In the world of cryptocurrencies, token unlocks play a significant role in shaping market dynamics. They involve the gradual release of tokens into circulation over time, incentivizing service providers to contribute to the long-term growth of crypto projects. However, the trading dynamics surrounding these unlocks are often misunderstood or overlooked by market participants. In this article, we will delve into the intricacies of token unlocks, focusing on the upcoming unlock events of Optimism and SUI. By understanding the strategies employed by project teams and investors and evaluating the impact of important upgrades and partnerships, we can gain valuable insights into the trading dynamics and potential price movements associated with these unlocks.

What you'll learn 👉

Unlocking Tokens: A Closer Look

When crypto projects launch their tokens, they do not release them all at once. Instead, these tokens “vest” or “unlock” gradually according to a predetermined schedule. This approach ensures that service providers, including the project team and investors, are incentivized to contribute to the network’s growth over the long term.

Crypto markets, however, have a tendency to overlook or misprice forward events, as seen in the trading dynamics surrounding the US government sale. Despite publicly known unlock dates and quantities, these unlocks often go unnoticed or undervalued.

Unlocks and Trading Strategies

Savvy traders can take advantage of token unlocks by employing specific trading strategies. For example, shorting the token before an unlock allows them to profit at the expense of insiders, such as the project team and investors. This strategy effectively transfers profit and loss from the insiders to the traders executing the short positions.

The Craftiness of Teams and Investors

Recognizing the potential threat to their profits, project teams and investors employ strategic tactics to counteract the negative impact of unlocks. They schedule important upgrades, announce partnerships, and tease exciting additions to the project roadmap specifically timed around unlock events. These tactical moves aim to mitigate the downward pressure on token prices resulting from increased supply.

