The Cardano price performed impressively yesterday, surging from $0.66 to over $0.81, marking a 22% increase. However, the market became volatile afterwards, with ADA now consolidating in the $0.75-0.77 range.

Grayscale’s move to file for a Cardano ETF signifies growing institutional interest in ADA, which could be one of the driving factors. Santiment posted a viral tweet yesterday, highlighting some interesting ADA on-chain metrics.

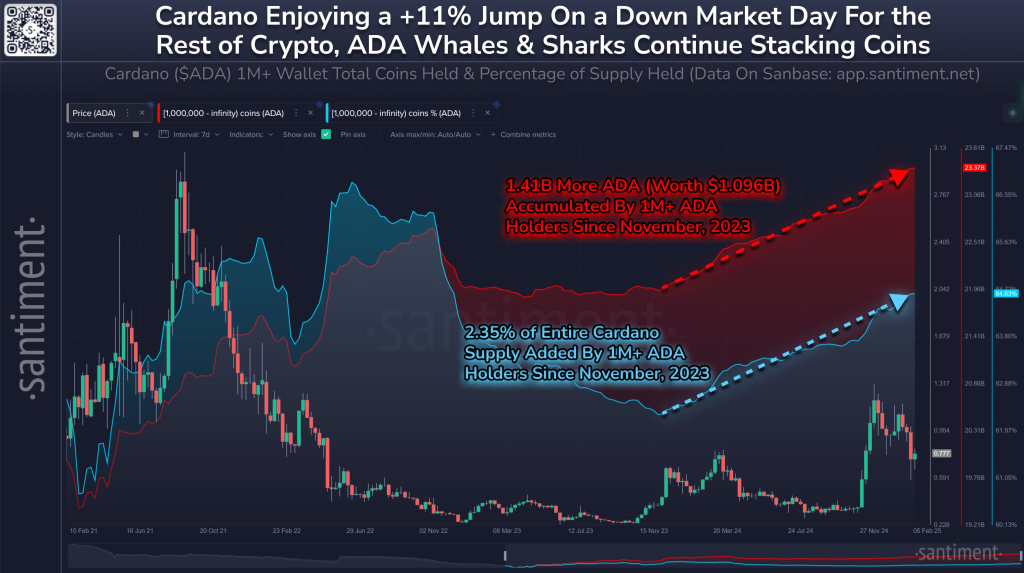

According to Santiment’s data, Cardano managed to rise by 11% during a period when most of the crypto market was declining. This impressive performance coincides with significant accumulation by whales and sharks (large and mid-sized investors) who have been steadily increasing their ADA holdings.

Since November 2023, these large holders have added approximately 1.41 billion ADA to their portfolidity, valued at $1.096 billion. This substantial accumulation represents 2.35% of the entire ADA supply, suggesting strong confidence from institutional investors and wealthy individuals.

The accumulation pattern has shown a clear correlation with the ADA price movement. Since these large investors began their buying spree, the Cardano price has increased by 107%. The historical price chart shows a significant peak in mid-2021, followed by a prolonged decline, but recent price recovery aligns perfectly with the increased whale and shark accumulation.

This sustained buying pressure from large holders often indicates long-term confidence in an asset. When whales and sharks accumulate over extended periods, it typically creates natural price support levels and reduces overall selling pressure. However, investors should note that while this accumulation pattern is positive, the market remains subject to volatility, particularly if these large holders decide to take profits.

Subscribe to our YouTube channel for daily crypto updates, market insights, and expert analysis.

We recommend eToro

Wide range of assets: cryptocurrencies alongside other investment products such as stocks and ETFs.

Copy trading: allows users to copy the trades of leading traders, for free.

User-friendly: eToro’s web-based platform and mobile app are user-friendly and easy to navigate.