An analysis by YavuzAkbay on TradingView looks at historical Bitcoin halving cycles and technical indicators to forecast a potential six-figure BTC price by 2025. Every four years, the Bitcoin protocol halves the block reward paid to miners. Historically, these “halving” events have preceded parabolic bull runs in the BTC price.

What you'll learn 👉

Historical Halvings Spark Massive Bull Runs

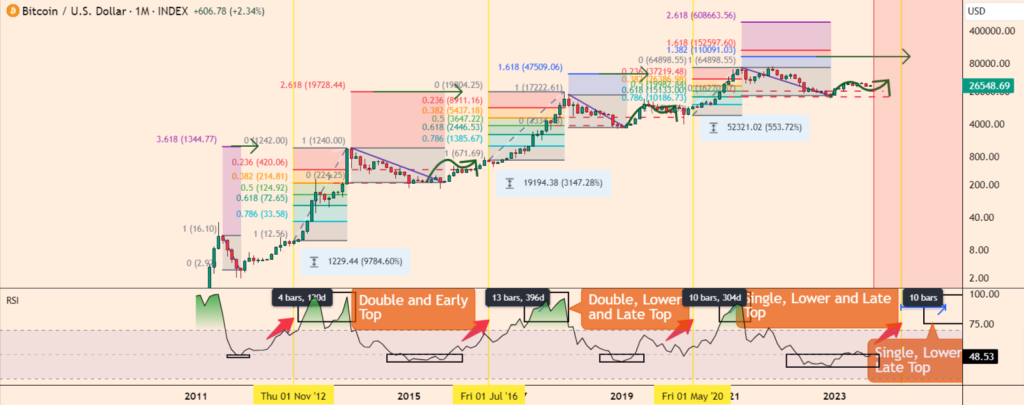

Three halving-driven bull cycles have occurred since Bitcoin’s creation in 2009. After the first halving in late 2012, BTC rose nearly 10,000% over the next year. The second halving in mid-2016 kicked off a rally of over 3,000% to almost $20,000 by late 2017. Most recently, 2020’s halving ignited a 550% surge to an all-time high above $64,000 in 2021.

Fibonacci Levels Map Out Peak Price Targets

Each bull run peaked around key Fibonacci retracement levels when applied to the bear market preceding it. The 2013 top occurred near the 3.618 Fib level of the 2011 bear trend. The 2017 apex aligned with the 2.618 level of the 2014-2015 bear. And 2021’s peak hit the 1.618 Fib of the 2018-2020 bear. This declining sequence of Fib ratios reflects Bitcoin’s logarithmic price charts.

Based on the current bear market that began in late 2021, the 1.382 Fib level points to an optimistic target above $100,000 by the next halving cycle peak in 2025. More conservative targets at higher Fib levels remain possible if the bull run exceeds expectations.

The RSI indicator also peaks consistently around halvings, but with diminishing intensity over time. This favors a lower RSI peak over the next cycle, likely in late 2024 or early 2025 based on historical timing.

When the RSI dips below 50 it has reliably marked Bitcoin bottoms. This signaled optimal buying opportunities after previous halving-related corrections. Currently it suggests possible entry points around $20,000 if BTC retests lows.

In summary, halving cycles and technical indicators point to six-figure Bitcoin prices by 2025. Investors should consider building positions around the next halving and utilizing cost averaging to weather volatility. As with any forecast, realize actual market action may deviate from modeled targets. But probability favors tremendous upside ahead.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.