Unlock Events: Optimism’s Tactical Approach

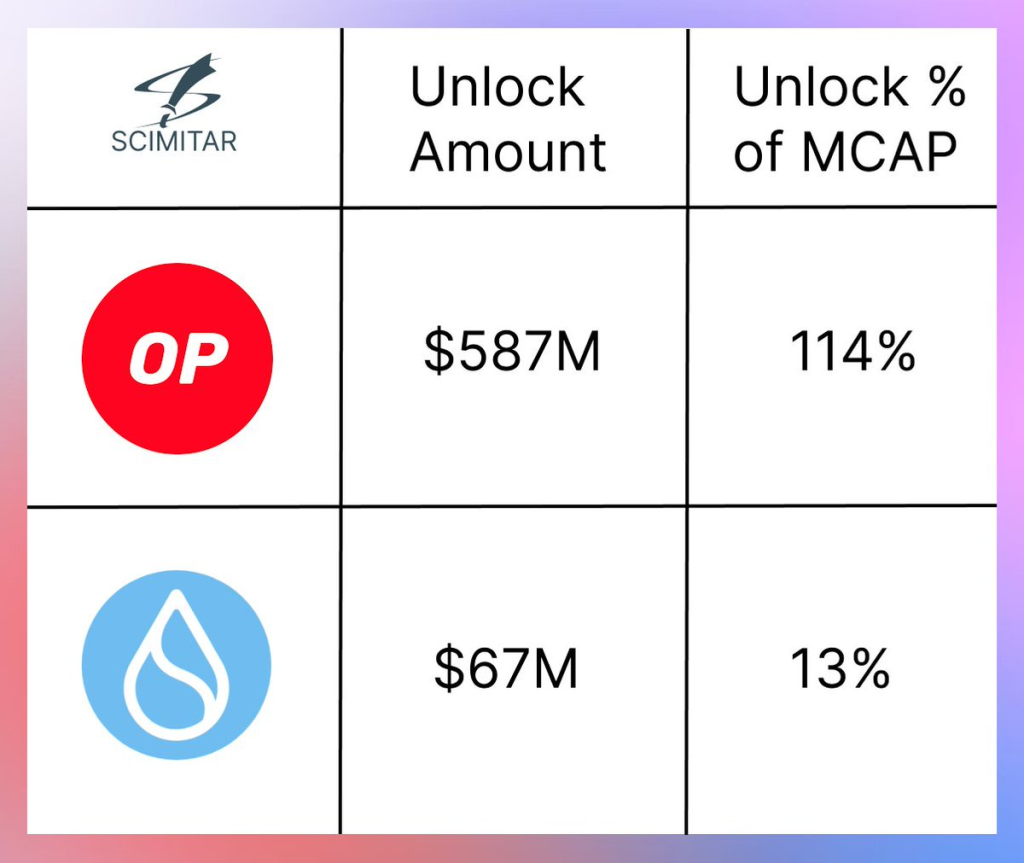

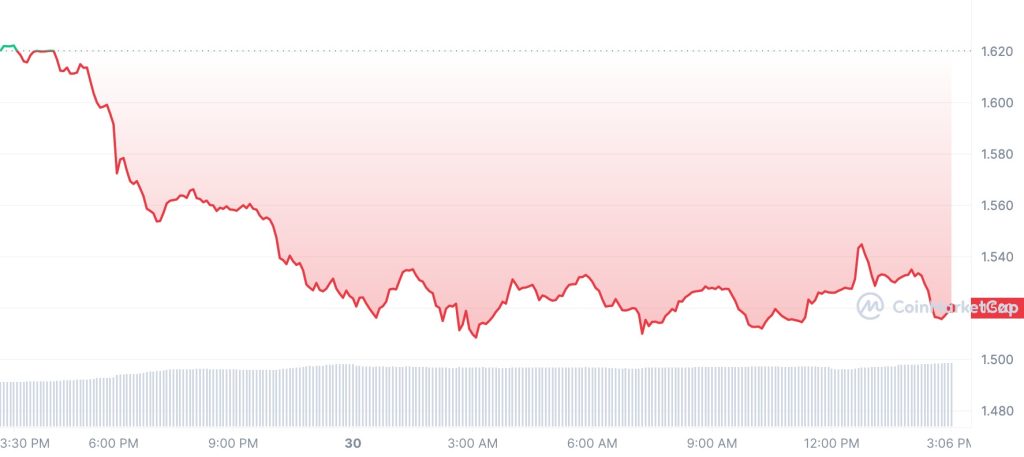

Let’s examine the upcoming unlock event of Optimism as an example. This week, Optimism faces a significant unlock, with over 114% of the current circulating supply becoming available. Based on the principle of supply and demand, this increase in supply should ideally result in a lower token price.

However, the Optimism team has a well-executed plan to counteract this supply increase. Just one week after the unlock, they have a monumental upgrade scheduled for the Optimism stack. This upgrade is expected to bring several improvements, including reduced fees and shorter block times, aiming to enhance the overall user experience.

Bedrock Explainer: Optimism’s Upgrade

The upcoming upgrade, known as “Bedrock,” represents the official release of the OP Stack. This collection of free and open-source modular components powers the Optimism network. With Bedrock, the team aims to enhance the functionality and performance of the Optimism platform, providing users with a more efficient and seamless experience.

Balancing Supply Increase with Upgrades

Evaluating the impact of token unlocks requires careful consideration of the increase in supply versus the upgrades, partnerships, and news ammunition the project team and investors possess. The success of their efforts will ultimately determine the trajectory of the token’s price.

Trading Against Titans: The Incentives

When deciding to trade against unlocked tokens, traders must consider who they are up against. In the case of Optimism, heavyweight investors like a16z and Paradigm, as well as the project insiders, are incentivized to coordinate and minimize losses resulting from preselling. Engaging in a PvP (player versus player) situation against these industry insiders may not be the most favorable strategy for traders.

SUI’s Unlock: A Different Scenario

Contrasting Optimism’s unlock, SUI follows a different pattern. In this case, the unlock benefits airdrop farmers, rather than the project team and investors. Trading against retail holders who lack coordination might appear less challenging compared to taking on well-connected insiders.

Strategic Ammunition for SUI

To counteract the impact of the unlock, the SUI team has employed a strategic approach. They have scheduled the Suiswap Initial DEX Offering (IDO) to take place on the exact same date. The IDO involves the issuance of 10 million SUI tokens, valuing Suiswap at an impressive $200 million fully diluted valuation (FDV).

The Unchanged Metadata

Interestingly, the metadata for the SuiSwap site features a picture of AptosSwap. It appears that the developers were negligent in modifying the metadata, which gives the impression of a low-effort copy-and-paste approach.

Insights from an Astute Trader

A respected trader has shared their SUI thesis, which prompted further research into SUI and its unlocking event. Their insights contribute to the overall understanding of the situation and provide valuable perspectives for traders and investors.

Evaluating Relative Impact on Price

While the Optimism unlock accounts for a significant 114% of the token’s supply, and SUI’s unlock represents a smaller 13%, evaluating the relative impact on price for these events is not a simple task. Several complex factors, including strategic upgrades, partnerships, and trading dynamics, come into play. As a result, it is highly likely that both tokens will experience price depreciation over the long run.

Conclusion

Unlock events in the crypto space have a substantial impact on trading dynamics and token prices. By understanding the strategies employed by project teams and investors, evaluating the influence of important upgrades and partnerships, and considering the nature of the unlocking parties, market participants can make more informed decisions. The upcoming unlocks of Optimism and SUI present unique scenarios, each with its own set of strategic maneuvers. As traders and investors, it is crucial to thoroughly analyze and weigh these factors to accurately price these unlock events.