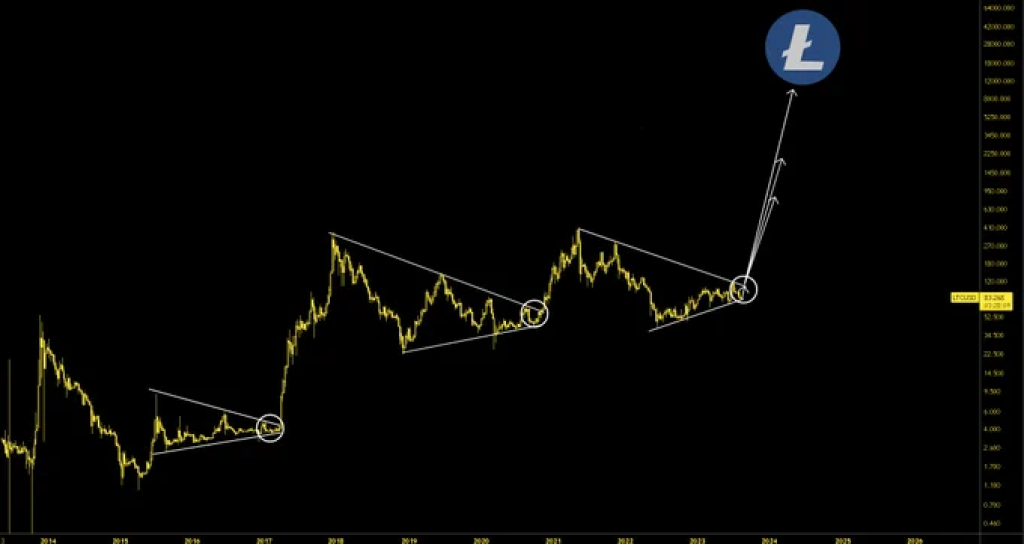

Litecoin (LTC) appears ready for a significant price move upward based on technical analysis of recent price action. The cryptocurrency has formed a symmetrical triangle pattern on its chart, which in the past has preceded major bull runs.

According to analyst Shan Belew, Litecoin’s triangle formation mirrors structures that led to substantial gains after previous breakouts. They cite similar momentum building in the LTC/BTC ratio that echoes the 2017 crypto frenzy.

If historical patterns hold, the culminating move could propel Litecoin to fresh all-time highs. The upside price target proposed is around $830, more than double the existing high near $415.

For the breakout to occur, Litecoin will need to decisively surpass resistance around the $250 level where the triangle apex converges. This could happen within the next several weeks according to prognostications.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Some contend now marks the critical window to accumulate Litecoin before the impending upswing gets underway. If the technical thesis proves correct, the coming 2-3 months could see Litecoin stage a parabolic climb to reset its record valuation.

Of course, chart-based analysis is not foolproof. External factors like broad risk sentiment could delay or derail the anticipated mega-surge. But Litecoin’s trajectory shows undeniable bullish confluence that makes the target scenario plausible.

If breakout triggers as projected, Litecoin could significantly outpace Bitcoin and the wider crypto market in Q4 2022. For holders, the months ahead may realize substantial returns. However, investing based purely on chart patterns comes with inherent risks. Prudent risk management remains essential.

Litecoin (LTC) is currently priced at $65.29, which represents a -13.48% decline in the last 24 hours. Over the past week, the price has seen a decline of -21.49%. The current market capitalization of Litecoin is $4,799,663,458, ranking it at #15 on CoinGecko. The 24-hour trading volume for Litecoin is $1,313,185,623.84.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.