With cryptocurrency markets in an upward trend, trader Jacob Canfield shared tips on Twitter for how to exploit these conditions and achieve over a 90% win rate. He covers key strategies and assets to target in the current bullish environment.

Buy the Dips: Trader Jacob Canfield advises buying on pullbacks and dips in an uptrending market to get a high win rate. Time entries at support levels.

Manage Emotions: Staying disciplined, scanning for trades, and avoiding over-leverage are keys to executing effectively without getting shaken out.

Spot ETFs: Canfield expects Bitcoin and Ethereum spot ETF approvals to bring fresh money into those assets and related ecosystems.

Solana Opportunity: With its narrative and development activity, Canfield sees Solana potentially rivaling Ethereum this cycle as an investment opportunity.

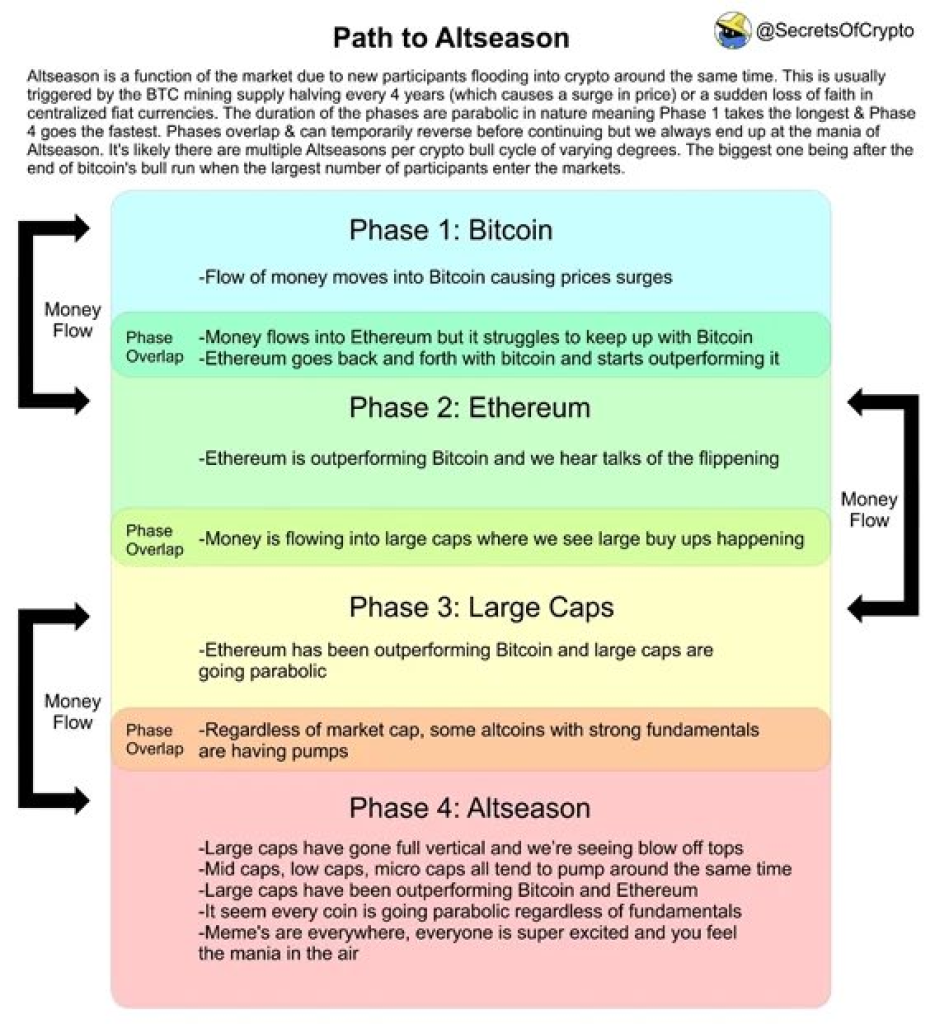

Target Key Narratives: Canfield recommends looking for sectors with compelling narratives like AI, gaming, regulation, etc. These will see pumps of money.

Airdrops & Staking: Protocols sharing fees via airdrops and staking rewards are worth investigating early as passive income streams.

Take Profits: If holdings spike, take partial profits (60-70%) while letting the rest ride in a frenzied market. Set aside for taxes.

Vet Sources: Follow credible accounts for ideas, but rely on your own research for trades rather than others’ opinions.

Read also:

- DOT Expert Explains Why You Need to ‘Buy Polkadot Before It’s Too Late’

- Ethereum Whale Makes Another Big Buy Amidst Price Rally

- XRP price stuck under $0.60. Will XRP, TRX, or $ROE Reach $1 First?

In summary, Canfield provides a strategic guide to optimizing gains in the current crypto bull market. By selectively buying dips, controlling emotions, and targeting specific narratives, he believes traders can consistently win over 90% of trades.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.