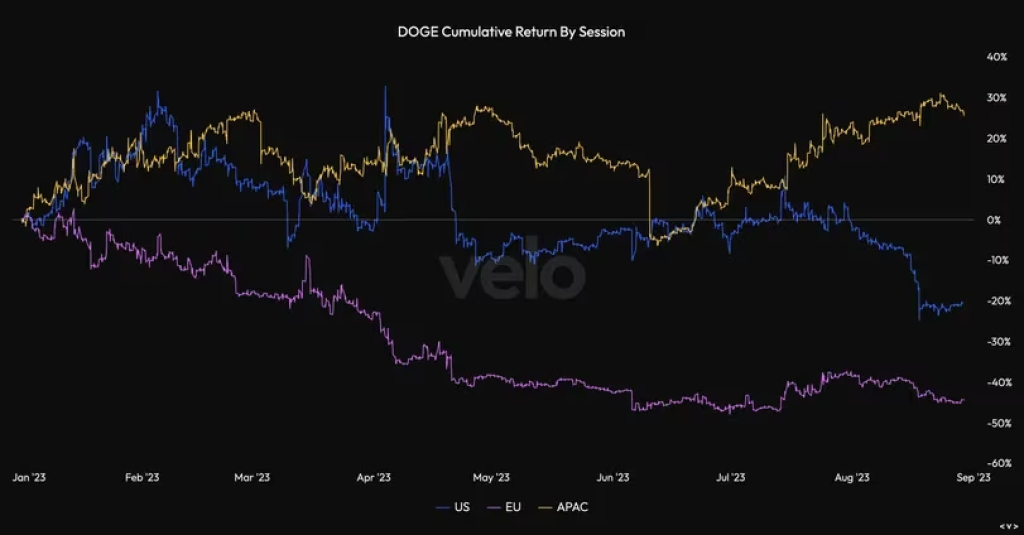

Dogecoin (DOGE), the cryptocurrency that started as a joke but became a market sensation, has seen a 10% decline this year. According to analytics from the Velo Data app, the bearish sentiment is particularly strong during European trading hours.

What you'll learn 👉

The Influence of Time Zones on DOGE’s Performance

Data reveals a stark contrast in DOGE’s performance based on the time zones. During European and U.S. trading hours, the cryptocurrency has suffered with year-to-date returns of -44.44% and -25%, respectively. On the flip side, the Asia-Pacific trading day has seen a positive return of 25.6%.

European Hours: 8:00 a.m. to 6:00 p.m. Brussels time

U.S. Hours: 8:00 a.m. to 6:00 p.m. New York time

Asian Hours: 8:00 a.m. to 6:00 p.m. Seoul time

In essence, sellers have been more active during the European and U.S. trading windows, while buyers have seized control during the Asian hours.

Shiba Inu (SHIB), another meme cryptocurrency often dubbed as the “Dogecoin killer,” mirrors DOGE’s trading pattern. Meanwhile, Bitcoin has shown resilience, primarily rallying during American hours.

Velo Data chose these time windows based on local volume profiles and stock exchange hours, acknowledging some overlap between the sessions.

The South Korean Influence

Meme cryptocurrencies like DOGE and SHIB have been popular on South Korean exchanges such as Upbit and Bithumb. This explains their positive performance during Asian trading hours. For instance, during DOGE’s 10% surge in late July, a significant portion of the trading volume originated from Upbit, a platform known for its speculative crypto-Korean won trading pairs.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +According to Matrixport, South Korea’s market has a strong appetite for smaller tokens, driven by factors like limited social mobility opportunities, high property prices, and a competitive labor market.

The underwhelming performance of DOGE and SHIB during U.S. and European hours aligns with the uncertain regulatory landscape for alternative cryptocurrencies. The U.S. Securities and Exchange Commission (SEC) has been scrutinizing altcoins, as evidenced by its lawsuits against Coinbase and Binance filed in June. Although DOGE and SHIB were not directly mentioned, any tightening of regulations could adversely affect the meme cryptocurrency market.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.