In a surprising turn of events, major banks have been observed making significant investments in MicroStrategy (MSTR), a company renowned for its substantial Bitcoin holdings. This trend, which emerged in the first quarter of 2023, has sparked intrigue and speculation within the cryptocurrency community.

Find High-Potential Token, yPredict, powered by its native token $PRED, is emerging as a significant player in the crypto space. The presale YPRED, which is ongoing at ypredict.ai, has already raised over $2.25 million in seed round funding from early investors. As a new low market cap coin currently on presale, it powers an AI-based tool that predicts market movements and identifies high-potential tokens. The token also offers added utility for holders, unlocking access to a suite of analytics tools, including in-depth research into the tokenomics of upcoming crypto games and NFT projects. Get in on the Ground Floor and Unlock Exclusive Analytics Tools!

Show more +MicroStrategy, a business intelligence company, is currently the largest institutional holder of Bitcoin, with a staggering 140,000 BTC in its possession. At current market prices, this amounts to over $3 billion. The company’s stock, therefore, offers a unique opportunity for investors to indirectly gain exposure to Bitcoin, especially in the United States where Bitcoin ETFs are yet to be approved.

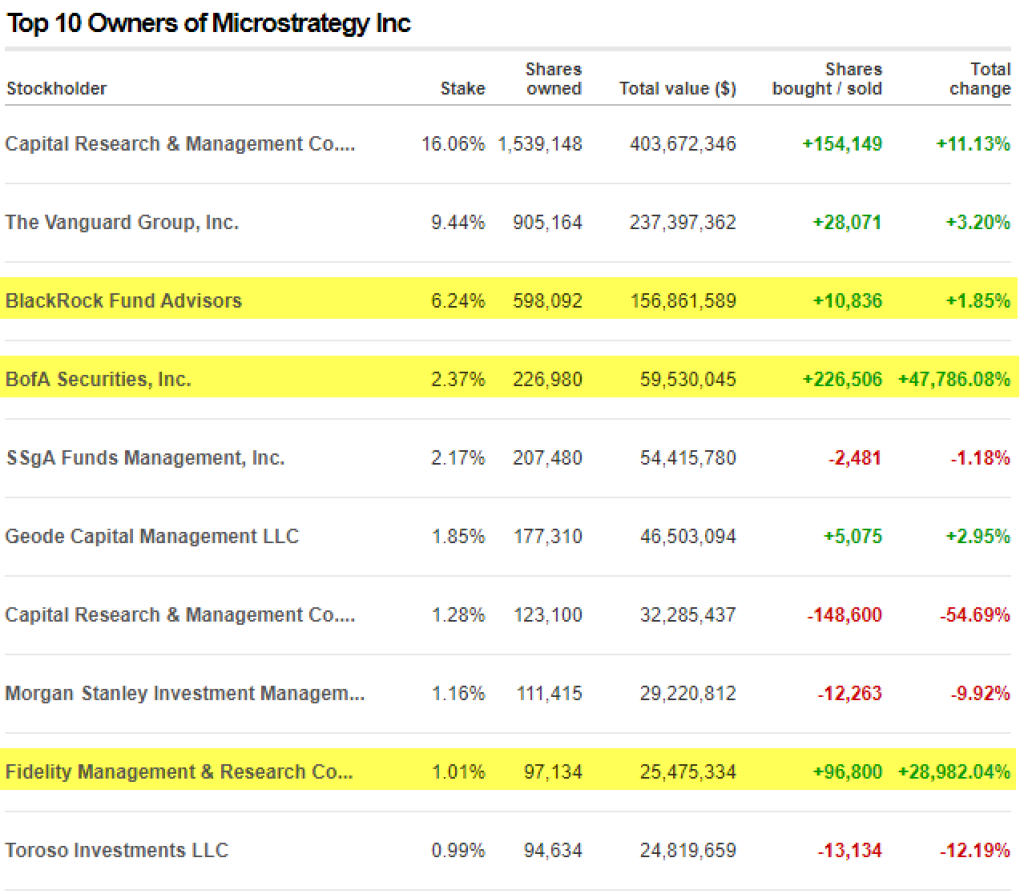

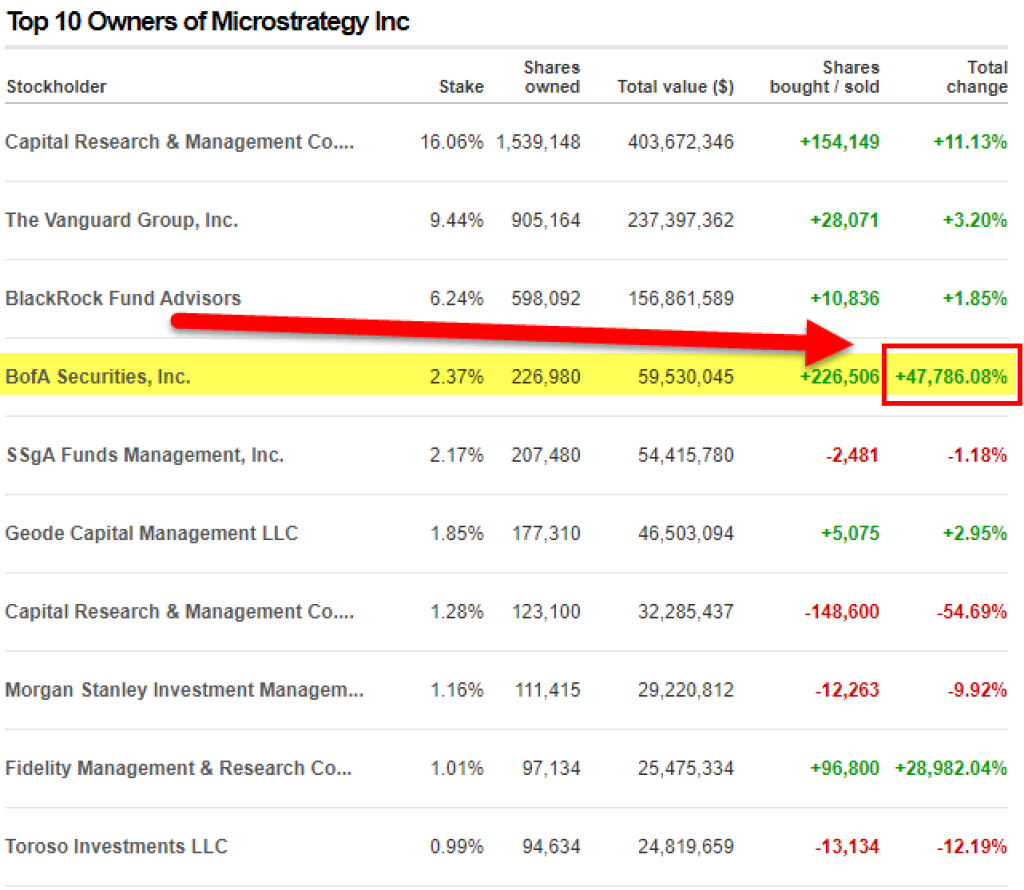

Among the major banks buying up MSTR stock, Bank of America (BOA) stands out. The second-largest bank in the U.S., with a market capitalization of $233 billion and over $3 trillion in assets under management (AUM), BOA has increased its exposure to MSTR by a whopping 47,800% in Q1 2023.

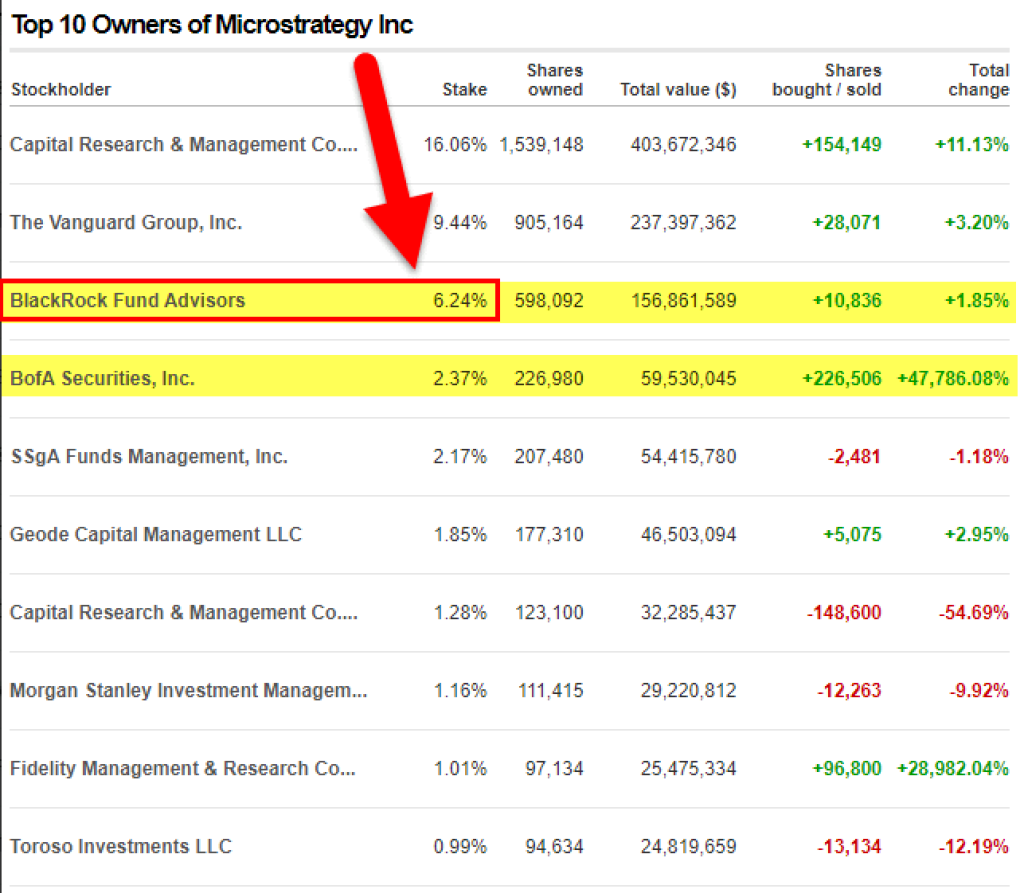

However, the world’s largest asset manager, BlackRock, with over $10 trillion in AUM, has also been quietly increasing its stake in MSTR. BlackRock’s stake in MSTR is three times larger than BOA’s, standing at a significant 6%, worth over $156 million.

