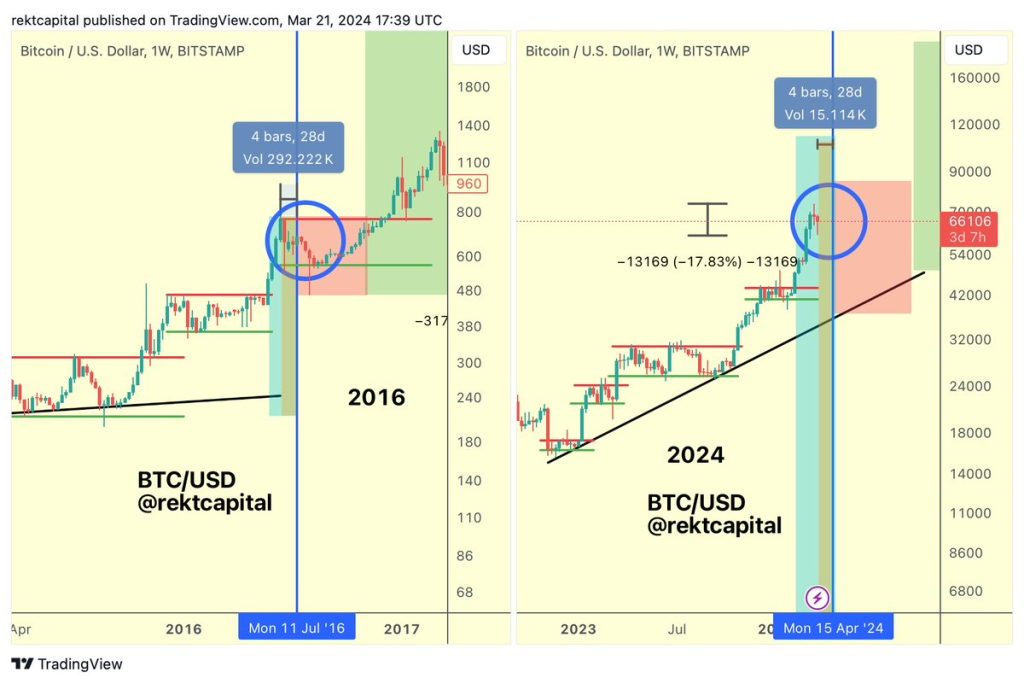

As Bitcoin enters the final stretch before the highly anticipated 2024 halving event, top analyst Rekt Capital has drawn intriguing parallels between the current market dynamics and the 2016 cycle. In an analysis, Rekt Capital highlights several striking similarities, suggesting that the 2024 cycle may unfold in a manner akin to its 2016 counterpart.

What you'll learn 👉

Pre-Halving Re-Accumulation Range Breakout

Moreover, one of the key similarities noted by Rekt Capital is the pre-halving re-accumulation range breakout. Just as Bitcoin broke out from a re-accumulation range to embark on its “pre-halving rally” phase in 2016, the cryptocurrency has recently experienced a similar breakout in 2024, marking the beginning of its ascent towards the halving event.

Another striking parallel lies in the timing of the pre-halving retrace. Rekt Capital points out that in both 2016 and 2024, Bitcoin began its pre-halving retrace approximately 28 days before the halving event itself. This uncanny similarity in timing has caught the attention of market participants, raising questions about potential market dynamics leading up to the halving.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Initial Reaction to the Pre-Halving Retrace

Furthermore, Rekt Capital draws attention to the initial reaction following the beginning of the pre-halving retrace. In 2016, the week following the start of the retrace saw a strong downside wick in the weekly candle, indicating a temporary but short-lived reaction. Interestingly, Bitcoin has exhibited a similar behavior in 2024, producing a strong downside wick but showing signs that this reaction may also be short-lived.

However, Rekt Capital cautions that for Bitcoin to avoid a repeat of the 2016 scenario, where the initial reaction was strong but short-lived, leading to further downside, the cryptocurrency will need to maintain its current highs. Failure to do so could result in a similar fate, with additional selling pressure and a prolonged retrace.

As Bitcoin continues its journey towards the 2024 halving, the crypto community remains vigilant, closely observing the market dynamics and drawing insights from historical cycles. Rekt Capital’s analysis serves as a reminder of the potential similarities between the current and past cycles, offering valuable perspective for traders and investors navigating the turbulent waters of the cryptocurrency markets.

You may also be interested in:

- Kaspa Has “Already Grown too Much” – Expert Cautions Against Further KAS Investment

- Beyond Ethereum’s (ETH) Shadow: Here’s Why PEPE Meme Coin Could Shine in the Upcoming Alt Season

- Why BIG MONEY Is Secretly Buying These Cryptos In 2024!

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.