One project that has caught the attention of many is ONDO Finance, a decentralized finance (DeFi) platform focused on tokenizing real-world assets (RWAs). Despite not following Bitcoin’s price trajectory, ONDO Finance has managed to maintain its momentum, raising questions about its potential as an investment opportunity.

According to blockchain enthusiast and analyst @blockchainedbb, ONDO Finance stands out as one of the few tokens that did not retrace when altcoins fell by 40-50% after Bitcoin peaked at $73,000 in April. With Bitcoin regaining momentum, the question arises: can we still invest in ONDO Finance, and should we ride the wave of DeFi disruption?

What you'll learn 👉

Understanding Real-World Assets (RWAs)

To understand the appeal of ONDO Finance, it’s essential to grasp the concept of real-world assets and their tokenization. RWAs are any assets, whether physical, digital, or data-based, that gain value from their presence outside the blockchain. Tokenizing these assets creates a digital twin on the blockchain, opening up new investment opportunities.

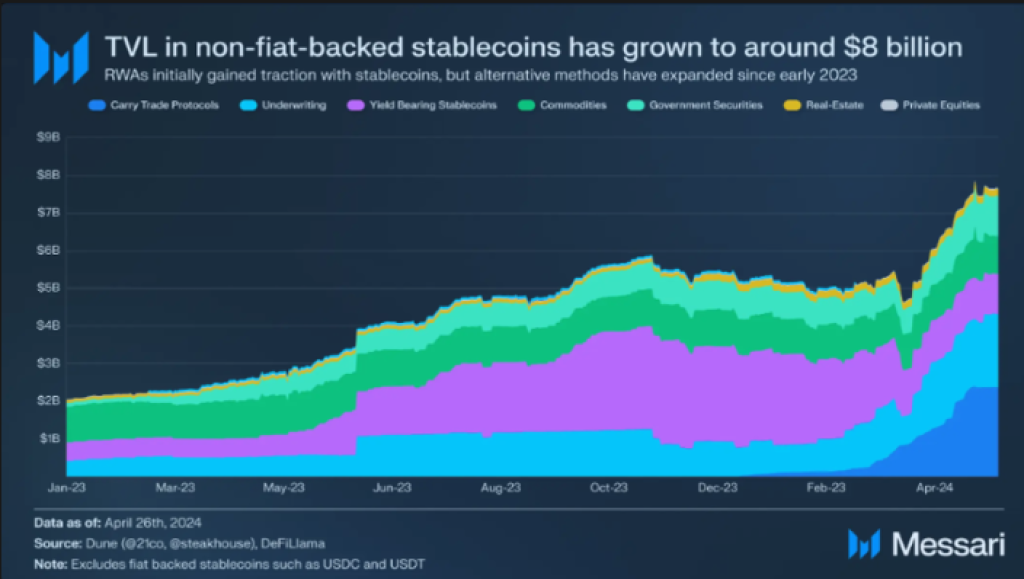

Examples of RWAs include real estate, stocks and bonds, commodities, art, and carbon credits. The RWA market has witnessed significant growth, notably in 2023, driven by the need for returns by crypto natives despite shifting macroeconomic circumstances and increasing interest rates. The total value locked (TVL) in RWA protocols, excluding fiat-backed stablecoins, has increased from over $2 billion at the start of 2023 to around $8 billion.

ONDO Finance falls within the realm of yield-bearing assets and debt-based processes, enabling users to lend a specific amount of assets to the protocol in return for a fixed or variable interest rate. The platform aims to promote financial inclusion by making institutional-grade finance available to a wider audience, including those unfamiliar with cryptocurrency.

Read Also: Top Analyst Says DOT Price Target is ‘Likely’ $18 Amid Polkadot 2.0 Release and These Catalysts

The tokenomics of ONDO Finance are also worth considering. With a large market cap token of 1.3 billion ONDO and a circulating supply of around 1.38-1.44 billion tokens (13.8-14.4% of the total supply), explosive growth like that of smaller-cap tokens may not be realistic. However, the platform has linear vesting periods ranging from 1 to 5 years, meaning that the supply will increase exponentially, and adoption must keep pace to drive demand.

ONDO Finance employs marketing and strategic relationships to target both institutional and retail investor outreach, fostering innovation and adoption. However, potential risks and myths surrounding the project must be addressed.

One concern is the potential drop in Treasury yields if the Federal Reserve cuts interest rates. While higher interest rates enhance Treasury security yields, driving the growth of treasury-backed RWAs, ONDO Finance has strategies in place to manage potential decreases in yield from its tokenized treasury instruments like OUSG (tokenized U.S. Treasuries).

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Another risk factor is the possibility of ONDO Finance going bankrupt or its USDY stablecoin depegging. The platform has detailed documentation outlining contingency plans for such scenarios, aiming to provide transparency and mitigate risks for investors.

Additionally, there are rumors circulating about BlackRock investing in ONDO Finance, which have been clarified as a strategic collaboration rather than a direct investment or stake acquisition by the asset management giant.

ONDO Price Potential and Outlook

In summary, while ONDO Finance may not offer explosive growth potential like smaller-cap tokens, its focus on tokenizing real-world assets and its compliance efforts position it as a relatively safe investment with significant price appreciation potential during a bull run. The supply of ONDO Finance will increase over time, and the platform must foster demand to keep pace.

Adoption is critical to the development of the RWA market, as it is still in its early stages. Consequently, ONDO Finance can be considered a medium-risk, medium-return investment opportunity. While it may not reach 100x returns, the token seems to be a solid choice with the potential for significant price appreciation during the peak of the bull run.

Buy Zones and Price Targets

Analyst @blockchainedbb suggests that good buy zones for ONDO Finance could be the 55 and 100 daily exponential moving averages (EMAs) for those looking to average their positions. For long-term investors, a significant price decrease to $0.4 may present itself in January following the next election cycle or in September when the Federal Reserve pivots its policy stance. A large unlock of ONDO tokens is also scheduled for January 13, 2025, which could impact the supply and demand dynamics.

While no investment can be assured, @blockchainedbb believes that the historical support zones around $0.7 and $0.4 identified on the chart represent a potential buy zone, with a strong likelihood of the price returning to this level before potentially skyrocketing.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.