RektCapital, a prominent analyst in the cryptocurrency realm, recently offered his perspective on the likelihood of a more pronounced Bitcoin downturn. He delves deep into the technical indicators and historical data to provide a comprehensive view of the current market scenario.

Key Takeaways:

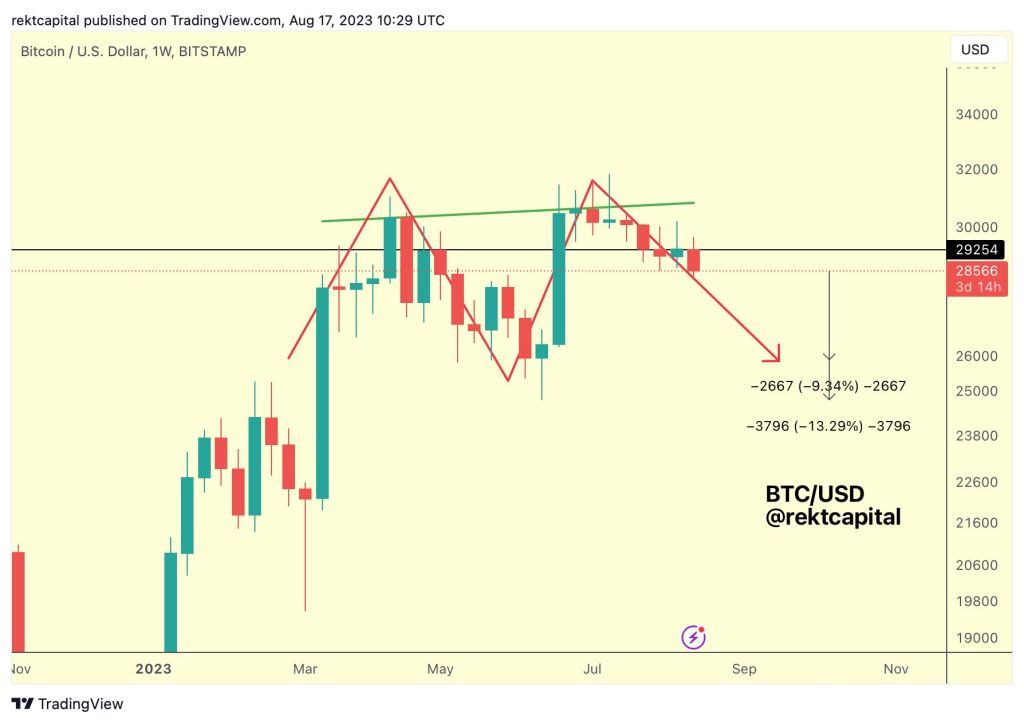

One of the primary indicators RektCapital highlights is the weekly bearish divergence observed in the Bitcoin price and the Relative Strength Index (RSI). This divergence suggests that while the price of Bitcoin might be increasing, the momentum behind this rise is weakening.

Historically, August has been a month that tends to see a downside in Bitcoin’s price. Especially in pre-halving years like 2015 and 2019, significant drawdowns were observed. Given that 2023 is also a pre-halving year, the pattern might repeat.

The RSI is currently respecting its primary downtrend, which is pushing it into a lower high. This indicates mounting weakness in the market. Two significant downtrends are evident: a multi-month and a multi-week downtrend.

RektCapital points out the possibility of a double top formation, a bearish reversal pattern. The 29,250 level is acting as a strong resistance, with multiple upside wicks failing to break this level, similar to patterns observed in late April and early May.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Another bearish sign is the declining volume in the market. Despite the price of Bitcoin being in a downtrend and flipping old supports into new resistances, there isn’t much volume coming into the market. This indicates a lack of interest from buyers.

The combination of the bearish divergence, declining volume, and the price’s position relative to the 29,250 level all suggest a bearish trend. These signs feed into the potential formation of the double top over the coming weeks.

While the current indicators suggest a bearish trend for Bitcoin, it’s essential to monitor the market closely for any signs of reversal. As always, RektCapital emphasizes the importance of staying informed and making well-researched investment decisions.

For those interested in more in-depth analyses and insights, subscribing to RektCapital’s channel and newsletter is highly recommended.

Note: This article is based on the analysis provided by RektCapital in his YouTube video. Always conduct your own research before making any investment decisions.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.