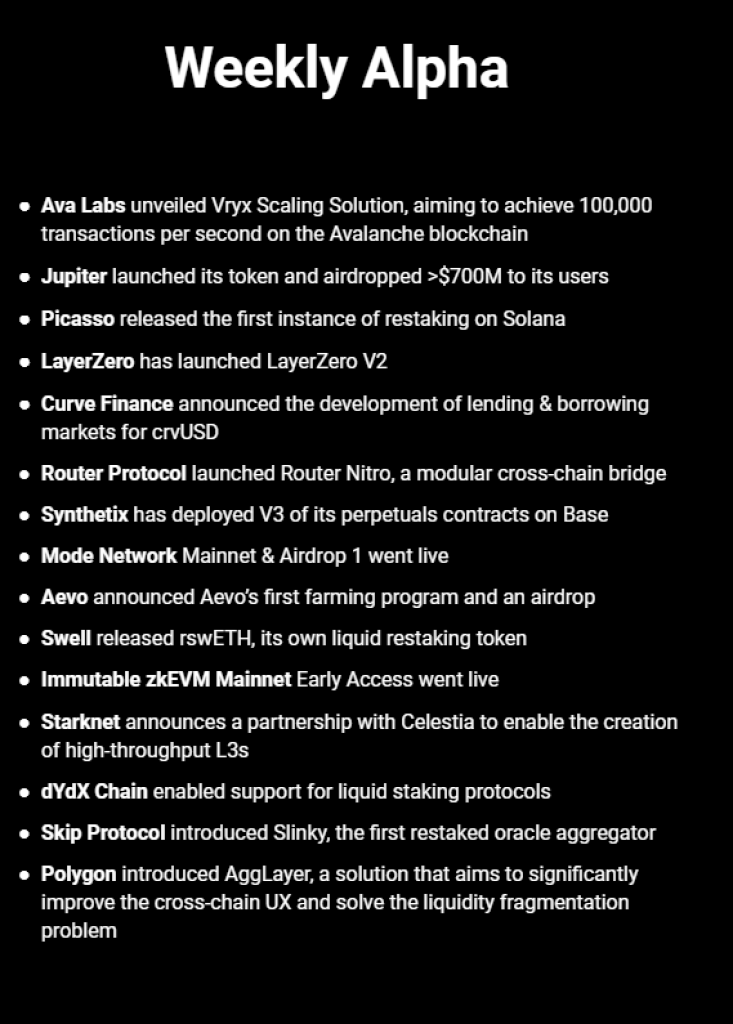

According to a post on X by The DeFi Investor, a slew of major upgrades, product launches, token distributions and partnerships position over a dozen leading crypto projects including Avalanche and Polygon for increased utility and volatility.

Ava Labs, the team behind Avalanche (AVAX), has made a significant breakthrough with the introduction of the Vryx Scaling Solution. With a goal to achieve an impressive 100,000 transactions per second (TPS) on the Avalanche blockchain, this solution promises to enhance scalability and performance. If successful, this development could position Avalanche as a more attractive choice for developers and users alike.

Polygon Unleashes AggLayer to Enhance Cross-Chain User Experience

Polygon (MATIC) continues to solidify its position as a leading blockchain platform with the introduction of AggLayer. This innovative solution aims to significantly improve the user experience for cross-chain transactions and address the issue of liquidity fragmentation. By facilitating seamless interactions across different blockchains, AggLayer seeks to streamline the process and make it more user-friendly. As the adoption of AggLayer grows, it could introduce increased trading activity and potential volatility for MATIC.

Jupiter Launches Token and Conducts Airdrop

Jupiter, another notable project in the DeFi realm, has launched its own token and conducted a substantial airdrop worth over $700 million to its users. What sets Jupiter apart is its reserved allocation of a large percentage of the token supply for future airdrops. This strategic move not only rewards early adopters but also generates excitement and anticipation for upcoming token distributions.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +In addition to Avalanche (AVAX) and Jupiter, several other cryptocurrencies are poised for significant developments:

Picasso introduces the first instance of restaking on Solana, allowing users to deposit SOL and SOL liquid staking tokens in restaking vaults.

LayerZero unveils LayerZero V2, enabling developers to build applications and tokens that function seamlessly across different blockchains.

Curve Finance announces the development of lending and borrowing markets specifically for crvUSD, expanding possibilities for users to leverage their crvUSD holdings.

Router Protocol launches Router Nitro, a modular cross-chain bridge that aims to reduce cross-chain transaction costs by 60%.

Synthetix deploys V3 of its perpetuals contracts on Base, introducing new features and enhancing the trading experience on the platform.

Mode Network Mainnet and Airdrop 1 go live, offering a new Modular DeFi L2 powered by Optimism.

Aevo announces its first farming program and an airdrop, providing users an opportunity to increase their airdrop rewards through participation.

Swell releases rswETH, its own liquid restaking token, offering users a way to earn additional rewards on their holdings.

Immutable zkEVM Mainnet Early Access goes live, powered by Polygon, and aims to revolutionize GameFi projects.

Starknet partners with Celestia to enable the creation of high-throughput Layer 3 solutions.

dYdX Chain now supports liquid staking protocols, expanding its functionality within the DeFi ecosystem.

Skip Protocol introduces Slinky, the first restaked oracle aggregator designed for DeFi applications that prioritize performance and trustlessness.

As these projects make significant strides, it’s important to remember that the cryptocurrency market remains highly volatile. Investors should exercise caution and conduct thorough research before making any investment decisions.

You may also be interested in:

- AI Forecasts Cardano (ADA) Price Target When Bitcoin Hits $150,000

- Ripple’s XRP Ready for Takeoff: Analyst Makes Bold Prediction Despite Recent Struggles

- NuggetRush ICO Triumphs, Surpassing BONK’s Recent Market Performance

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.