Legendary NFT trader Alex Becker recently sparked much debate with his prediction that we may see no major crypto bull runs until 2030.

With nearly 900k X (Twitter) followers, Becker is one of the pioneers of NFT trading, gaining prominence during the 2021 NFT boom. His experience and influence lends credibility to the sobering possibility of a “lost decade” in crypto.

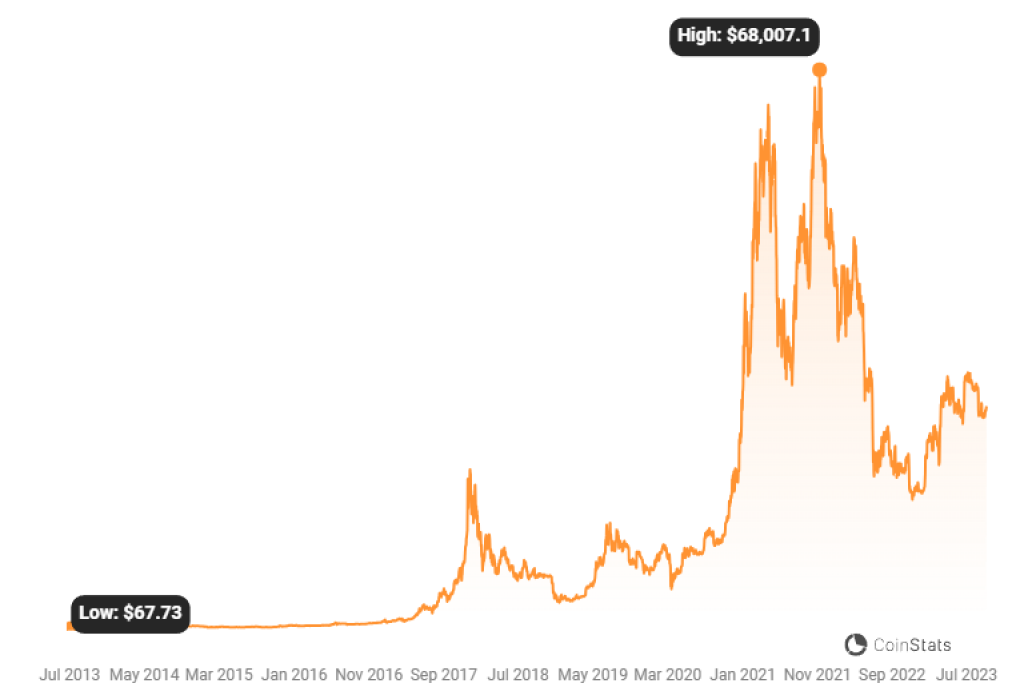

A lost decade would mean that after the monumental 2021 bull run, we may not see another sustained market rally until 2030. This implies nearly 10 dry years for the crypto space between two bull runs. The last time such a long gap occurred was over 2011-2017 after Bitcoin’s initial price surge.

Source: CoinStats – Start using it today

Prolonged bear markets make it challenging for projects and investors alike. Investment dries up without bullish sentiment, making it difficult for crypto startups to grow. With falling token prices, traders also find it harder to profit from market volatility. Speculative interest declines as hype fades in the absence of new highs.

However, Becker remains cautiously optimistic. He advises people to hope for the best but prepare for the worst. His advice is to build skills and businesses that can thrive even without relying on big market rallies. Becker is personally focused on finding ways to grow his net worth 10x regardless of market conditions.

Like it or not a “lost decade” situation where we could potentially see no “big bull runs” till 2030 is totally on the table.

— Alex Becker 🍊🏆🥇 (@ZssBecker) September 19, 2023

Hope for bull, be ready for a bull, but build yourself, your skills and business sense that it’s a BONUS… not your main n only way to make it.

The key takeaway is that crypto investors need backup plans and long-term thinking. A decade-long bear market would be challenging but not impossible to navigate. By improving oneself and building sustainable income streams, the next bull run whenever it comes can be taken advantage of. Patience and perseverance will be essential virtues in the years ahead.

How to prepare for a long bear market?

However, there are ways for resilient crypto investors to not just survive but even thrive during extended periods of downward or sideways drifting markets.

Building a diversified portfolio is key, with assets uncorrelated to crypto like stocks, real estate and commodities. Stable passive income streams should be created via lending, staking, yield farming or running blockchain nodes. Having sufficient fiat reserves allows grabbing undervalued crypto assets during capitulation events.

Investing time into building skills, experience and professional networks prepares you for a variety of economic conditions. Projects that solve real-world problems and provide utility have the best chance of weathering bear trends.

Finally, limiting expenses, having robust risk management mindset and sticking to a long-term plan even through rough patches will help overcome negative sentiment. Crypto veterans who’ve experienced past drawdowns advise patience and perspective despite short-term pain.

While the crypto winter may last longer than many hope for, it does not spell doom. With prudence and grit, individuals and businesses can transcend market cycles to eventually thrive when the next bull run arrives.

You can review our Bitcoin price prediction.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.