The recent resurgence in decentralized finance (DeFi) tokens has created lucrative trading opportunities for investors able to ride the wave. According to Lookonchain, one savvy trader named Maven11 Capital profited over $1.4 million by buying and selling Uniswap (UNI), Aave (AAVE), and other popular DeFi coins at opportune times.

Seizing Opportunity With UNI

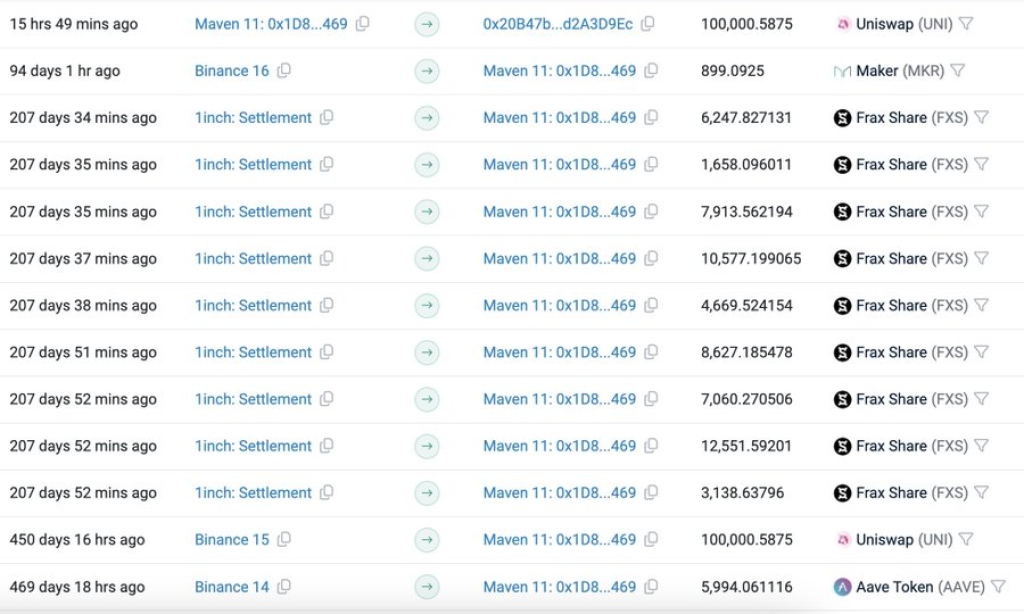

Maven11 demonstrated skill in profiting from the DeFi boom. He purchased 100,000 UNI tokens for $574,000 at $5.74 each on the Binance exchange. As UNI prices climbed to $11.20, Maven11 sold the tokens and secured gains of $546,000, equal to a 95% return on his investment.

Cashing in on the Maker Run

Another well-timed trade involved the DeFi governance token Maker (MKR). Maven11 bought 899 MKR tokens when prices traded at $1,469, paying $1.32 million in total. As Maker prices increased 38%, the position swelled by $500,000, allowing him to lock in substantial earnings.

Doge2014 raises 500K in days celebrating Dogecoin. Make potentially big profits and get in on exclusive airdrop!

Show more +Adding Gains from AAVE and FXS

To further expand profits, Maven11 also traded the DeFi lending protocol Aave (AAVE) and the Frax ecosystem token Frax Share (FXS). He purchased 5,994 AAVE tokens for $383,000 at $64 and sold during the 58% price rise. On FXS, he bought over 62,000 tokens for $379,000 and made $164,000 as values moved 43% higher.

Conclusion

Through well-timed purchases and sales of leading DeFi coins like Uniswap, Aave, and Maker, trader Maven11 Capital demonstrated savvy by generating over $1.4 million as prices surged. It shows the potential profits at play in volatile cryptocurrency markets for investors nimble enough to jump on opportunities. Of course, such trading strategies also court substantial risks of losses. But Maven11’s DeFi profits illustrate that fortunes can be made by smart traders riding hot momentum.

You may also be interested in:

- Why is XAI Token Surging? Analyst Says ‘Consolidation Breakout Retested’ – Here’s His Outlook

- Starkent (STRK) and Filecoin (FIL) Prices Pumping – Here’s Why

- Meet The Viral Cryptos – Bitcoin Minetrix and BlockDAG (BDAG) Raise Millions In Their Ongoing Presales While Jupiter Surges

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.