Ripple technical analysis has not been positive in the past two days. The price has seen more than a 7% dip within that timeframe, and there is likely room for more.

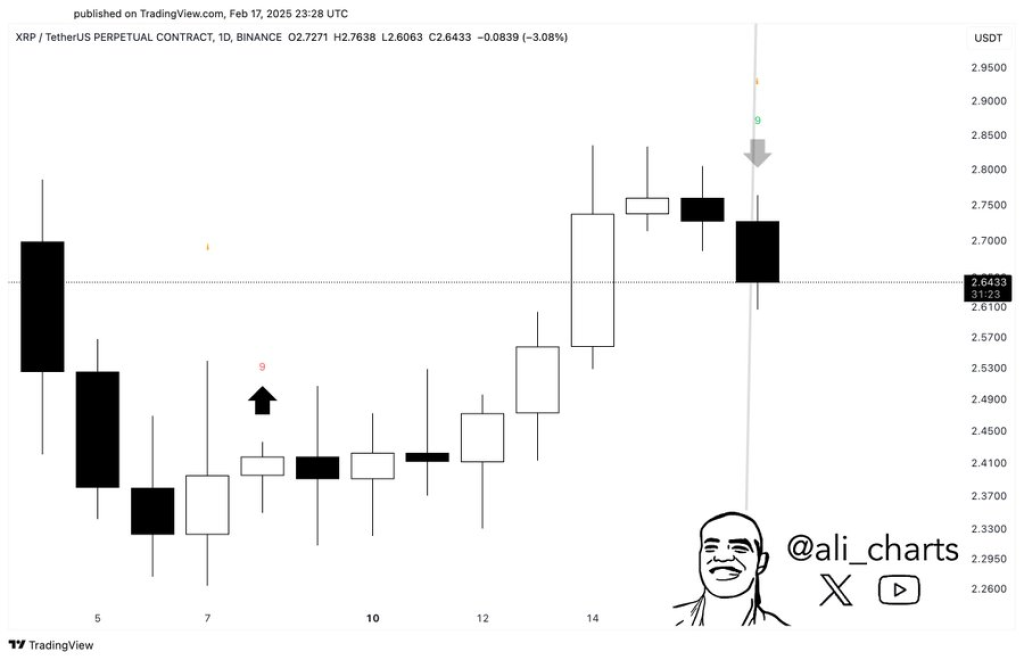

Adding to the bearish sentiment is Ali, a popular crypto analyst on X, who also noted that the TD Sequential indicator is signaling a sell.

“XRP may be set for a pullback, as the TD Sequential indicator flashes a sell signal on the daily chart,” he noted, drawing attention to what technical traders consider a significant warning sign.

The TD Sequential indicator, widely respected in technical analysis circles, has completed a 9-count on the XRP/USDT chart as noted by Ali. This pattern typically suggests an imminent trend reversal. Adding weight to this signal, the latest candles are in red, reinforcing expectations of price retreat after recent gains.

What you'll learn 👉

Trendline Analysis Shows Critical XRP Support Level

Looking beyond immediate indicators, XRP daily timeframe chart reveals an ascending trendline that has served as reliable support throughout recent price action. While the cryptocurrency is currently pulling back from its recent highs, it remains above this trendline – suggesting the overall bullish structure hasn’t been compromised yet.

This trendline represents a pivotal technical level that could determine XRP fate in coming trading sessions. If this support holds firm, it could provide a springboard for price recovery and continuation of the broader uptrend.

However, a decisive break below this trendline would trigger significant concern. Such a breakdown could activate stop-loss orders and trigger liquidations, potentially accelerating downward momentum.

Potential Scenarios for XRP Price Moving Forward

The market appears poised between two distinct possibilities. In the bullish case, if buyers step in to defend the price above the trendline, XRP could stabilize and resume its upward movement. This scenario would likely maintain investor confidence and validate the asset’s longer-term positive outlook.

Read Also: Hedera’s Next Move: Could This Market Cycle Push HBAR Price Past $5?

Conversely, a clear break below the trendline would confirm a trend reversal, significantly increasing the likelihood of deeper price declines as selling pressure intensifies.

Is This Time to Sell XRP Token

For now, the current pullback remains within acceptable parameters as long as price action respects the established trendline support.

Read Also: Why Is Alchemy Pay (ACH) Price Rising?

Short-term traders might need to reconsider their entries if XRP price breaks below this trendline. However, long-term traders might want to secure some profit if the price shows signs of a quick sell-off.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.