This move by BlackRock is particularly intriguing, given the firm’s reputation for investing in ESG-friendly (Environmental, Social, and Governance) companies. The question arises: why is BlackRock, along with other major banks, investing in Bitcoin-related companies?

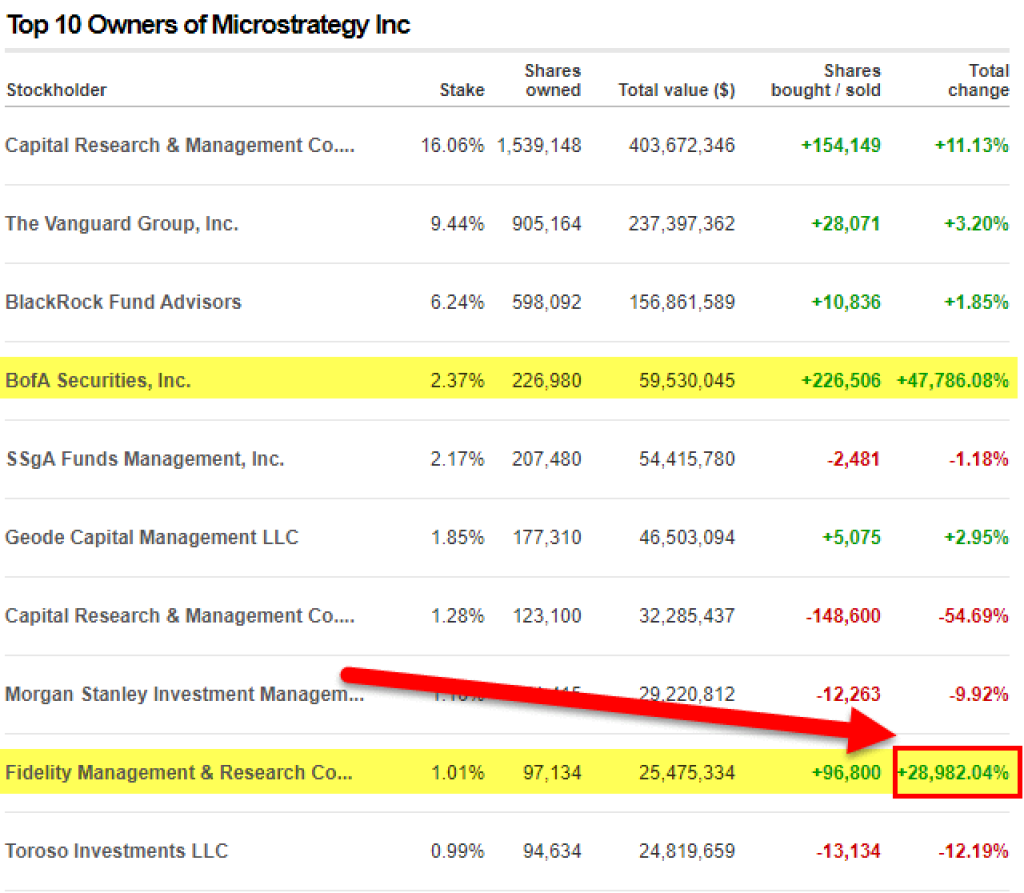

The trend is not limited to U.S. banks. Fidelity, a financial services giant with over $4.5 trillion in AUM, has increased its exposure to MicroStrategy by 28,000%, holding a 1% stake in the company. Furthermore, the sixth-largest bank in Canada has purchased over half a million dollars worth of MicroStrategy stock in 2023, indicating a global appetite for Bitcoin exposure.

The timing of these investments is also noteworthy. Despite Bitcoin’s price being down by 60% in early 2023, major banks are increasing their stakes in Bitcoin-related stocks. This move aligns with the prediction made by the $700 billion bank, Standard Chartered, that Bitcoin will hit $100,000 by the end of 2024.

These investments by major banks may seem more logical when considering three key factors: the Bitcoin multiplier effect, the other banks buying Bitcoin in Q1 2023, and the upcoming Bitcoin halving in 2024. With the available supply for sale shrinking and demand predicted to go parabolic, the stage is set for a potentially significant shift in the cryptocurrency landscape.

In conclusion, the recent actions of major banks and asset managers indicate a growing interest in Bitcoin and related assets. Despite regulatory challenges and market volatility, these institutions are positioning themselves to capitalize on potential future growth in the cryptocurrency market. The question remains: what do they know that we don’t?