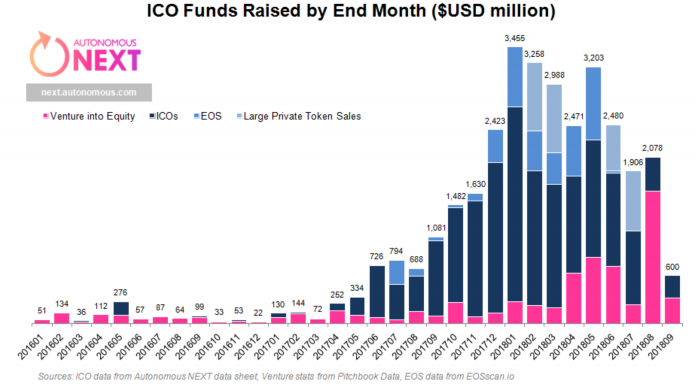

An independent study by Autonomous Research found that activities around Initial Coin Offerings (ICOs) fell by over 90% worldwide this year. While the tokens were still generating 3 billion US dollars at the beginning of the year, the figure in September was less than 300 million dollars.

What you'll learn 👉

Less activity around ICOs

According to a study by Autonomous Research, activities around ICOs were very low in September. The company wrote:

Without ‘EOS and other large private tokens’, as the text says, activity with ICOs has fallen by 88.53 % since January. Including these, the figure is 90.7 %. It is also said that the “trend is generally continuing to fall”.

Last month saw about $300 million in ICO funds raised, with the month before that revised to a bit over $400 million, a far cry from the $2.4 billion in January of this year. If we include EOS and other chunky private token raises, the highs go to over $3 billion, suggesting that monthly ICO activity is down 90%, which of course looks a lot like Ether’s price performance, but with a 3-month lag.

Autonomous Research was founded in 2009 and offers independent global investment research in areas such as banking, investment, insurance, finance and information services.

Investors lose interest in ICOs

The research company cites possible reasons for the significant decline in activity. On the one hand, investors may have lost interest in the token as it does not yet entail any legal obligations for the companies. Investors may prefer to buy shares in a company right away.

Security Token Offerings the new trend?

The decline could also be linked to security token offerings (STOs for short). According to the US Securities and Exchange Commission, ICOs are securities. They therefore fall within their scope of responsibility. “STOs are the new ICOs,” wrote Blockchain consultant Michael Spencer. Security tokens are actual securities,” he explained.