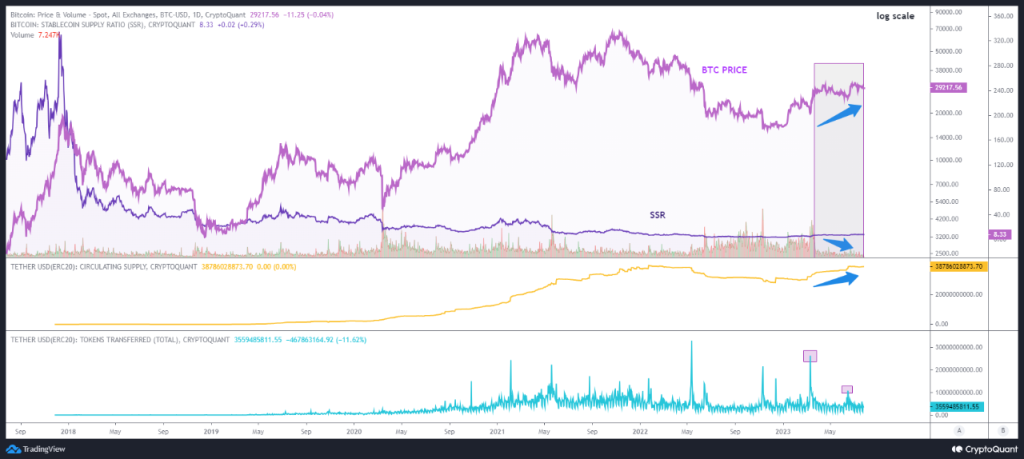

Stablecoin Supply Ratio (SSR) has emerged as a significant metric for understanding market trends. The SSR is defined as the ratio of the market cap of Bitcoin (BTC) to the market cap of all stablecoins. This ratio provides insight into the buying power of stablecoins over the Bitcoin supply.

The SSR is a valuable tool for gauging the level of exchange activity and market volatility. An increasing trend in the SSR indicates a slowing down of stablecoin’s buying power, which is often associated with a bearish or sideways market sentiment. Conversely, a decreasing trend in the SSR signifies a rising status of stablecoin’s buying power, which is typically linked to a bullish market sentiment.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Trading volume is another crucial metric in determining the flow of an asset. While it may not provide a complete picture of trading activities in the market, as it does not include over-the-counter (OTC) transactions, it remains a useful metric for informing us about price movements, buyer interest, and especially the asset’s liquidity.

Recent trends have shown a decrease in trading volume and a stagnation in the SSR since March end. Interestingly, this has coincided with an increase in the circulating supply of Tether (the largest stablecoin in terms of volume), followed by a rise in Bitcoin’s price.

Some market observers interpret these trends as an indication that large investors have stocked up on stablecoins and are waiting for better prices. The recent increase in the price of Bitcoin may actually be the result of a rotation of the money already existing in the market.

A low SSR implies high purchasing power for Bitcoin. This suggests the potential for a bullish trend when large buyers re-enter the market to purchase Bitcoin. As the cryptocurrency market continues to evolve, metrics like the SSR will remain critical tools for understanding market dynamics and predicting future trends.