Whale tracker Whale Alert, recently reported a significant transaction involving Litecoin (LTC). According to their tweet, 300,000 LTC, equivalent to approximately $25,998,888, was transferred from an unknown wallet to Binance. The transaction details can be found here.

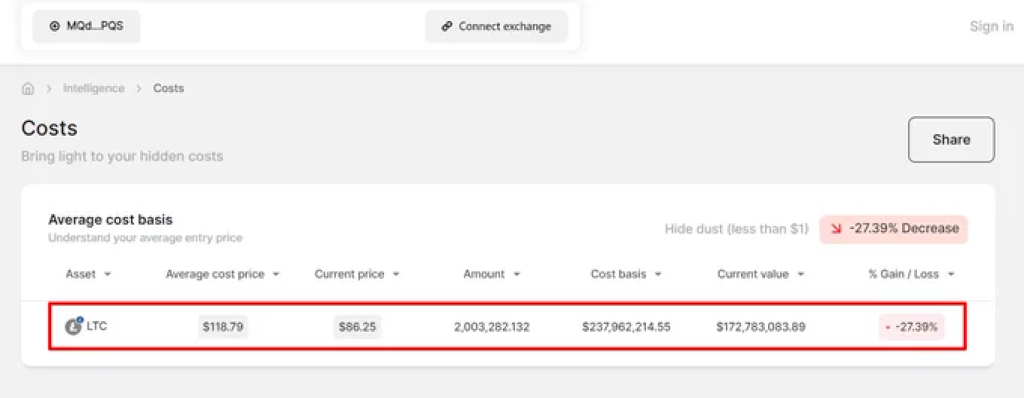

In response to this, Prithvir @Prithvir12, co-founder and CEO of Loch chain, provided a detailed analysis of the wallet involved. He stated that the LTC balance in the wallet stands at 2 million, accumulated over a span of more than 3 years. The average cost price of these coins is $118.79, resulting in a cost basis of $238 million. However, the current value of these coins amounts to $173 million, indicating a present loss of $65 million.

The current situation suggests that we might be witnessing the aftermath of a Litecoin halving event, and there could be a potential “whale dump” incoming.

A “whale dump” refers to a situation where a large holder (a “whale”) sells a significant amount of a cryptocurrency, which can lead to a sharp drop in its price. In this case, the whale has accumulated 2 million LTC over more than three years, with a cost basis of $238 million. However, the current value of these coins is $173 million, indicating a present loss of $65 million.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +This significant loss, coupled with the recent transfer of a large amount of LTC to Binance, could be an indication that the whale is preparing to sell a large portion of their holdings. This could potentially flood the market with LTC, leading to a decrease in its price.

On the day of its anticipated “halving” event, Litecoin plunged to its lowest price in a month, dropping to as low as $86. This is a level not seen since June 30, and it represents a roughly 6% decline during the day. This underperformance is notable, especially when compared to Bitcoin (BTC) and the broader crypto market, which were down by 0.8% and 0.5%, respectively.

The halving event, which occurs roughly every four years and is similar to Bitcoin halvings, cuts the rewards for miners in half, thereby curbing the issuance of new tokens. However, the price performance of LTC around halvings differs from BTC’s behavior.

While Bitcoin has tended to move higher following halvings, Litecoin has typically peaked prior to the event and then slid lower for months afterward. This time, LTC surged to as high as $112 on July 3, reaching its highest price for the year roughly one month before the halving. Since then, it’s down by 22%.