As the Bitcoin network continues to evolve, one of its most anticipated events is the halving, a mechanism designed to regulate the supply of the world’s largest cryptocurrency. With the fourth halving on the horizon, scheduled for April 2024, it’s an opportune time to reflect on the impact of previous halvings and speculate about what the future might hold.

What you'll learn 👉

A Look at Bitcoin’s Past Halvings

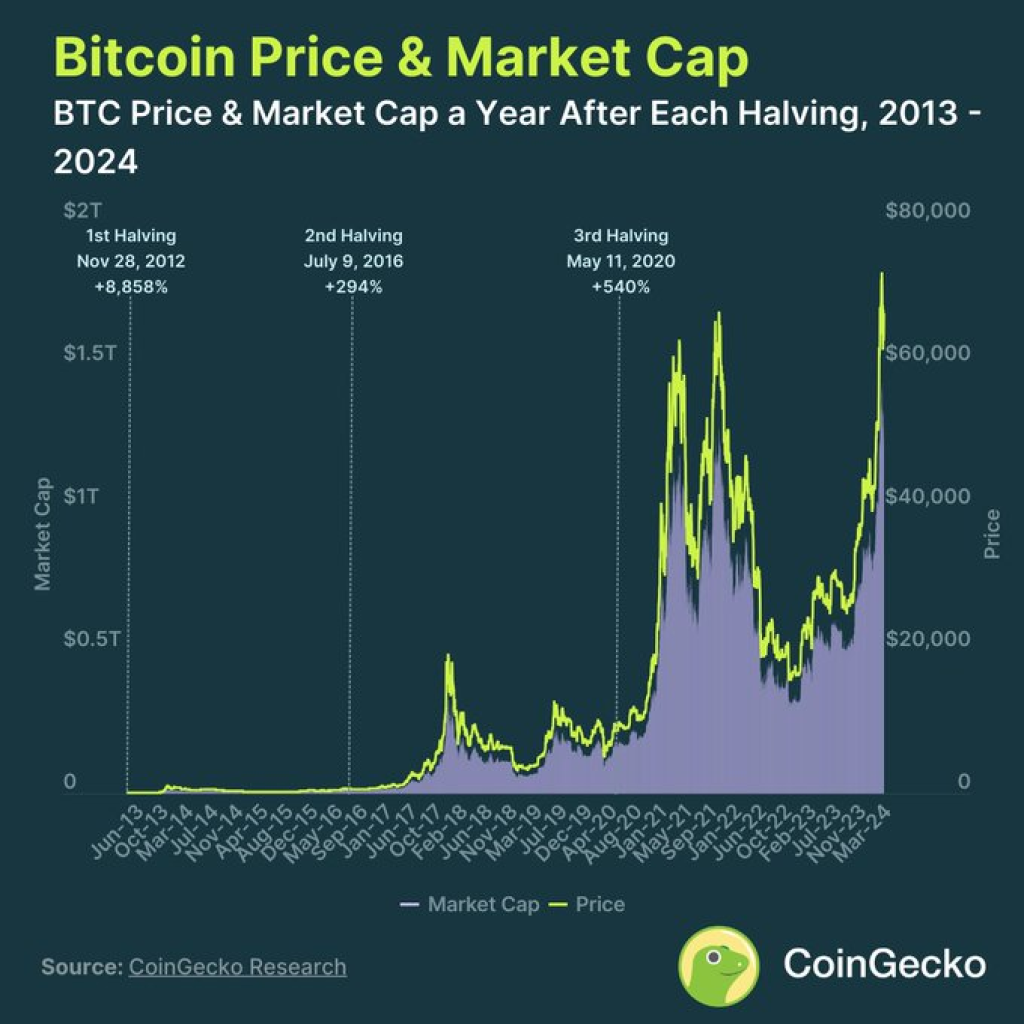

Bitcoin’s history is punctuated by three previous halving events, each with its own unique set of market dynamics and price implications, according to a recent report by CoinGecko.

The First Halving: November 28, 2012

On November 28, 2012, the first halving took place, reducing the block reward from 50 BTC to 25 BTC. Within a year, Bitcoin’s price skyrocketed from approximately $12 to $1,075, representing a staggering 8,858% valuation increase. This event marked the beginning of Bitcoin’s journey towards mainstream recognition and adoption.

The Second Halving: July 9, 2016

The second halving took place on July 9, 2016, further reducing the block reward from 25 BTC to 12.5 BTC. In the following 12 months, Bitcoin’s price rose from around $650 to $2,560, a 294% valuation increase. While significant, this gain was notably smaller than the first halving, hinting at the possibility of diminishing returns as the market matured.

The Third Halving: May 11, 2020

The most recent halving occurred on May 11, 2020, slashing the block reward from 12.5 BTC to 6.25 BTC. Within a year, Bitcoin’s price climbed from approximately $8,727 to $55,847, representing a 540% valuation increase. The Federal Reserve’s expansionary monetary policies, which effectively repriced Bitcoin relative to fiat currencies, partially fueled this surge.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +The Diminishing Returns of Bitcoin Halvings

While the price gains following each halving have been substantial, the data suggests that the impact of these events is diminishing over time. Several factors, such as Bitcoin’s increasing market maturity, the diminishing returns as more bitcoins enter circulation, and the market’s increasing efficiency in pricing the asset, contribute to this trend.

The Fourth Halving: Anticipation and Potential Challenges

As the fourth halving approaches, anticipation within the crypto community is reaching fever pitch. However, several potential challenges loom on the horizon, including:

- Selling Pressure: Bitcoin miners may take profits due to anticipated higher mining costs, while the distribution plan for the Mt. Gox creditors could unleash 200,000 BTC (approximately $13.9 billion) into the market.

- Regulatory Uncertainty: The ongoing evolution of cryptocurrency regulations could impact market sentiment and investor confidence.

- Macroeconomic Conditions: Global economic factors, such as interest rates and inflation, could influence Bitcoin’s demand and price dynamics.

Despite these challenges, Bitcoin’s market positioning has never been more secure. The launch of approved Bitcoin ETFs has elevated the asset’s legitimacy, paving the way for a new generation of investors to enter the market.

Furthermore, the continued devaluation of fiat currencies in the debt-based monetary regime could further bolster Bitcoin’s appeal as a scarce and decentralized asset.

As Bitcoin’s inflation rate drops below 1% after the fourth halving, the demand threshold required to outpace its supply will be lower than ever before.

While past performance is no guarantee of future results, the historical data and market dynamics suggest that the fourth halving could present an opportunity for Bitcoin to cement its position as a viable alternative to traditional financial systems.

You may also be interested in:

- Why is Ethena (ENA) Token Price Surging?

- Here Are 4 Reasons Why Bitcoin Price is Down Ahead of BTC Halving

- Bonk (BONK) Nemesis BUDZ Gains BONK Investor Support For 420 Launch

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.