SUI has been making big moves lately. After starting below $1.20, it rallied past $4.00, grabbing traders’ attention along the way. But now, the big question is, what’s next?

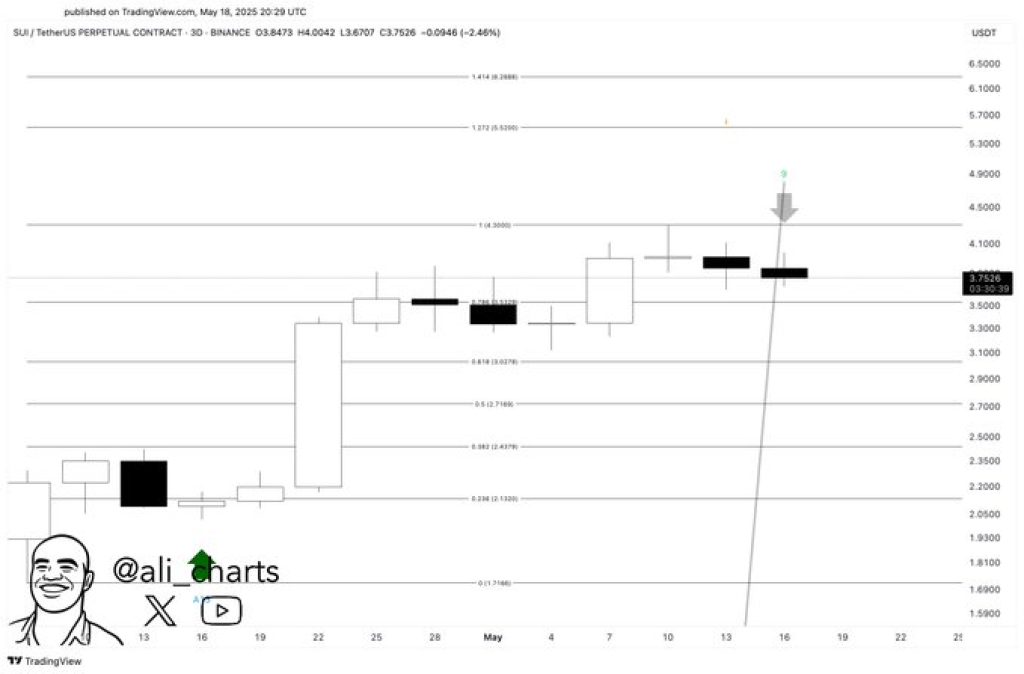

According to a tweet from crypto expert Ali, the chart just flashed a possible warning sign. He pointed out that SUI price needs to break above $4.30 to cancel out a sell signal from the TD Sequential indicator. That level is now in the spotlight as traders wait to see if the rally has more gas in the tank or if momentum is fading.

Since mid-April, the trend has been mostly up. But with recent candles showing hesitation near $4.30, some are wondering if this is just a cool-off or the start of a bigger pullback.

What you'll learn 👉

SUI Resistance at $4.30 Aligns with Sell Signal

The TD Sequential indicator, used to identify trend exhaustion, has produced a “9” sell setup on SUI daily chart. This pattern generally signals a potential slowdown or reversal in upward momentum. Since this marker appeared, SUI price action has remained below the $4.30 threshold, forming small-bodied candles that indicate uncertainty among market participants.

The $4.30 mark also coincides with the 1.0 Fibonacci extension level, reinforcing it as a resistance point. According to the chart, a break above this price level may be required to maintain bullish momentum and counter the sell signal forecast.

Read Also: Meme Coin Season Returns: Will PEPE Double in Price Before June?

Fibonacci Levels Define Support and SUI Price Next Targets

The SUI chart is structured using Fibonacci retracement and extension levels, beginning at $1.16 and extending to recent highs above $4.00. These levels highlight several price zones that traders are monitoring. Immediate support appears around $3.60 to $3.75. A further pullback could find footing near $3.14, which aligns with the 0.618 Fibonacci level.

If SUI price moves above $4.30, the next extension levels are projected between $4.90 and $5.30. These levels represent the next technical targets for bullish continuation.

SUI Price Short-Term Trend Cools While Market Awaits Confirmation

While the intermediate trend remains upward, the short-term picture reflects a pause in momentum. The candles following the TD Sequential signal show hesitation rather than continuation. Traders are now assessing whether this marks the beginning of a correction or just a temporary stall.

Until the $4.30 level is breached decisively, the risk of downward pressure remains. SUI price would need strong buying interest to push above this threshold and resume its previous trend. Otherwise, a move down to the identified support levels remains a possible scenario.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.