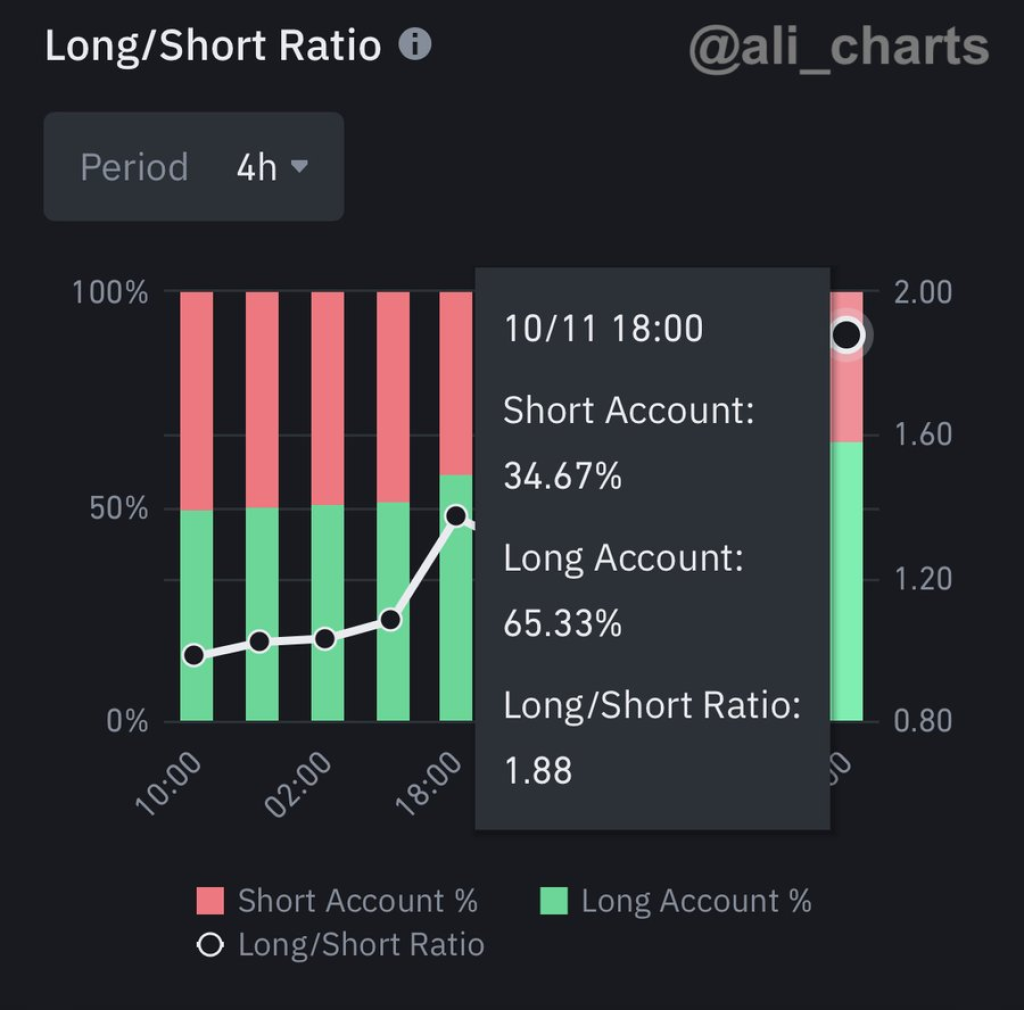

As Bitcoin’s price slipped below the $27,000 level, crypto analyst Ali observed a bullish sign on Binance, the world’s largest cryptocurrency exchange. According to data shared by Ali, over 65% of Binance accounts with open BTC futures positions were going long, signaling confidence that Bitcoin’s price would rebound.

Despite Bitcoin’s ongoing slide, which has seen it fall from all-time highs above $68,000 in November 2021, most traders on Binance appear to be taking an optimistic view. Their long positions indicate they believe Bitcoin is close to reaching its bottom and will bounce back up from current levels.

Buying the Dip: A Popular Crypto Strategy

The actions of these traders align with the popular cryptocurrency strategy known as “buying the dip.” This involves purchasing an asset when its price undergoes a temporary downturn with the expectation that it will recover.

Proponents of buying the dip cite advantages like setting a lower average entry price and amplifying returns if the asset’s price increases. However, the strategy also carries risks if the downtrend persists. Prudent investors weigh these pros and cons carefully when deciding if and when to buy the dip.

While only time will tell if the dip buyers on Binance are making the right move, their bullish stance certainly bucks the bearish sentiment that has dominated crypto markets in recent months. Their confidence could signal a coming trend reversal and recovery for Bitcoin. But in the volatile world of cryptocurrency, nothing is guaranteed.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.